Introduction

November 2024 brings a range of significant developments within the auto market. As we progress through the fourth quarter, seasonal trends and broader economic factors are affecting wholesale prices, retail dynamics, and auction activities. Here’s a breakdown of the key changes shaping the automotive landscape this month.

Quick Stats Summary

- Wholesale Market: Market-wide wholesale prices decreased by -0.46%.

- Car Segments: Recorded a price adjustment of -0.52%.

- Truck & SUV Segments: Experienced a drop of -0.44%.

- Auction Sales Rate: Held steady at 58%, reflecting consistent dealer activity.

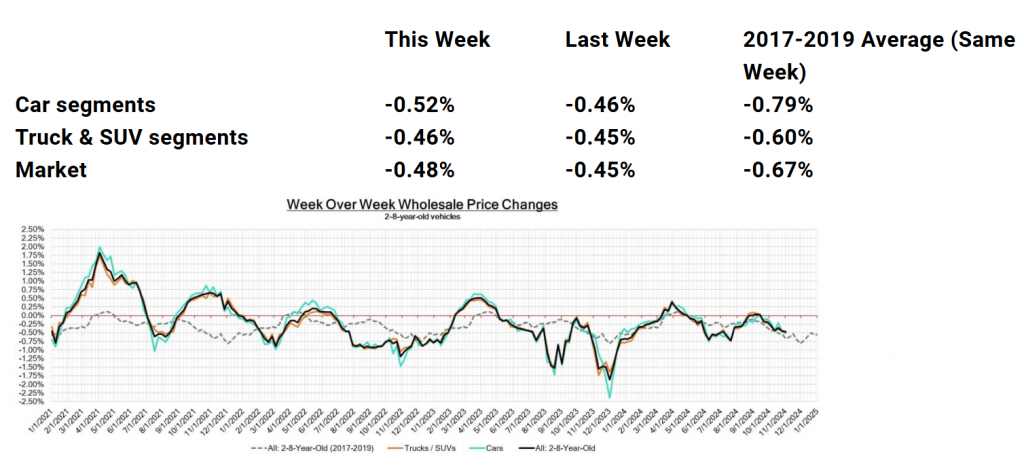

1. Wholesale Price Index

- November Trends: The overall market saw a -0.46% dip in wholesale prices, aligning with typical fourth-quarter trends where depreciation tends to increase. This seasonal adjustment comes as dealers prepare for year-end and adjust buying to match shifting consumer demand.

- Yearly Comparison: Compared to the 2017-2019 average for the same week, which was -0.67%, this November’s market decline is slightly milder. Visual Aid: Add the Wholesale Price Index Chart here to provide a visual overview of wholesale price shifts across 2-8-year-old vehicles.

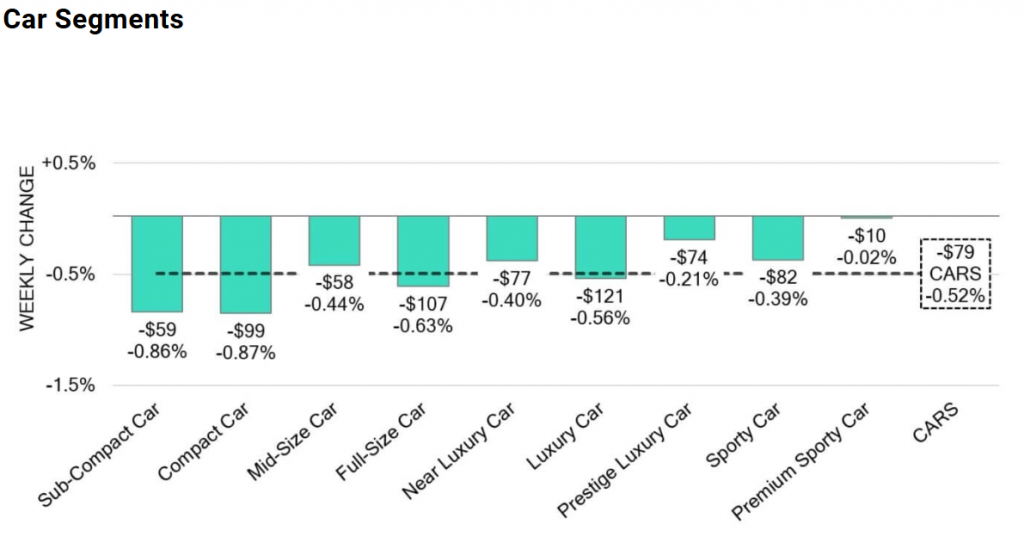

2. Car Segments Analysis

- Volume-Weighted Basis: The Car segment overall decreased by -0.52% this week, up from the -0.33% decline last week.

- Age-Specific Data: Vehicles aged 0-2 years showed a smaller decrease of -0.48%, while 8-16-year-old cars recorded a sharper decline of -0.54%.

- Segment Highlights: Seven of the nine car sub-segments reported declines. Notably, the Prestige Luxury Car segment had the largest decrease at -1.05%, while the Sporty Car segment saw modest gains of +0.05%.

- Special Notes: The Compact Car segment for 0-2-year-olds fell by -0.33%, breaking its previous streak of stability. Visual Aid: Insert the Car Segments Graph here to display weekly price changes for each car sub-segment.

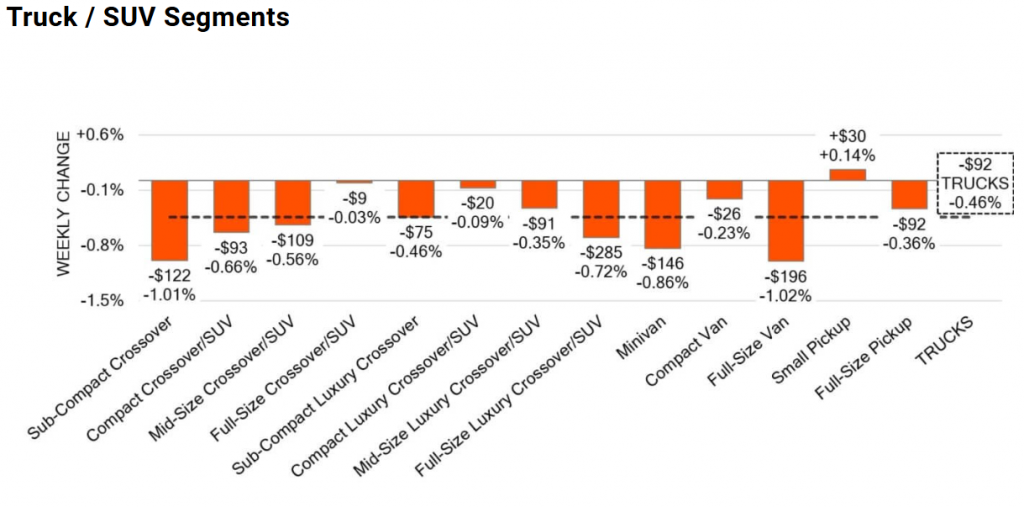

3. Truck & SUV Segments Analysis

- Overall Performance: The Truck and SUV segment dropped by -0.44%, compared to -0.36% in the prior week.

- Age-Specific Data: 0-2-year-old models in this segment decreased by -0.31%, while 8-16-year-olds fell by -0.55%.

- Segment Highlights: All thirteen truck sub-segments experienced declines, with Compact Crossover SUVs seeing a notable -0.79% drop, while Small Pickups managed a less severe decrease of -0.35%.

- Long-Term Trends: This marks a continuing pattern of depreciation in the Truck/SUV segment as inventory stabilizes and demand fluctuates. Visual Aid: Place the Truck & SUV Segments Graph here to illustrate week-over-week price changes across all sub-segments.

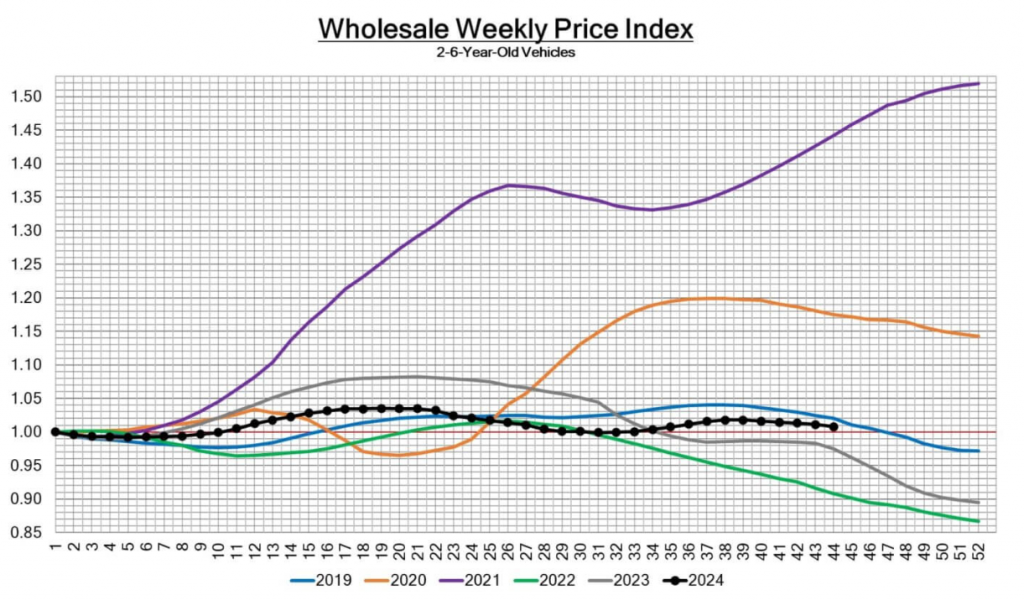

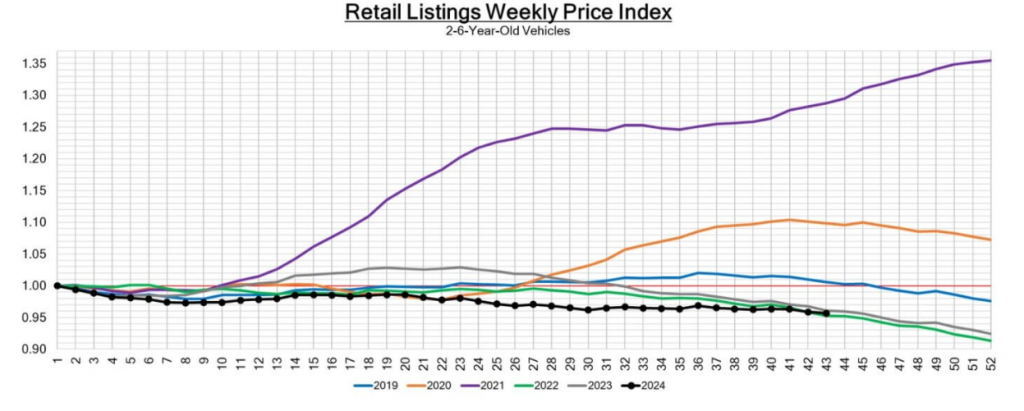

4. Weekly Wholesale Price Index

- Historical Context: The Weekly Wholesale Price Index shows prices indexed to the first week of the year for 2-6-year-old vehicles. This November, the price trend reflects typical fourth-quarter depreciation, with values showing slight declines after a relatively stable start to the year. Visual Aid: Add the Weekly Wholesale Price Index Graph here to capture the historical trend across 2024 and previous years for comparison.

5. Inventory Levels

- Current Trends: The Used Retail Active Listing Volume Index is steady, showing a balanced inventory across independent and franchised dealerships.

- Days-to-Turn: Estimated Days-to-Turn for used retail listings is currently at 51 days, indicating stable turnover and an alignment with consumer demand levels. Visual Aid: Include the Inventory Graph here to reflect current retail volume and days-to-turn data.

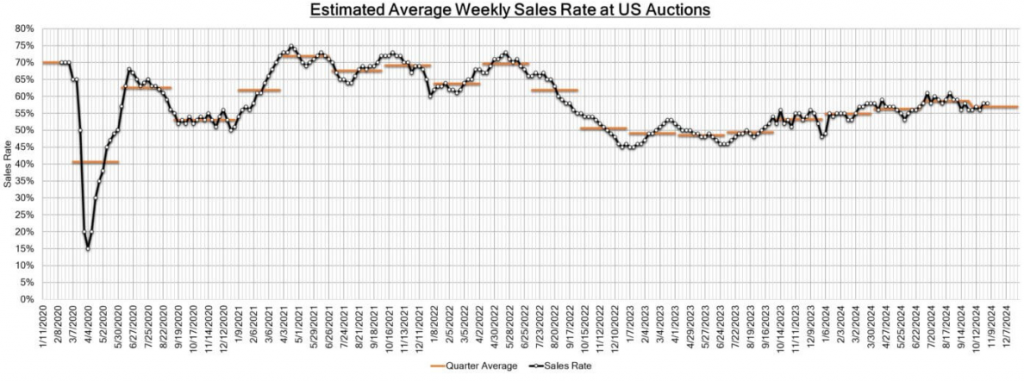

6. Auction Sales Rate

- Auction Performance: Auction conversion rates held at 58% for the second consecutive week. This consistent rate points to balanced dealer engagement in auction activities, as market conditions remain stable and predictable.

- Market Impact: The steady auction rate suggests cautious but steady purchasing from dealers, adapting to both seasonal adjustments and longer-term economic factors. Visual Aid: Insert the Auction Sales Rate Graph to visualize the consistency in auction activity over recent months.

Not sure if the insurance offer is fair? Get a Free Claim review from our experts!

Conclusion

November 2024’s auto market trends highlight a mix of typical seasonal adjustments and consistent demand-driven behaviors. While wholesale prices reflect predictable year-end depreciation, inventory levels and auction activity remain stable. As the year winds down, dealers and consumers alike are preparing for potential shifts in the new year.