Tesla’s EV Dominance Dips: A Deeper Look at the U.S. Electric Vehicle Market Trends in 2023

Analyzing Tesla’s 2023 Electric Vehicle Market Share Decline (PDF)

The electric vehicle (EV) revolution in the United States is undergoing a subtle transformation as the market experiences a shift in consumer preferences, and Tesla, the company that has long dominated the EV landscape, is seeing its market share decline. According to Experian data, in the first eight months of 2023, Tesla’s EV market share dipped from 65.1% to 58%, marking a significant change in the landscape.

The Driving Forces Behind Tesla’s Decline

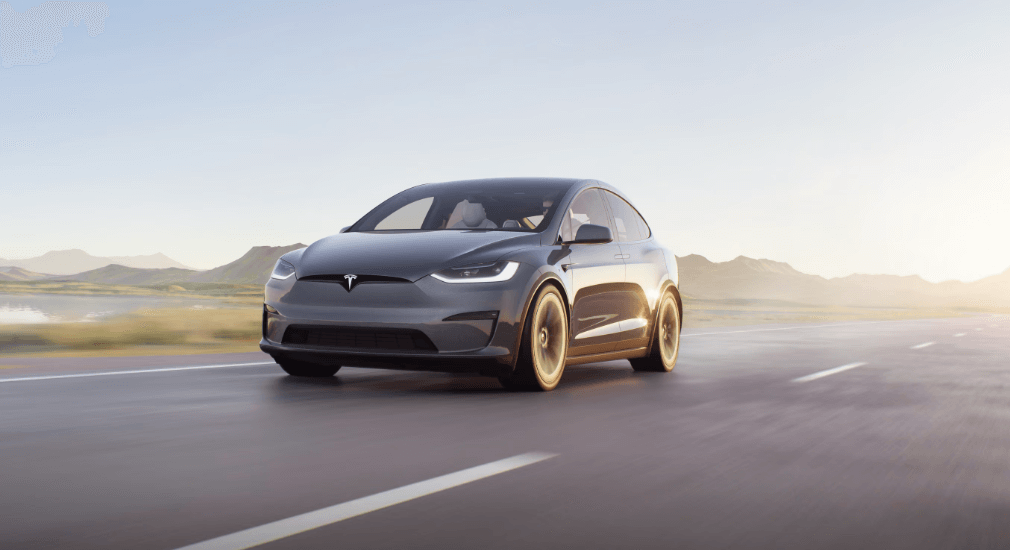

A closer look reveals that Tesla’s iconic high-end vehicles, the Model S sedan and Model X crossover, have seen double-digit percentage drops in registrations. Model S registrations fell by a staggering 51% to 9,743, while Model X registrations dropped by 18% to 16,162 during this period.

However, the decline in Tesla’s share is not solely due to waning popularity. While the high-end models struggled, Tesla’s more affordable Model 3 sedan and Model Y crossover made significant gains. These more budget-friendly models helped the automaker’s overall registrations grow by an impressive 46% to a total of 437,944. Nevertheless, with other manufacturers entering the EV market and increasing their registrations, Tesla’s share naturally decreased.

Top 10 EV Nameplates in 2023

The list of the top 10 EV nameplates for 2023 provides a comprehensive view of the market dynamics:

| Jan.-Aug. 2023 | Jan.-Aug. 2022 | |

|---|---|---|

| Tesla Model Y | 263,971 | 135,206 |

| Tesla Model 3 | 148,068 | 124,082 |

| Chevrolet Bolt EUV | 27,802 | 11,774 |

| Volkswagen ID4 | 23,576 | 9,121 |

| Ford Mustang Mach-E | 22,785 | 25,527 |

| Hyundai Ioniq 5 | 21,170 | 16,925 |

| Chevrolet Bolt EV | 17,368 | 4,700 |

| Tesla Model X | 16,162 | 19,760 |

| BMW i4 | 16,117 | 3,128 |

| Rivian R1S | 13,241 | 94 |

A Noteworthy Global Slowdown

Tesla’s global sales also saw a decline in the most recent quarter, with Q3 2023 sales at 435,059, a decrease from the previous quarter’s 466,140. This dip has been attributed to factory downtime necessary for plant upgrades. However, the company continues to introduce new models and plans to launch the Cybertruck pickup soon.

Changing Strategies in Marketing

To counter the decline in its market share, some analysts are suggesting that Tesla should shift its tactics from price cuts to marketing. While Tesla CEO Elon Musk has consistently advocated for word-of-mouth promotion by Tesla owners over traditional advertising, some experts argue that mainstream consumers need more information about EVs to make informed decisions.

Gary Black, managing partner of The Future Fund, believes that Tesla should invest in advertising rather than further price cuts. According to him, “To move beyond early adopters and green-focused customers, Tesla needs to do more to educate would-be EV consumers about lower upfront costs, charging convenience, how long a charge lasts, EV performance, technology, safety, and lower maintenance and operating costs.”

Tesla’s Recent Price Cuts

Recent price reductions, however, indicate a proactive approach to remaining competitive in mainstream segments. Tesla cut prices for its Model 3 and Model Y by up to $2,250 and reduced Model S and Model X prices by up to $8,500. This has brought the Model 3 and Model Y below the average U.S. vehicle price of around $48,000, making them more appealing to a broader range of consumers.

The Broader EV Landscape

Despite Tesla’s dip in market share, the EV market in the United States is expanding. Competitors, both legacy automakers and startups, are gaining traction. Chevrolet is now the second-largest EV brand after Tesla, with a 6% share of the EV market, and its new EV registrations nearly tripled in the first eight months of the year.

Ford, despite seeing a slight decline in market share, experienced growth in new EV registrations, notably for its F-150 Lightning. Other manufacturers, like Hyundai and BMW, also made significant strides in increasing their market share.

Rivian, an up-and-coming EV manufacturer, significantly increased its new EV registrations, reflecting growing interest in the brand. Additionally, Mercedes-Benz quadrupled its new EV registrations, while Kia’s share fell due to changes in the federal EV purchase incentive program.

In Conclusion

The U.S. EV market is evolving, and Tesla’s dominance is facing challenges. As more automakers enter the scene and consumer preferences shift, the electric vehicle landscape is becoming more competitive.

Tesla, a company synonymous with EVs, is adjusting its strategy to maintain its leading position, while other manufacturers are gaining momentum. This shift indicates a bright future for the EV market, driven by innovation and consumer demand.