Auto Market Update – January 18, 2025

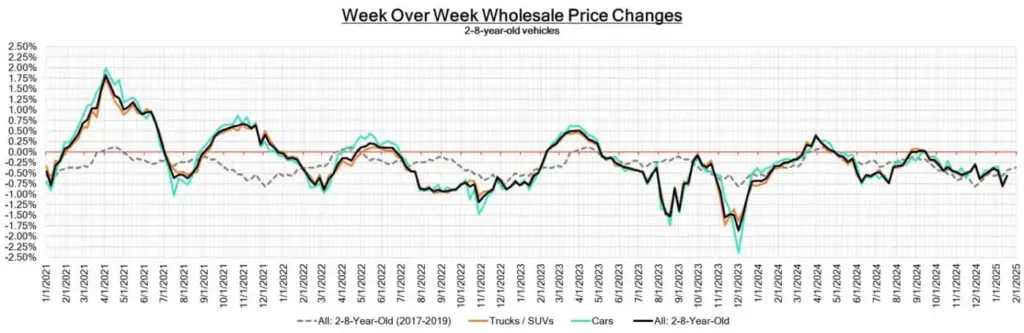

Wholesale Price Trends

| This Week | Last Week | 2017–2019 Average in Same Week | |

| Car Segments | -0.58% | -0.75% | -0.49% |

| Truck & SUVs Segments | -0.56% | -0.83% | -0.39% |

| Whole Market | -0.57% | -0.81% | -0.43% |

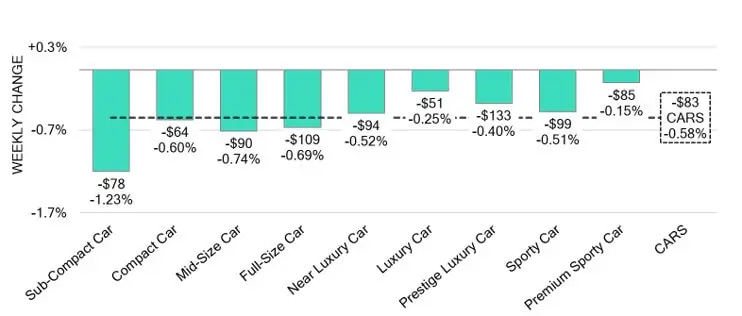

Car Segments

- Average Weekly Depreciation: -0.58% (slight improvement from -0.62% prior week).

- Largest Declines:

Mid-Size Car: -0.74% (accelerated depreciation due to oversupply).

Sub-Compact Cars: -1.23% (steady decline driven by low demand). - Bright Spot: Premium Sporty Car saw a minor downgrade at -0.15%, likely due to tax season demand.

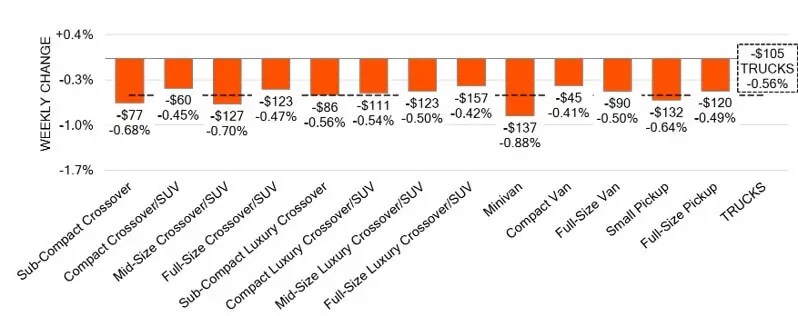

Truck & SUV Segments

- Average Weekly Depreciation: -0.56% (worsening from -0.47% prior week).

- Largest Declines:

Minivan: -0.88% (overshadowed by new model launches).

Mid-Size Crossover/SUV: -0.88% (inventory glut from fleet returns).

Stability: Compact Van held strong at -0.25%, supported by commercial demand.

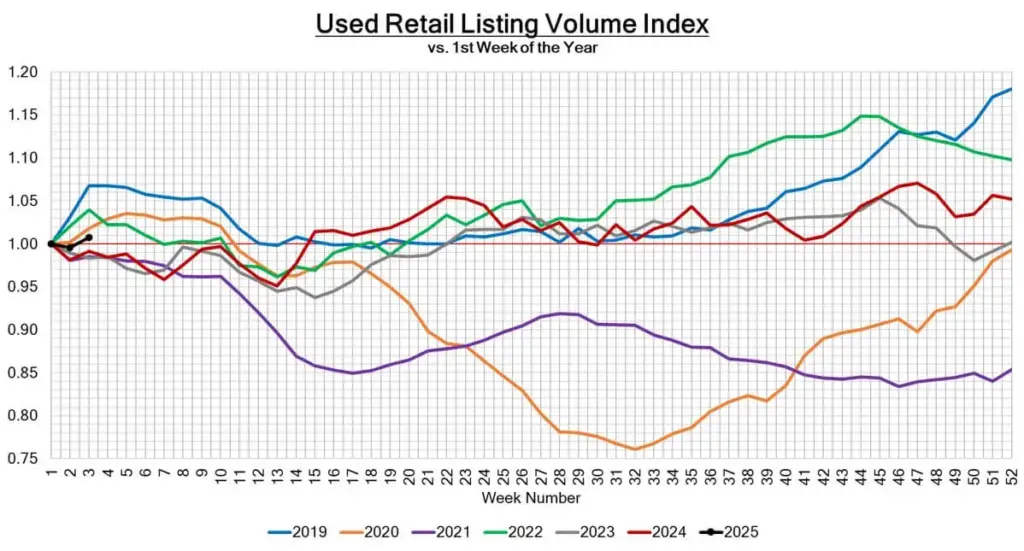

Inventory and Retail Trends

The Used Retail Active Listing Volume Index remained stable, reflecting consistent inventory levels across dealerships.

Used Retail Listing Volume Index

Remained stable, indicating balanced supply and demand across dealerships.

2025: 1.02 (vs. 1st week of 2025).

2024 Comparison: -3% YoY, reflecting tighter inventory management.

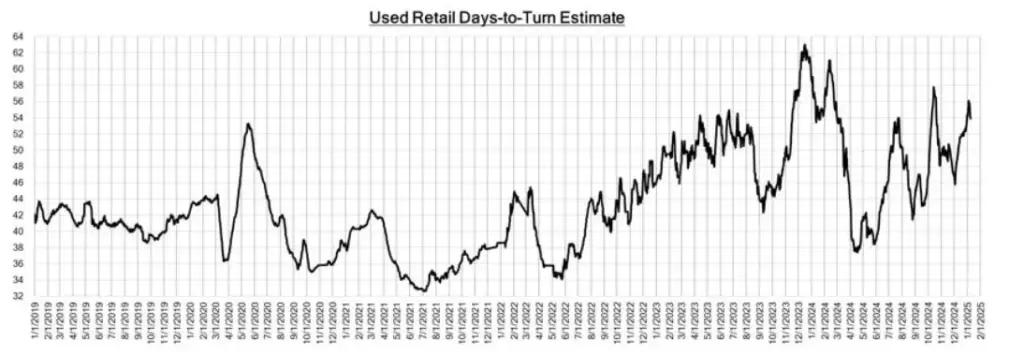

Used Retail Days-to-Turn Estimate

Improved to 54 days (down from 55 days last week), signaling faster sales velocity.

Industry News Highlights

1. U.S.-China Trade Tensions Escalate Over Proposed Tariffs

The Trump administration’s proposed 10% tariffs on Chinese automotive imports—including EVs, batteries, and components—threaten to disrupt global supply chains. Chinese automakers like BYD and NIO may fast-track U.S. production to bypass tariffs, while American OEMs brace for cost hikes. Georgia drivers could see delayed EV deliveries and higher repair costs for Chinese-made parts.

2. Tesla Launches Redesigned Model Y in China Amid Price Wars

Tesla defied China’s EV price-cutting trend by releasing a refreshed Model Y with a $2,000 price hike and upgraded LFP battery tech. The gamble comes as BYD’s Seagull EV dominates budget markets, claiming 65% of China’s NEV sales. For Georgia Tesla owners, the upgrade may slow depreciation for older models.

3. Ford Extends Free Home Charger Promotion to Boost EV Sales

Ford extended its free home charger incentive through March 2025 to attract cost-conscious EV buyers. The promotion drove Ford’s best-ever Q4 2024 EV sales, but critics argue it sidelines public charging infrastructure. Georgia residents can leverage this offer for F-150 Lightning or Mustang Mach-E purchases.

Conclusion

The automotive market is facing a dynamic start to 2025 with fluctuating wholesale prices and strategic shifts by key players. As the EV landscape evolves and regulations tighten, staying informed is essential. Keep an eye on industry trends to navigate this rapidly changing market.

Stay tuned for more updates!