October 2024: Auto Market Update – Week of 10/22/24

The automotive market in the third week of October 2024 continued its seasonal adjustments, with wholesale prices experiencing further declines across both car and truck segments. Market behavior this week reflects expected trends as we move further into fall, where price adjustments typically accelerate. With that in mind, let’s break down the key trends shaping the market this week.

DOWNLOAD THE “2024 Auto Market Update October” PDF

The average diminished value amount is $6,200. We can help you get what you deserve.

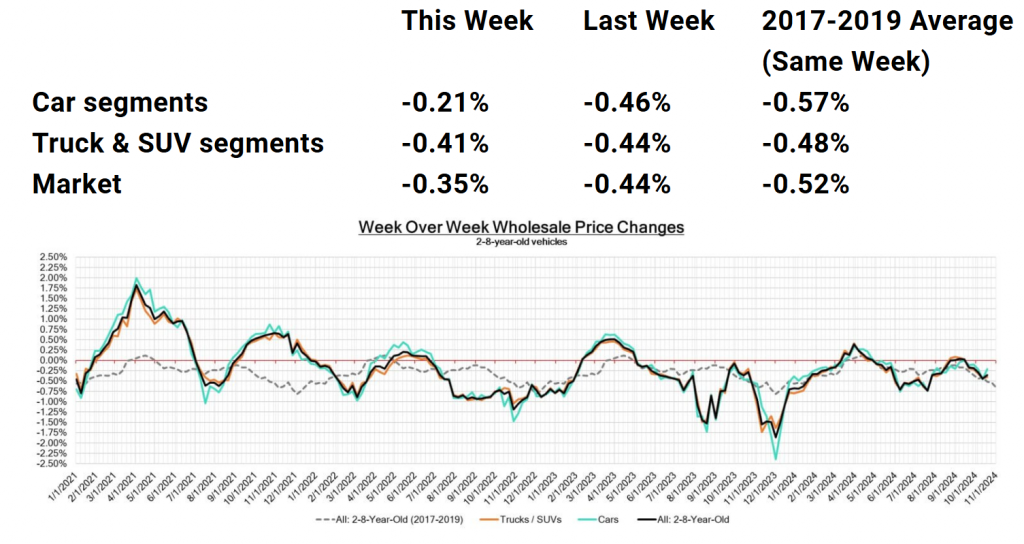

Wholesale Price Trends

In the week ending October 22nd, 2024, wholesale prices saw a market-wide decline of -0.44%, continuing the downward trend from the previous week’s -0.35%. Both car and truck/SUV segments experienced price drops:

- Car segments decreased by -0.33%, which is a slight acceleration compared to last week’s -0.26% drop.

- Truck & SUV segments saw a larger decline of -0.45%, following the -0.41% dip observed in the previous week.

These price reductions align with the 2017-2019 average for this time of year, which saw a similar seasonal softening of -0.41%. As we approach the end of the year, we can expect further declines in wholesale prices as demand slows.

Car Segments Breakdown

Most car segments followed the overall market trend with price drops this week, though there were some notable differences in performance across individual segments:

- Full-Size Car: Prices dropped by -0.65%, reflecting a steeper decline compared to other segments.

- Near Luxury Car: This segment recorded a drop of -0.66%, contributing to the continued price softening in premium categories.

- Luxury Car: Luxury vehicles faced the sharpest decline, with prices falling -1.02% this week.

- Sporty Car: On a brighter note, the Sporty Car segment posted a modest increase of +0.10%, marking the third consecutive week of gains in this category.

Overall, seven out of nine car segments posted declines, with luxury and premium categories seeing the most significant drops. However, consumer interest in sporty models remains strong, likely fueled by continued demand for performance vehicles.

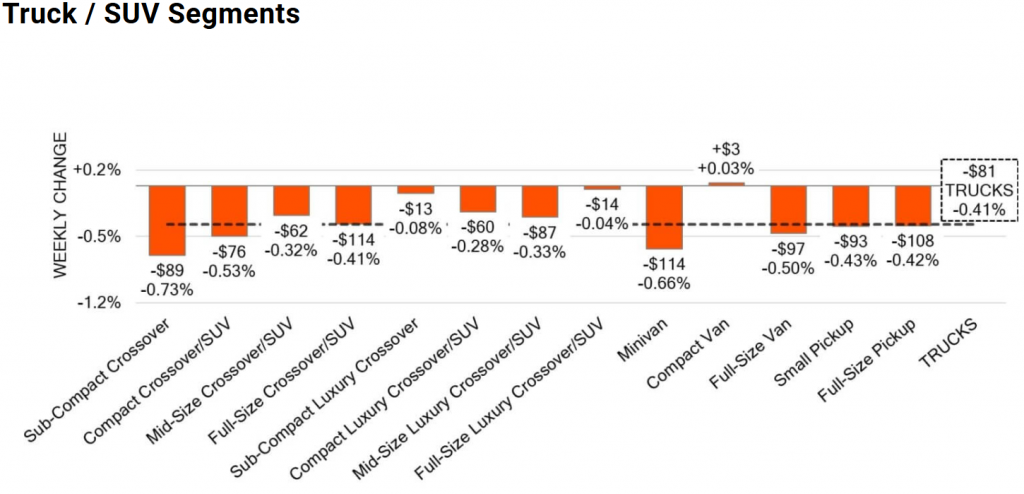

Truck/SUV Segments Breakdown

The Truck and SUV segments experienced even sharper declines this week, with every subcategory posting negative numbers:

- Sub-Compact Crossovers saw a significant decline of -0.74%.

- Mid-Size Crossovers recorded a drop of -0.79%, making it one of the worst-performing sub-segments this week.

- Full-Size Crossovers experienced a -0.42% decline, indicating a slight softening of demand in larger vehicles.

- Minivans dropped -0.56%, continuing a downward trend from last week.

All segments in the truck category were down, which continues the broader trend of declines we’ve seen for several weeks. This week’s drop in the Truck/SUV segment of -0.45% builds on the previous week’s -0.41% reduction, indicating a market-wide softening as inventory increases and demand cools.

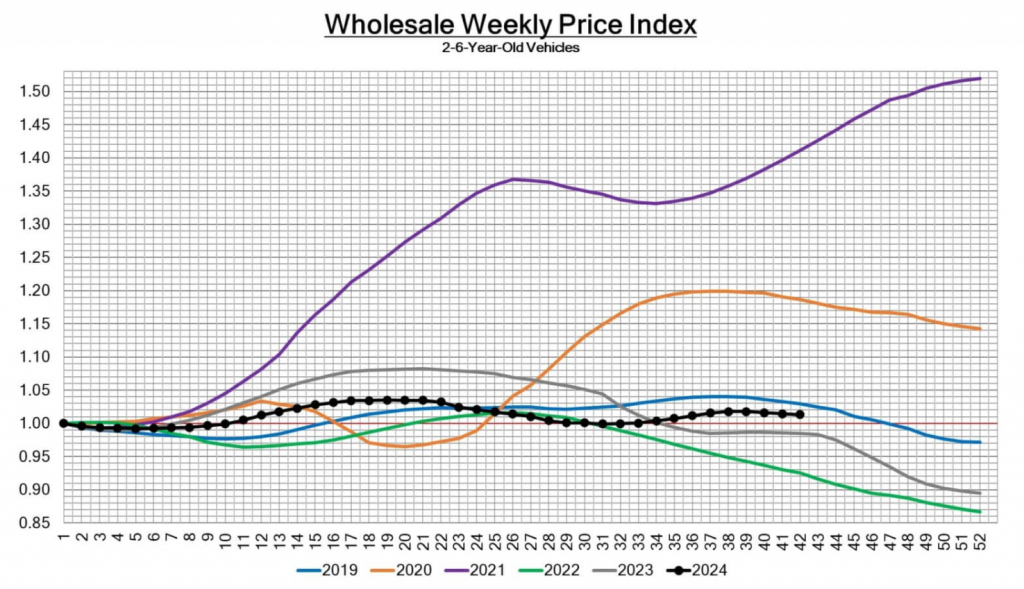

Weekly Wholesale Price Index

Looking at the Wholesale Weekly Price Index for 2-6-year-old vehicles, prices continue to show a steady seasonal decline. This week’s movement mirrors the trends seen in 2023, but remains far more stable than the fluctuations observed in 2021 and 2022. The graph shows that 2024 price trends are tracking closely with pre-pandemic levels from 2019, indicating a return to more typical seasonal patterns.

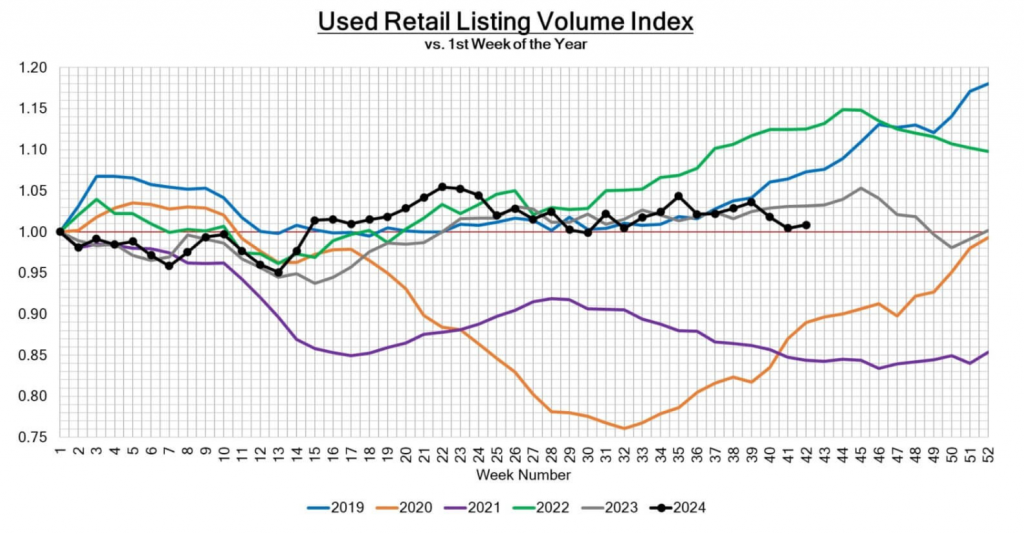

Used Retail Listing Volume

The Used Retail Listing Volume Index for this week shows that 2024 listings have remained stable compared to recent months, with a slight increase over last year’s numbers. Dealerships continue to see healthy inventory levels, with many looking to offload vehicles before the year’s end. However, demand may be softening as more used vehicles enter the market, causing some dealers to offer more competitive pricing.

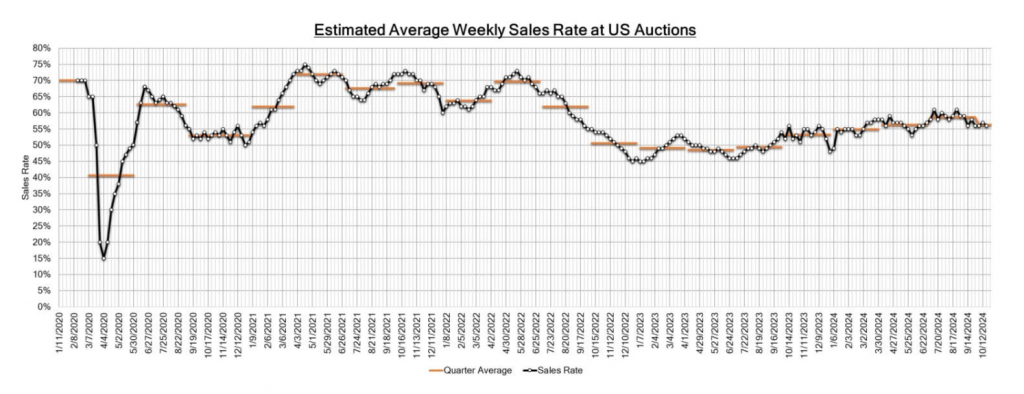

Auction Sales Rate Trends

The auction conversion rate held steady this week at 57%, maintaining the same level as the previous week. This figure suggests that, despite some price drops, demand at auction remains consistent. However, the steady rate is influenced by regional market variations, including supply disruptions due to weather-related events in some areas. As we move forward, we could see more volatility in auction sales if these factors persist.

Biggest Auto Market News of the Week

1. Bugatti Hypercars Crash During Morocco Tour

Two Bugatti hypercars—a Chiron Super Sport and a Chiron Pur Sport—collided during the Morocco Tour. Both were attempting to overtake a truck, resulting in a crash. The Super Sport sustained heavy damage, but no injuries were reported.

2. Japanese Study Chinese EVs for Affordable Production Secrets

Japanese companies are studying how BYD and NIO produce low-cost EVs by disassembling their models. They found that standardization and in-house production significantly reduce costs, making Chinese EVs highly competitive.

3. October New Vehicle Sales Expected to Increase by 10%

October 2024 new vehicle sales are projected to rise 10% over September, aided by extra selling days and favorable conditions. The SAAR is steady at 15.8 million, with rising incentives supporting the market.

Not sure if the insurance offer is fair? Get a Free Claim review from our experts!

Conclusion

The third week of October 2024 continued the market’s seasonal pattern of declining prices in both car and truck/SUV segments. Wholesale prices are softening across the board, with luxury vehicles seeing the steepest drops.

As we move deeper into fall, we can expect these trends to continue, especially with increased inventory levels and softening demand. Dealers should prepare for further price adjustments as the year winds down, particularly in the larger vehicle segments.