Auction Retention Index – ARI

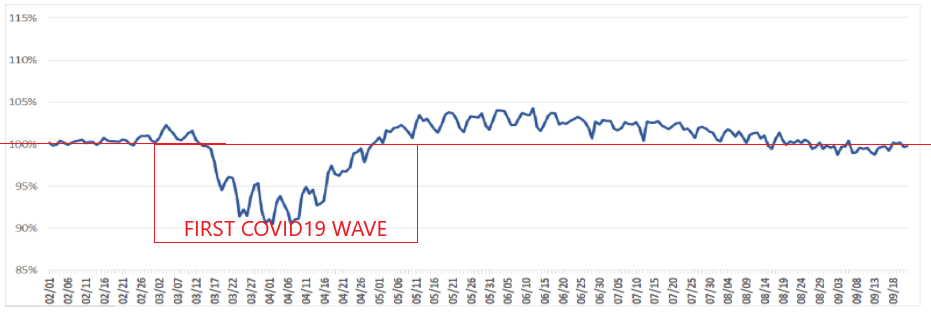

The Auction Retention Index is a good indicator of market stability.

Theoretical retention is at or around 100%, but with market turbulence, this index can greatly fluctuate.

If the index is under 100%, wholesale inventory is being transacted below the target price, meaning cars are cheaper than they normally should be.

For example, a 2018 Honda Accord should fetch $16,000 on the wholesale market, if the retention index is 92%, this vehicle is likely to bring $14,720.

After a sharp index decline, a period of recovery is usually witnessed as prices correct and the index may be higher than 100%.

There are make/model specific indexes as cars depreciate differently depending on the segment. Below is a chart showing the overall auction retention index from February 2020 to September 2020. Notice the COVID-driven sharp dip between March and May 2020.

The top 10 car makes for sale currently at U.S. auctions are:

| Make | Vehicle Count |

| BMW | 4,765 |

| Mercedes-Benz | 4,948 |

| Hyundai | 5,120 |

| Dodge | 5,548 |

| Honda | 5,676 |

| Jeep | 6,434 |

| Toyota | 9,912 |

| Nissan | 10,762 |

| Chevrolet/GMC | 18,847 |

| Ford | 24,032 |

| Total | 96,044 |

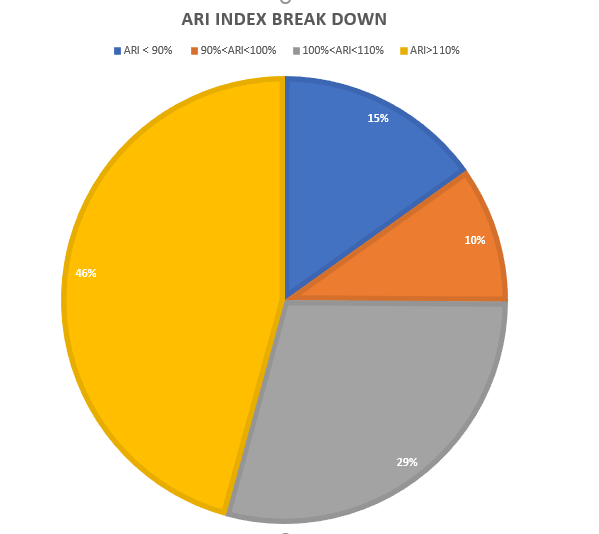

Analysis of the Auction Retention Index:

As of Sept 24, 2020.

Vehicles for Sale: 96,044

Vehicles for Sale, Buy it Now: 44,604

| Buy It Now | 100.0% | 44,604 |

| ARI < 90% | 15.1% | 6,755 |

| 90%<ARI<100% | 10.0% | 4,442 |

| 100%<ARI<110% | 29.2% | 13,007 |

| ARI>110% | 45.7% | 20,400 |

| ARI < 100% | 25.1% | 11,197 |

| ARI > 100% | 74.9% | 33,407 |