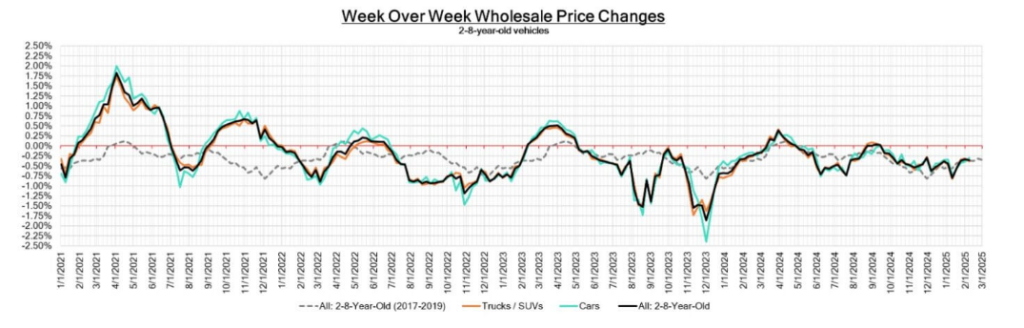

Wholesale Price Trends

| This Week | Last Week | 2017–2019 Average in Same Week | |

| Car Segments | -0.30% | -0.39% | -0.35% |

| Truck & SUVs Segments | -0.38% | -0.32% | -0.36% |

| Whole Market | -0.36% | -0.34% | -0.36% |

The U.S. wholesale market remains stable but faces pressure from tariffs and shifting demand. Here’s the latest breakdown:

- Car Segments: Average depreciation of -0.12%, led by Mid-Size Cars (-1.03%) and Full-Size Cars (-0.58%) .

- Truck/SUV Segments: Mixed performance with a slight +0.04% increase, driven by Compact Vans (+0.55%) and Mid-Size Crossovers/SUVs (+0.36%) .

- Market Stability: Depreciation aligns with seasonal norms, but tariff uncertainty looms .

Inventory & Retail Trends

New Vehicles:

- Inventory Surge: Total new inventory exceeds historical norms at 3.4M units, with Stellantis (232 days’ supply) and Ford (152 days) leading. Toyota (41 days) and Honda (69 days) remain tight .

- Hot Models: Toyota RAV4 (30 days’ supply) and Ford F-150 (140 days) dominate dealer lots .

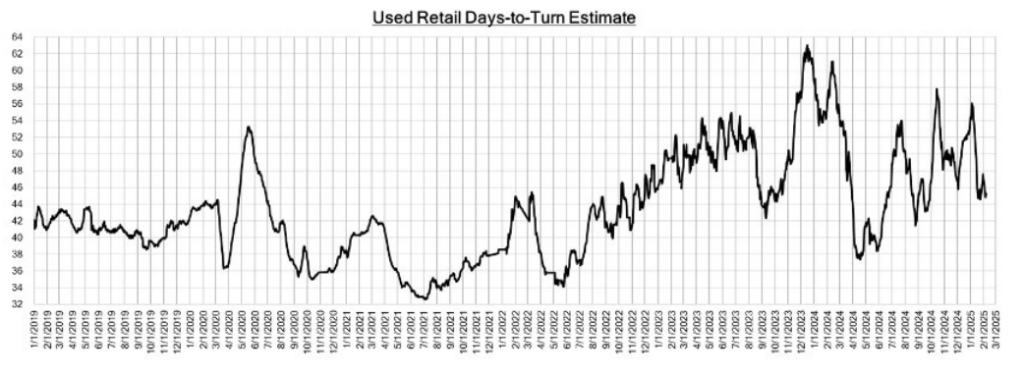

Used Vehicles:

- Retail Days-to-Turn: Improved to 46 days, but flood-damaged imports from Hurricane Idalia flood Georgia’s market, requiring rigorous appraisals .

- Listing Prices: Average used retail price dipped to $34,490, reflecting increased supply and competitive pricing .

Industry News Highlights

- Tariff Tensions Escalate:

- The U.S. enacted 25% tariffs on Canadian and Mexican auto imports, threatening supply chains and inflating prices for Georgia dealers .

- Tesla stands to benefit, as its U.S.-made vehicles avoid tariffs, while competitors like Hyundai face delays .

- EV Price Wars:

- Tesla slashed Model 3/Y prices by 6%, accelerating used EV depreciation in Georgia. BYD and XPeng followed, intensifying competition .

- Ford extended free home charger incentives to boost F-150 Lightning sales, but public charging gaps persist .

- BEV Market Shifts:

- Volkswagen canceled the ID.7 sedan in North America, citing a “challenging EV climate” .

- Toyota’s hybrid sales surged to 43% of global volume, outpacing BEV adoption .

- Leadership Changes:

- Honda Canada named Dave Jamieson CEO, succeeding Jean-Marc Leclerc, amid tariff disruptions .

Legislative & Policy Shifts

- Georgia’s Revised 17C Formula: Diminished value payouts for EVs capped at 15%, excluding battery depreciation—leaving Tesla owners undercompensated .

- Federal “Lemon Law” Expansion: Now covers used EVs with unresolved battery defects, increasing demand for pre-sale appraisals .

- Interest Rates: The Bank of Canada cut rates to 3%, easing financing pressures but complicating cross-border trade .

Georgia-Specific Insights

- Tesla Resale Crisis: Atlanta Model Y values dropped 12% post-LFP battery updates, with repair stigma deterring buyers .

- Hyundai Metaplant Delays: 6-month waits for Ioniq 5 batteries inflate repair costs by 35%, worsening diminished value claims .

- Classic Car Boom: 1970s muscle cars rose 25% in value, but accident repairs slash resale by 30% due to authenticity concerns .

Action Steps for Georgia Owners

- Demand USPAP-Compliant Appraisals: Counteract insurer lowball offers with certified reports proving battery-related depreciation .

- Pre-Sale Inspections: Verify flood-damaged vehicle histories to avoid hidden defects .

- Leverage OEM Mandates: Georgia requires OEM parts for cars under 2 years old—use this to secure fair repair valuations .

Next Week’s Watchlist:

- Impact of Trump’s tariffs on Georgia dealerships.

- Rivian’s Georgia plant revival and Tesla’s counterstrategy.

Need a FREE diminished value appraisal for your Tesla or classic car? Contact DVGA → Georgia’s #1 USPAP-certified experts since 2005.