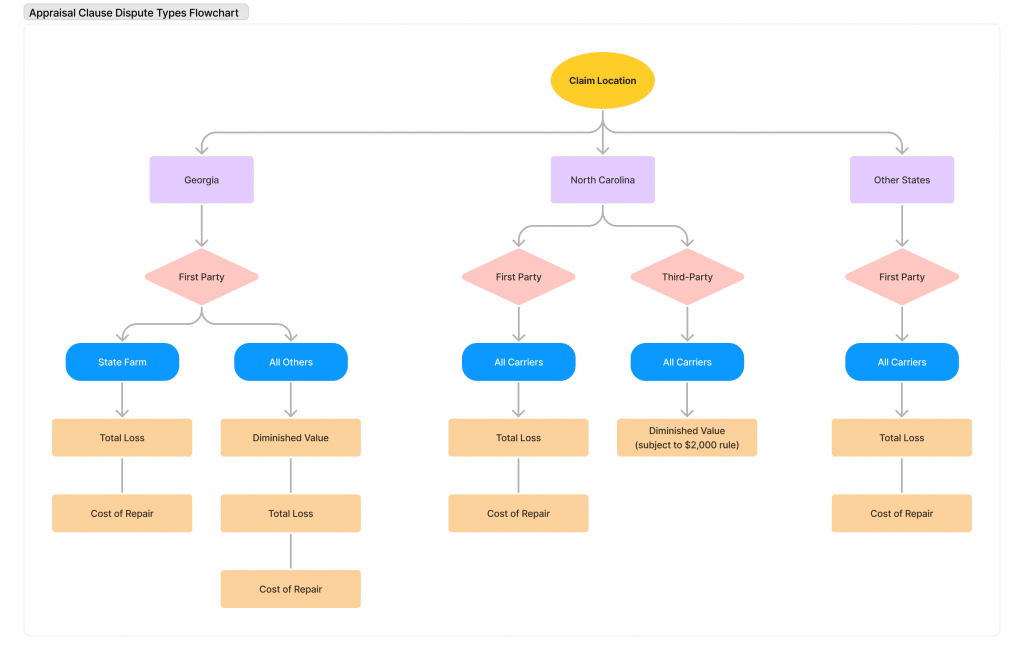

Navigating the world of insurance claims can be overwhelming, especially when dealing with appraisal clause disputes. This blog post aims to clarify the different types of disputes that can arise, focusing on three key states: Georgia, North Carolina, and other states in general. We will also provide a flowchart to help visualize the information.

Understanding Appraisal Clause Disputes in Insurance Claims (PDF)

What is an Appraisal Clause?

An appraisal clause is a part of an insurance policy that allows the policyholder and the insurance company to resolve disagreements about the amount of loss. When there is a dispute about the value of the damage or loss, either party can use the appraisal clause to have the matter settled by neutral appraisers.

Appraisal Clause Dispute Types in Insurance Claims

| Claim Location | Claim Type | Insurer | Total Loss | Diminished Value | Cost of Repair |

|---|---|---|---|---|---|

| Georgia | First Party Claim | State Farm | YES | NO | YES |

| First Party Claim | All Others | YES | YES | YES | |

| Third-Party Claims | All Carriers | NO | NO | NO | |

| North Carolina | First Party Claim | All Carriers | YES | NO | YES |

| Third-Party Claims | All Carriers | NO | YES (subject to $2,000 rule) | NO | |

| Other States | First Party Claim | All Carriers | YES | NO | YES |

| Third-Party Claims | All Carriers | NO | NO | NO |

What Do These Terms Mean?

- Total Loss: When the cost to repair a vehicle exceeds its market value, it is considered a total loss. Insurance companies will typically pay the market value of the vehicle before the accident.

- Diminished Value: This refers to the reduction in a vehicle’s market value after it has been repaired following an accident. Even if a car is fully repaired, its value can still be lower because it has a history of damage.

- Cost of Repair: This is the cost required to restore a damaged vehicle to its pre-accident condition.

Flowchart

Below is a flowchart to help visualize the different appraisal clause dispute types based on claim location, claim type, insurer, and coverage for total loss, diminished value, and cost of repair.

Conclusion

Navigating the complexities of appraisal clause disputes in insurance claims is crucial for policyholders. The procedures and rules can differ greatly depending on the state, the type of claim, and the insurance provider involved. This blog post has detailed how these disputes are managed in Georgia, North Carolina, and other states, providing valuable insights into the insurance claims process.

With this information, you will be better prepared to handle disputes, ensuring you receive the correct coverage and compensation. Understanding these intricacies can significantly improve your ability to manage insurance claims and protect your interests.