Diminished Value: First Party v. Third Party Claims

Diminished Value: First Party v. Third Party Claims

By: Tony Rached

Licensed Insurance Adjuster

Third Party v. First Party Claims

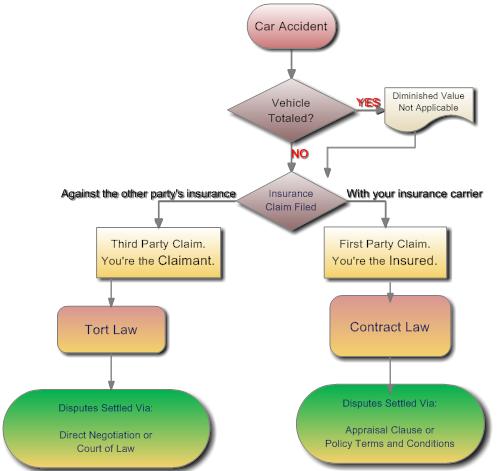

When involved in an auto accident and when filing a claim under an insurance policy, it is important to differentiate the relationship of the parties. First parties are those in direct contractual relationship with their own insurance company, i.e., “the Insured”. Third parties are those outside of the insurance relationship, meaning you file a claim against the other party’s policy.

In diminished value matters, the first party is typically the person responsible for the collision and whose own insurance company will pay the claims (both to fix the insured’s vehicle and the other party’s). A third party is typically the person not responsible for the collision. In other words, the first party is the one at fault causing damage to the third party.

Example: You rear end the vehicle in front of you, you are the first party with the other driver being the third party. Your insurance company considers you, “the insured” as the first party and the person your rear ended, “the claimant”, as the third party.

It is very important to differentiate between both claim types.

First Party Diminished Value Claims:

Your insurance policy is a contract between you and your insurance company, your claim recovery is therefore subject to contract law. Georgia is the only state that requires insurance companies to compensate their own insured for the loss in value of their vehicles. In other words, if you damage your own vehicle, you are entitled to that same vehicle’s loss in resale value.

Insurance companies use certain formulas to calculate Diminished Value, if you and your own insurance cannot agree on a settlement amount, your policy contains guidelines that determine the process in which a dispute can be handled. This is called the appraisal clause.

If both parties possess the same insurance carrier then both will be treated as an insured under the claim. (1st party for both)

Statute of Limitations: Usually 1 year.

Appraisal Clause:

This is why you should always file a claim against your own policy. Keep in mind, premiums follow risk and if you’re not at fault your insurance company will subrogate and collect from the at fault party.

What is the appraisal clause?

On a first party claim, if you fail to reach a settlement with your own insurance company, you have the right to invoke your policy’s appraisal clause.

What does the appraisal clause say?

A. If we and you do not agree on the amount of loss, either may demand an appraisal of the loss. In this event, each party will select a competent appraiser. The two appraisers will select an umpire. The appraisers will state separately the actual cash value and the amount of loss. If they fail to agree, they will submit their differences to the umpire. A decision agreed to by any two will be binding. Each party will:

1. Pay its chosen appraiser; and

2. Bear the expenses of the appraisal and umpire equally.

B. We do not waive any of our rights under this policy by agreeing to an appraisal.

Third Party Diminished Value Claims:

Since no contract exist between your insurance company and another party, the claim recovery falls under “tort law”.

Tort law has provisions that would allow a claimant to be compensated for direct and indirect losses caused by the other party’s negligence.

Direct Loss: This is the sheet metal or physical damage to your vehicle.

Indirect Loss: Loss of use, pain and suffering, diminished value etc…

Since there is no contract between you and the other party’s insurance company, and since there is no law quantifying Diminished Value, to be brought back whole, and to avoid going to court, both parties will engage in a negotiation process.

Statute of Limitations: 4 years.

Uninsured/Underinsured Motorist Coverage

In this case, your insurance company will act as if it was the other party’s insurance company, this will still be considered a first party claim.

—-The information provided in this column is for information purposes only and should not be construed as legal advice. You should always consult an attorney.—–