The Delinquency Disaster: By the Numbers

A perfect storm of inflation, predatory lending, and skyrocketing costs has pushed auto loan delinquencies to historic levels:

- 6.56% of subprime borrowers (credit scores ≤ 640) are 60+ days late—the highest rate since tracking began in 1994.

- 3% of all borrowers are 90+ days delinquent, risking repossession and credit ruin.

- Prime borrowers fare slightly better, but 60-day delinquencies still rose from 0.35% to 0.39% in 2024.

How about letting our team get you the best value for your insurance claim?

-

Discover your car’s true value -

No payment upfront -

Vehicle history report

Why Americans Are Drowning in Car Debt

Soaring Costs

- New Car Prices: Up 3% YoY to $48,641 (Cox Automotive).

- Insurance Rates: +16.5% in 2024, with another 7.5% hike predicted for 2025.

Dealer Traps

- Extended Warranties: Often slipped into loans without clear consent, adding $2k–$5k to debt.

- Gap Insurance & Add-Ons: Unnecessary fees inflate payments by 12–18%.

Interest Rate Burden

- Subprime borrowers face APRs up to 18–25%, doubling loan costs over 72-month terms.

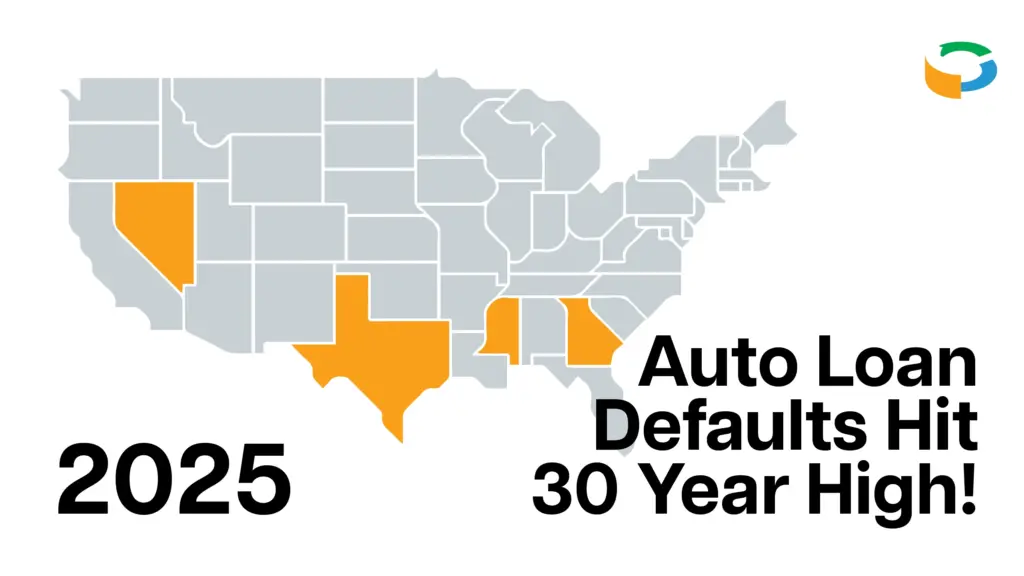

State-by-State Breakdown: Where Delinquencies Are Worst

| State | 90+ Day Delinquency Rate | Key Factor |

|---|---|---|

| Texas | 4.8% | Subprime loan concentration |

| Mississippi | 5.1% | Median income 20% below U.S. avg |

| Nevada | 4.9% | Gig economy instability |

| Georgia | 4.5% | Insurance costs up 28% YoY |

5 Lifelines to Avoid Repossession

1. Call Your Lender Immediately

- Request payment deferrals or extensions (Mitria Spotser, Center for Responsible Lending).

- Pro Tip: Georgia’s Fair Business Practices Act lets you sue lenders for deceptive add-ons.

2. Refinance Strategically

- Subprime → Prime Refi: Drop from 18% to 8% APR on a $25k loan saves $150/month.

3. Sell Privately

- Use Carvana or Facebook Marketplace to offload trucks/SUVs (values down 9%) for affordable sedans.

4. Slash Insurance Costs

- Drop collision coverage on older cars; raise deductibles to $1k.

5. Credit Counseling

- Nonprofits like GreenPath negotiate lower rates and halt repossession for $0 fees.

The Dealer Trap: How Add-Ons Sink Borrowers

- Extended Warranties: 72% of dealers bundle them without clear disclosure, per Consumer Reports.

- “Nitrogen Tires” & “Fabric Protection”: Scams adding $800–$1,200 to loans.

- Fight Back: Demand a Itemized Purchase Agreement and reject unnecessary services.

Real Case:

James R. (Houston) saved $3,200 by refusing a “paint protection” add-on and refinancing his Ford F-150 loan.

Not sure if the insurance offer is fair? Get a Free Claim review from our experts!

Legal Protections & Loopholes

- Repossession Laws: In 22 states, lenders can seize cars without warning.

- Deficiency Balances: Owe $10k after repossession? Lenders in Texas can garnish wages.

- Georgia’s Hidden Risk: “Title pawn” loans with 300% APRs target low-income buyers.

The Road Ahead

Economists warn delinquencies will rise through Q2 2025 as tax refunds dry up. However, proactive steps—like refinancing and selling overpriced vehicles—can help borrowers regain control.

Final Takeaways

- Avoid Dealership Traps: Compare prices online and reject unnecessary add-ons.

- Document Everything: Get payment deferrals in writing to avoid repossession surprises.

- Act Fast: Delaying a lender call risks credit score damage (150+ point drop).