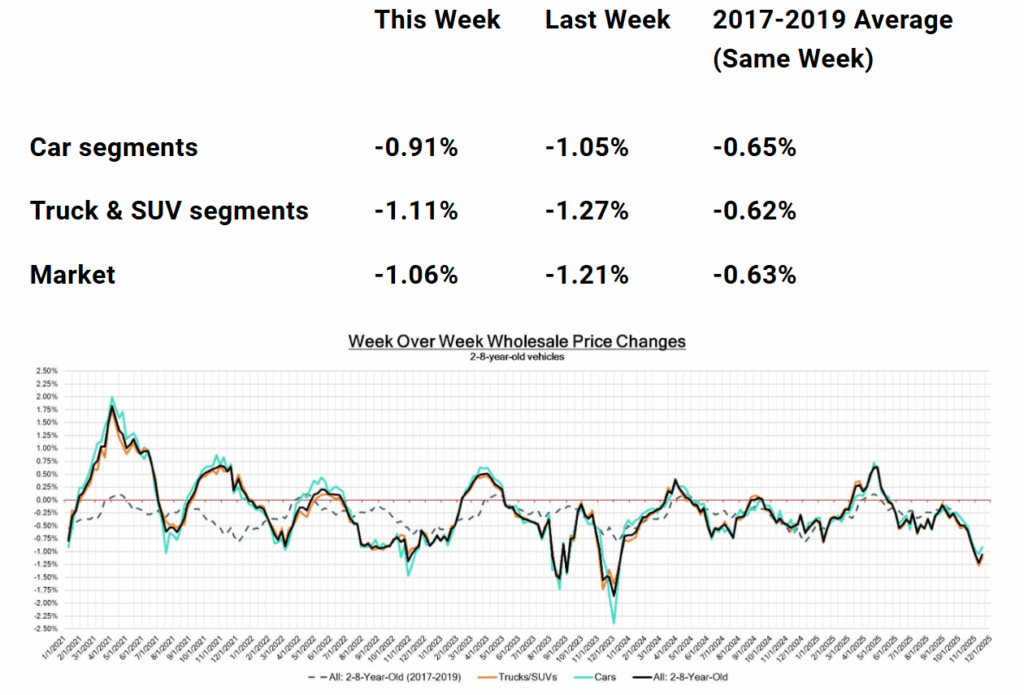

The used-vehicle market continued to slide last week, with wholesale prices dropping just over 1% on a volume-weighted basis. Both car and truck/SUV segments moved lower again, extending the depreciation streak that’s been building through November.

Mainstream models saw the sharpest declines, while buyers at the lanes remained active but highly selective, favoring clean, front-line-ready inventory over anything with risk factors or condition issues.

Week Over Week Wholesale Price Changes

The latest report for the week ending November 15, 2025 shows broad-based declines across the board.

The market is still trying to find equilibrium as higher depreciation meets lingering inventory imbalances. OEMs are also working through elevated unsold 2025 model-year stock, with some launch delays for 2026 models as a result.

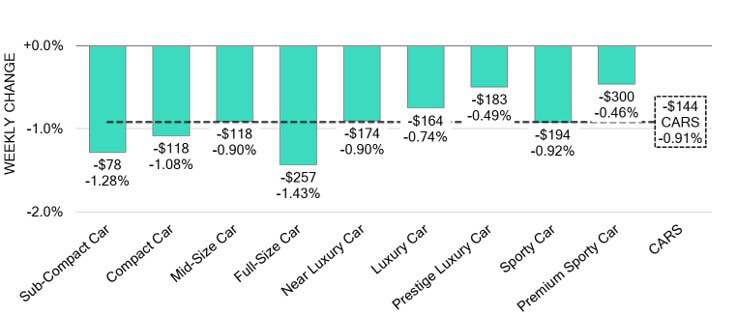

Car Segments

On a volume-weighted basis, overall car prices fell 0.91%, a slightly smaller decline than the previous week’s -1.05%.

Age breakdown:

- 0–2-year-old car segments: -0.85%

- 8–16-year-old cars: -0.60%

All nine car segments recorded declines.

Mainstream categories such as Sub-Compact, Compact, and Full-Size Cars each posted losses exceeding 1%, reflecting weaker demand and more price pressure at the lower and middle ends of the market.

Depreciation in the 0–2-year-old Sub-Compact Car segment eased to -0.87% after three straight weeks above -2%, but values remain under strong pressure.

Premium Sporty Cars are still holding up better than mainstream sporty models, although last week marked their largest drop since late November 2024.

For Georgia drivers, this pattern means compact and full-size sedans with accident history are likely to see steeper discounts than clean comparables, especially in the 0–8-year range where most retail demand is concentrated.

Truck & SUV Segments

The combined Truck and SUV category declined 1.11%, easing slightly from the prior week’s -1.27% but still posting a larger drop than pre-pandemic seasonal averages.

Age breakdown:

- 0–2-year-old trucks/SUVs: -0.96%

- 8–16-year-old models: -0.75%

All thirteen truck segments recorded decreases, with seven showing drops greater than 1%.

After several weeks of relative stability, Minivans started to align with broader trends, with depreciation quickening to -0.81% versus an average -0.41% over the prior four weeks.

The Sub-Compact Crossover segment posted the largest decline of the week at -1.49%, compared with an average weekly drop of -1.16% over the previous month.

In a truck-heavy market like Georgia, these numbers signal more aggressive pricing on crossovers, small utilities, and certain family movers, especially if they have prior damage or structural history.

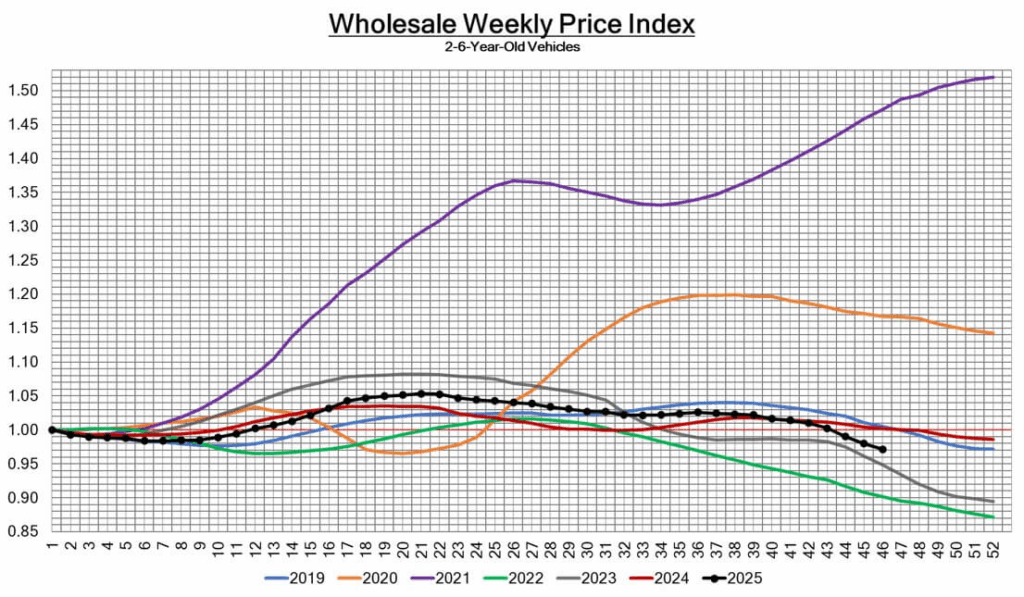

Wholesale Price Trends

The wholesale price index tracks 2–6-year-old vehicles, normalized to the first week of the year and adjusted for age mix. The latest readings confirm that 2025 is running softer than 2024, with more pronounced declines than in pre-pandemic years.

Values continue to step down week after week, especially in mainstream segments, as sellers clear aging inventory and adjust floors to meet the market.

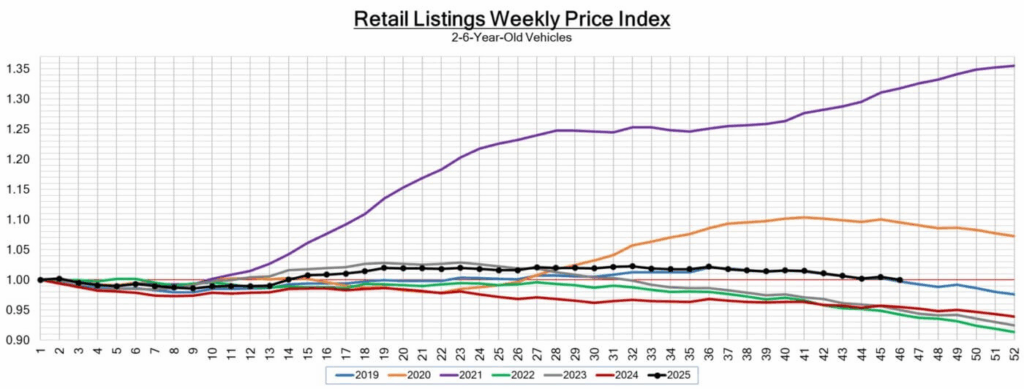

Used Retail Pricing

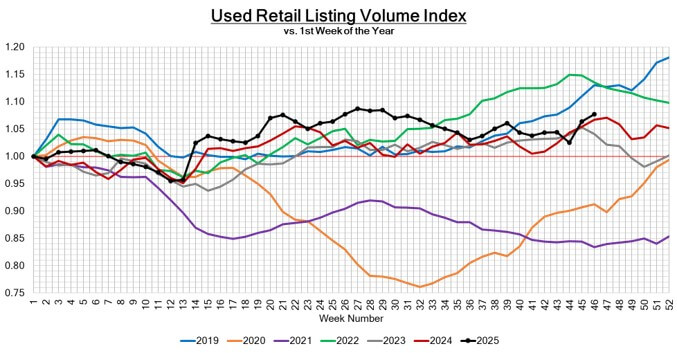

On the retail side, widespread no-haggle pricing continues to improve transparency, which makes it easier to track real-world trends. Black Book’s analysis of roughly two million active U.S. dealer listings shows that retail prices for 2–6-year-old vehicles are still edging lower, with 2025 performance trailing 2024.

For shoppers and claimants in Georgia, this means asking prices at dealerships may look stable on the surface, but underlying discounts, incentives, and willingness to negotiate are being shaped by a weaker wholesale floor.

Used Retail Pricing

Used Retail

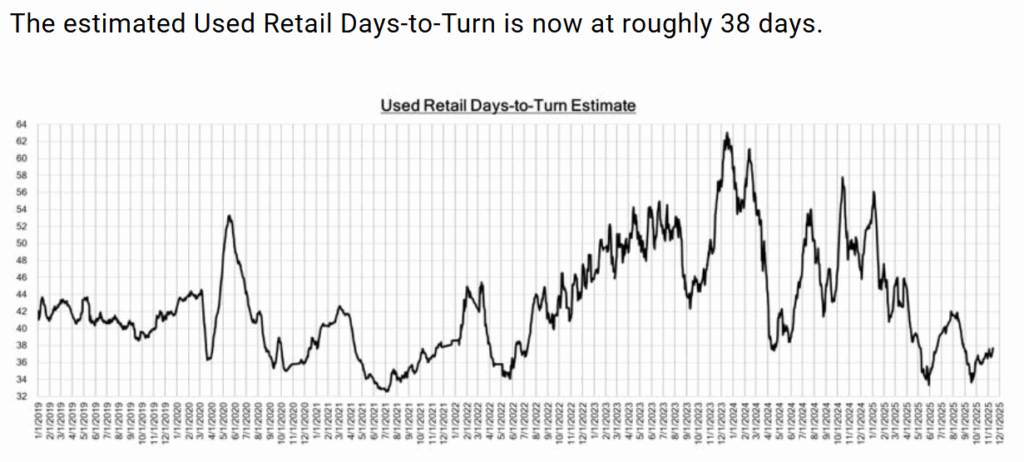

Inventory levels, based on the Used Retail Active Listing Volume Index, remain relatively steady on a year-to-date basis. Average days-to-turn now sit around 38 days, indicating moderate retail velocity and a market where dealers are still moving units but with more discipline.

Used Retail

Wholesale values declined again last week, with:

- Cars down 0.91%

- Trucks/SUVs down 1.11%

- Sub-Compact Crossovers and other smaller utilities facing the sharpest weekly drops

- Clean-condition units and hybrids drawing the strongest bidding

- Luxury and EV models softening further despite some incentive support

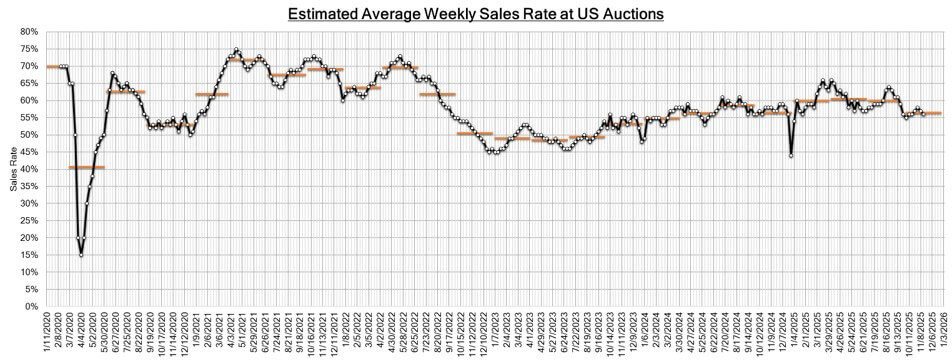

Auction conversion rates slipped to 56%, down about one point week over week, reflecting a cautious but still functioning wholesale environment heading into the late Q4 holiday period.

Analyst Note

Analysts continue to monitor segment-level performance, buyer selectivity, and inventory flow closely. For now, the pattern is clear:

- Mainstream vehicles are under heavy depreciation pressure, especially compacts, sub-compacts, and small crossovers.

- Trucks and SUVs are also declining faster than historical norms, even though they remain core demand segments in markets like Georgia.

- Elevated inventory, slower days-to-turn, and a more cautious credit environment are likely to keep values under pressure through the remainder of 2025.

For Georgia drivers, this backdrop makes accurate, data-driven appraisals more important than ever, particularly for vehicles with recent accident history, where separating normal market movement from true diminished value is critical for fair claim outcomes.

Industry News Highlights

Stellantis Expands U.S. Production

Stellantis announced a $13 billion U.S. investment, adding five new models and creating 5,000 jobs over the next four years. This expansion may increase future vehicle supply and add pressure to used-car pricing.

New 25% Tariff on Imported Trucks

A 25% tariff on imported medium- and heavy-duty trucks took effect on November 1, 2025, potentially raising fleet replacement costs and tightening used-truck availability.

Tariffs Are Changing Buyer Behavior

A recent J.D. Power survey found that 36% of new-car shoppers adjusted their timing because of tariffs, with 87% buying sooner than planned to avoid possible price increases.

Conclusion: What Georgia Drivers Should Take Away

This week’s depreciation isn’t happening in a vacuum. The new truck tariffs and the rush of buyers trying to beat possible price increases have added pressure to the wholesale lanes, amplifying normal Q4 softness. Dealers are bidding more cautiously, fleet buyers are adjusting plans, and mainstream segments, especially compacts, sub-compacts, and smaller crossovers, are feeling the fastest pricing shifts.

For Georgia drivers with accident history, this environment widens the gap between a clean vehicle and one with prior damage. Insurers may try to attribute these sharper drops to “normal market movement,” which makes it even more important to separate depreciation from true diminished value using real data.

If your vehicle was recently repaired, now is the ideal time to document its loss before the market shifts again.