Auto Market Update – January 17, 2025

As we step into 2025, the automotive market is experiencing notable developments across various segments. Here’s a comprehensive overview of the latest trends and industry news.

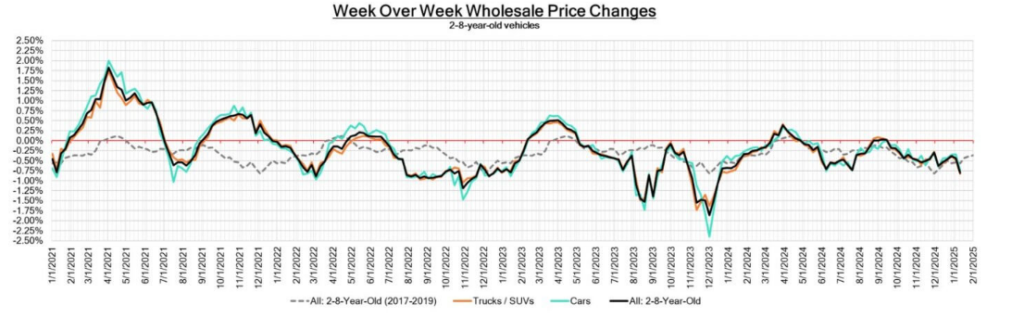

Wholesale Price Trends

In the final week of 2024, wholesale vehicle prices exhibited stability across both car and truck/SUV segments.

Car segments experienced a big depreciation of -0.75%. The truck and SUV segments saw a way higher decline of -0.83%. This steadiness occurred despite increasing auction inventories and improved conversion rates post-holiday, indicating a balanced market as auction activities resumed.

| This Week | Last Week | 2017–2019 Average in Same Week | |

| Car Segments | -0.75% | -0.35% | -0.62% |

| Truck & SUVs Segments | -0.83% | -0.47% | -0.52% |

| Whole Market | -0.81% | -0.44% | -0.56% |

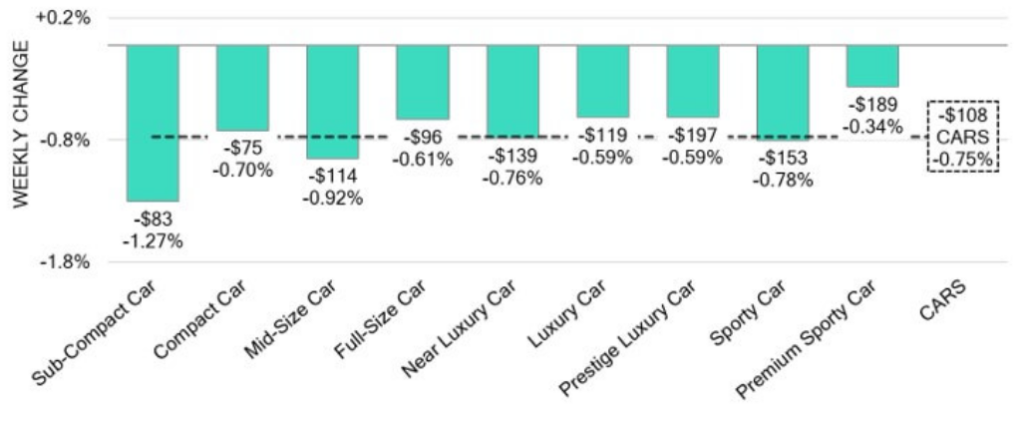

Car Segments

- Premium Sporty Cars: This segment experienced the lowest depreciation at -0.34%.

- Sub-Compact Cars: Hit the highest depreciation of the year, at an incredible -1.27% this week!

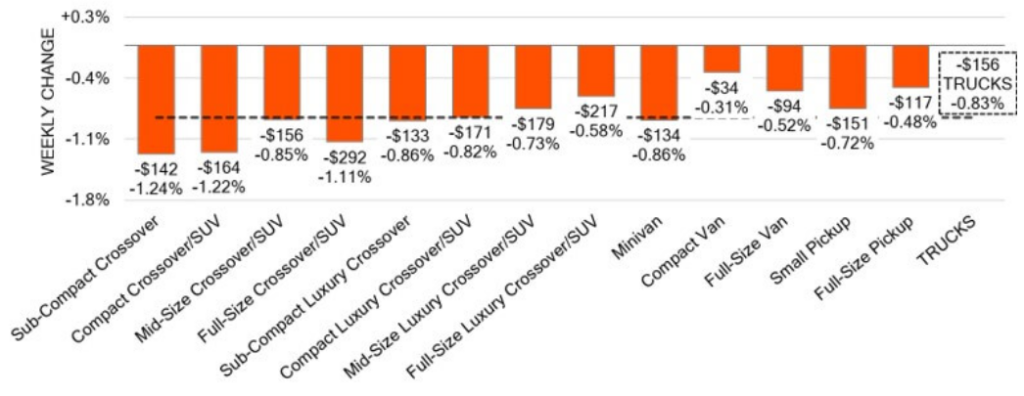

Truck & SUV Segments

- Sub-Compact Crossover: Saw the sharpest drop of the segment, at -1.24%.

- Compact Van: Remained relatively stable with a modest decline of -0.31%.

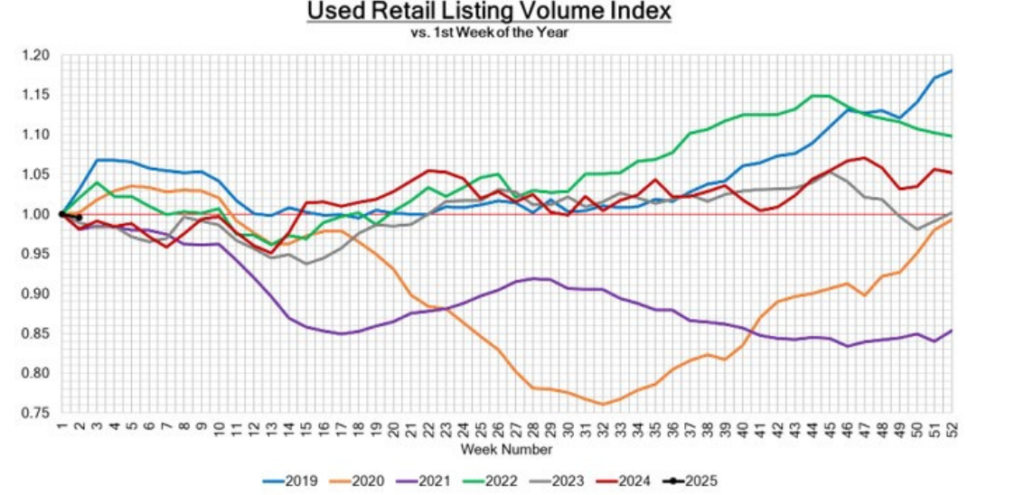

Inventory and Retail Trends

The Used Retail Active Listing Volume Index remained stable, reflecting consistent inventory levels across dealerships.

Used Retail Listing Volume Index

Remained stable, indicating balanced supply and demand across dealerships.

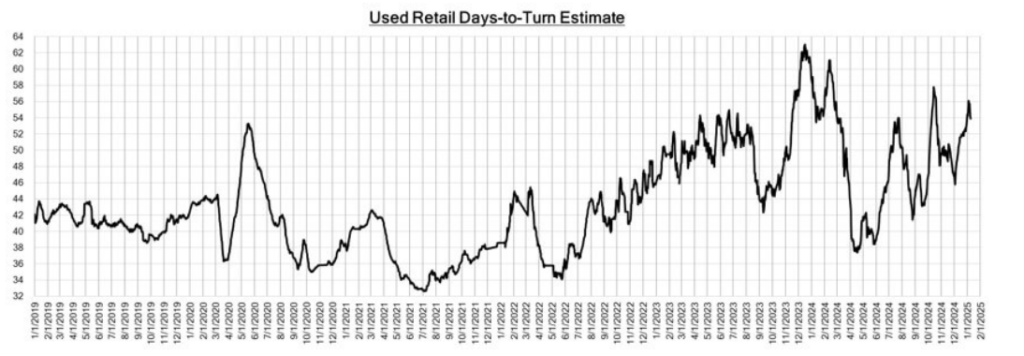

Used Retail Days-to-Turn Estimate

Improved slightly to an average of 54 days, reflecting efficient inventory management in the retail sector.

Industry News Highlights

Polestar’s New Strategy

Polestar plans to boost sales by 35% within three years by expanding dealership models and targeting profitability by 2027.

U.S. Bans Chinese Vehicle Imports

A ban on vehicles with Chinese-connected software and hardware will begin in 2027, citing national security concerns.

European Banks and Auto Challenges

Central Europe’s banks remain resilient despite economic challenges in the auto sector, which contributes 10% of the region’s GDP.

Conclusion

The automotive market is facing a dynamic start to 2025 with fluctuating wholesale prices and strategic shifts by key players. As the EV landscape evolves and regulations tighten, staying informed is essential. Keep an eye on industry trends to navigate this rapidly changing market.

Stay tuned for more updates!