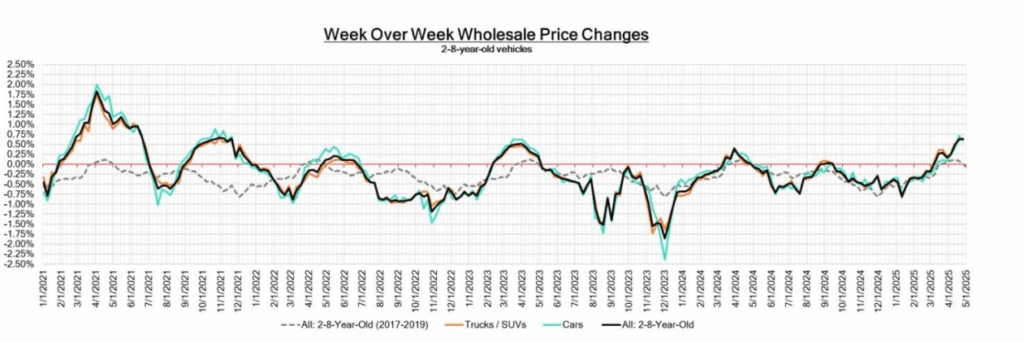

The 2025 auto market continues to defy traditional seasonal patterns, with wholesale prices surging 0.63% week-over-week—matching the prior week’s growth and far exceeding the 2017–2019 average of 0.00% for the same period. Fueled by tariff uncertainties, reduced new-vehicle inventories, and robust consumer spending, this upward trend highlights a resilient market with critical implications for Georgia drivers and diminished value claims.

Week Over Week Wholesale Price Changes

| This Week | Last Week | 2017~2019 Same Week Average | |

| Cars | +0.59% | +0.72% | -0.05% |

| Trucks and SUVs | +0.65% | +0.60% | +0.04% |

| Market | +0.63% | +0.63% | +0.00% |

- Market: +0.63% WoW (vs. +0.63% prior week), driven by tariffs on imports and production supplies.

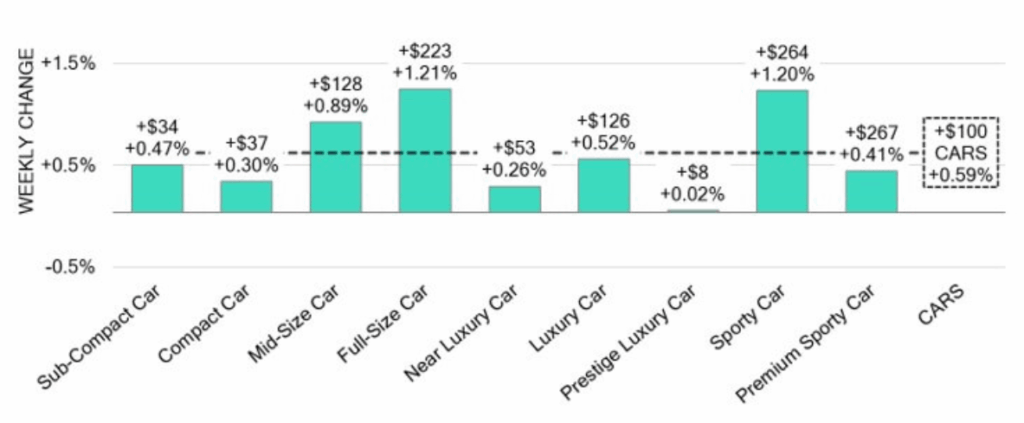

- Car Segments: +0.59% (vs. +0.72% prior week), led by Full-Size Cars (+1.21%)—their largest single-week gain since May 2021—and Sporty Cars (+1.20%).

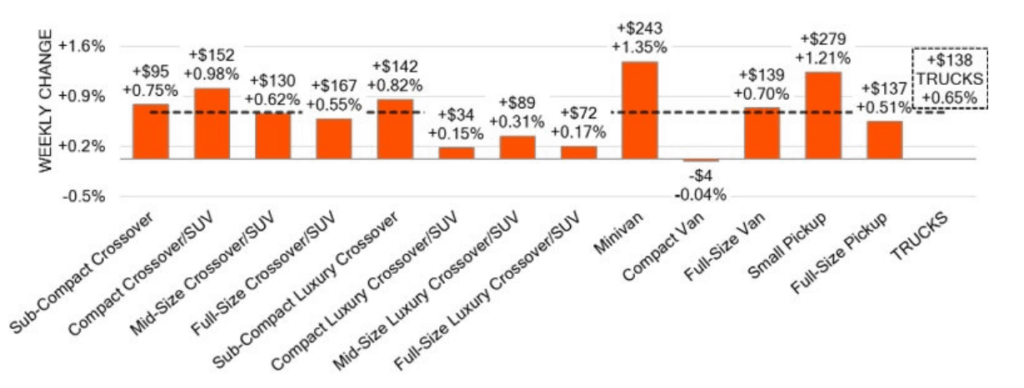

- Truck/SUV Segments: +0.65% (vs. +0.60% prior week), with Minivans (+1.35%) and Full-Size Pickups (+0.51%) outperforming historical averages.

Car Segments

Top Performers

- Full-Size Cars: +1.21% (0-2yo models) due to dwindling supply as manufacturers exit production.

- Sporty Cars: +1.20%, marking three consecutive weeks of growth (+0.62% prior week.

- Older Vehicles: 8-16yo cars rose +0.31%, reflecting demand for sub-$20k options amid new-car price hikes.

Truck & SUV Segments

Top Gainers

- Minivans: +1.35% (2-8yo models) as families prioritize affordability and space.

- Full-Size Pickups: +0.51%, the largest gain since November 2021, driven by tariff-driven demand for domestic models.

- Strugglers: Compact Vans dipped -0.04%, signaling stability after a +0.05% prior-week increase.

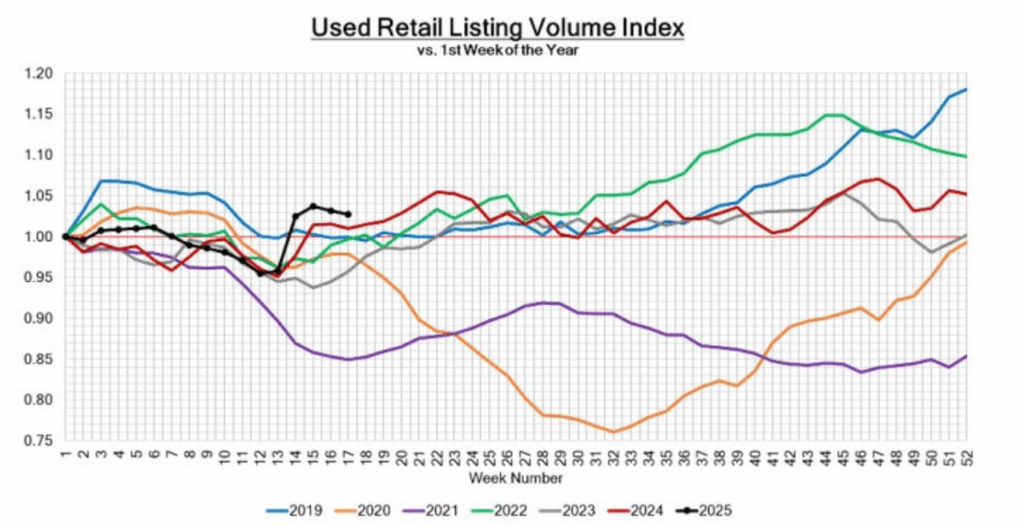

Inventory and Retail Trends

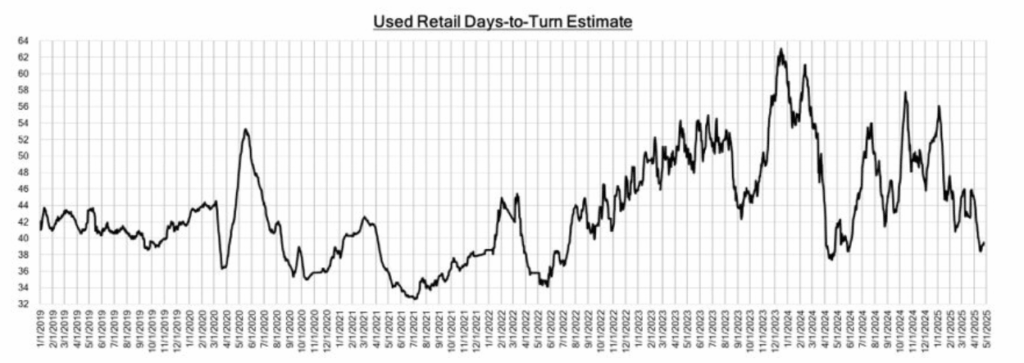

- Retail Prices: Days-to-Turn dropped to 39 days (from 43 days in April), with retail prices lagging wholesale by 6–8 weeks.

- Wholesale Activity: Auction inventory rose slightly, with a 63% conversion rate and increased OEM vehicle volumes.

- Tax Refund Boost: Average refunds rose 3% YoY, supporting consumer spending on used vehicles.

Industry News Highlights

Tariffs Reshape Demand

Proposed 25% tariffs on imports and production supplies are driving buyers toward domestic trucks and EVs. Compact Crossovers (e.g., Ford Escape) surged 9% YTD.

Auto Loan Rates Decline

Average rates fell to 9.38% for new and 14.22% for used vehicles, easing payment pressures and boosting financing activity.

EV Adoption Slows, Hybrids Rise

While luxury EVs (e.g., Mercedes S-Class) gained +0.47%, post-accident EVs still depreciate 42% faster than gas models. Hybrid demand surged 23% YoY, reflecting consumer caution.

How about letting our team get you the best value for your insurance claim?

- Discover your car’s true value

- No payment upfront

- Vehicle history report

Conclusion

The 2025 auto market thrives on volatility: tariffs boost domestic demand, declining loan rates ease buyer pressure, and EVs face dual realities of growth and depreciation. For Georgia drivers, strategic appraisals and swift action are critical to safeguarding value.

Need Help? Get a Free 2025 Appraisal to navigate this shifting landscape.