The auto market is like a rollercoaster these days—just when you think you’ve got a handle on it, something unexpected happens. As we delve into the week ending August 10, 2024, you’ll find that while some trends are sticking to the script, others are throwing us for a loop. From subtle shifts in depreciation rates to the ripple effects of dealer incentives, there’s more to this week’s update than meets the eye.

Before we dive in, let’s give you a quick preview: Wholesale prices are seeing some intriguing movements, car and truck segments are behaving in unexpected ways, and retail dynamics are being shaped by more than just buyer demand. Ready to uncover the details that most folks are overlooking? Let’s get into it!

Auto Market Update Week Ending August 10, 2024 (PDF)

A Closer Look at Depreciation Rates

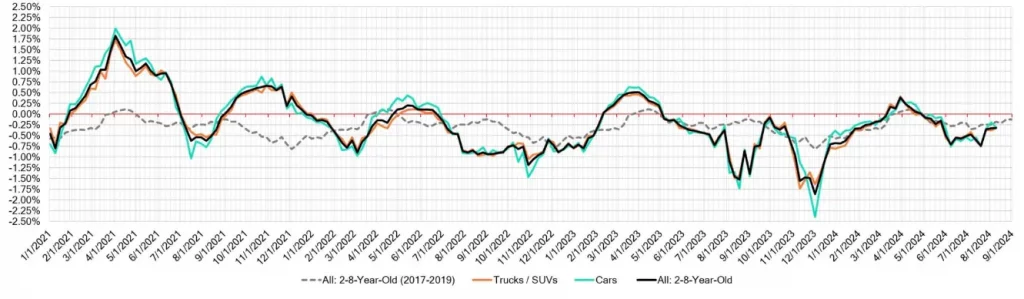

Depreciation rates often tell a bigger story than we realize. For the week ending August 10, 2024, the overall market is depreciating at a much slower rate compared to early July, which was a bit of a rollercoaster in itself.

To put it in perspective, the market saw a -0.60% drop around July 12th, but this week, it’s only -0.32%. Sure, it’s still higher than pre-pandemic norms, but it’s calming down, which might be a sign of stabilization—or maybe just the calm before the storm.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.30% | -0.19% | -0.18% |

| Truck & SUV segments | -0.33% | -0.38% | -0.19% |

| Market | -0.32% | -0.33% | -0.15% |

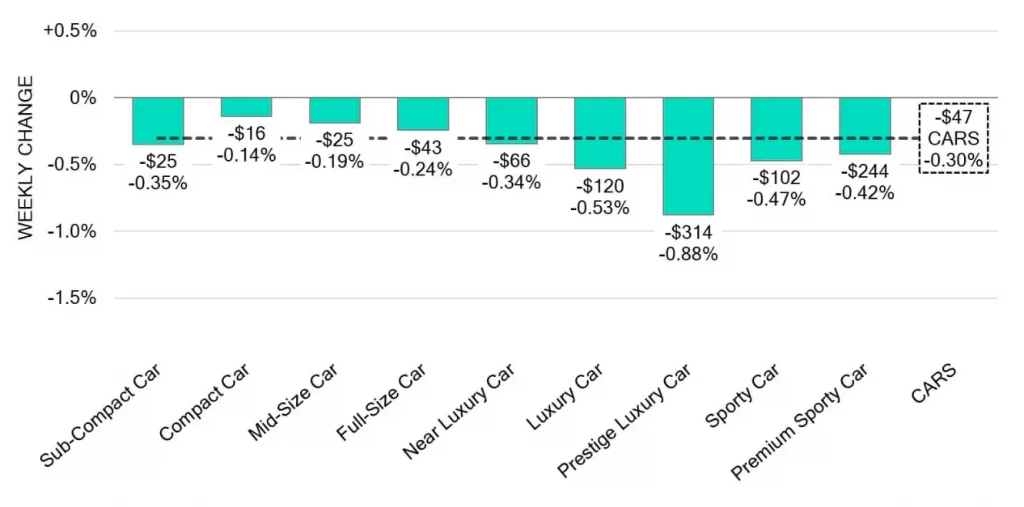

Car Segments

When it comes to cars, things aren’t as straightforward as they used to be. The volume-weighted depreciation for the Car segment was -0.30% this past week, a bit of a jump from the previous week’s -0.19%. Now, you might think that’s par for the course, but here’s where it gets interesting: while older cars (8-to-16 years old) depreciated by -0.48%, the newer ones (0-to-2 years old) only dipped by -0.24%. It’s like a tale of two markets within the same segment.

Even more intriguing is the performance of the Mid-Size Car segment. Last week, the newer models in this category actually appreciated, growing by +0.14%—this after a hefty +0.68% gain the previous week. On the flip side, Prestige Luxury Cars took a nosedive, plummeting by -0.88%. This segment has been on a steady decline, averaging a weekly drop of -0.73% over the past month.

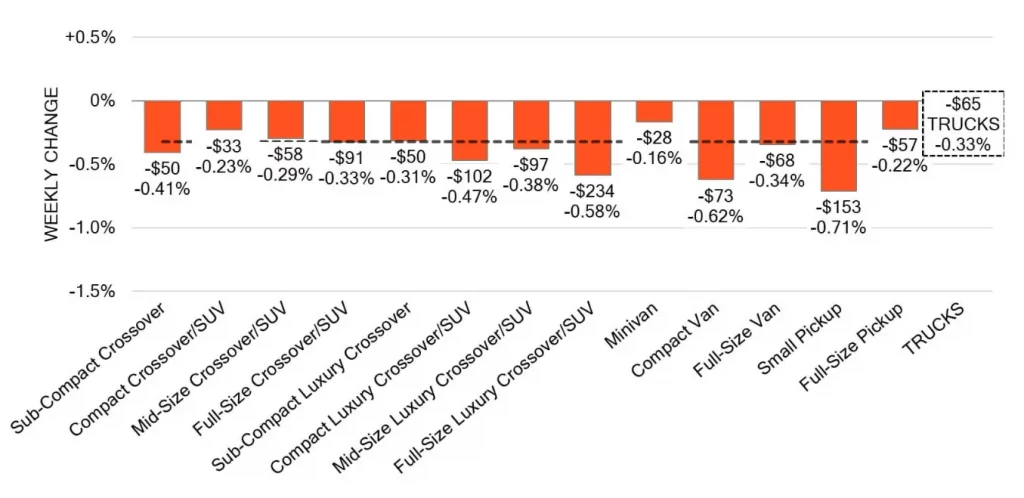

Truck and SUV Segments

Trucks and SUVs, usually the backbone of the auto market, are experiencing their own set of quirks. The overall Truck segment saw a -0.33% drop, a slight improvement from the prior week’s -0.38%. Yet, here’s where things get a bit wonky: the smallest decline was in the Minivan segment, which only dipped by -0.16%. And get this—the 0-to-2-year-old Minivans actually saw gains in four out of the last five weeks!

The biggest surprise, though, comes from the Small Pickup segment. This category saw a sharp -0.71% drop last week, continuing a month-long trend where it’s averaged a weekly depreciation of -0.88%. Compare that to Full-Size Pickups, which have been averaging a more modest -0.40% weekly depreciation. It seems that smaller trucks aren’t holding their value as well as their larger counterparts, which might make you think twice if you’re in the market for one.

Retail Dynamics: What’s Really Going On?

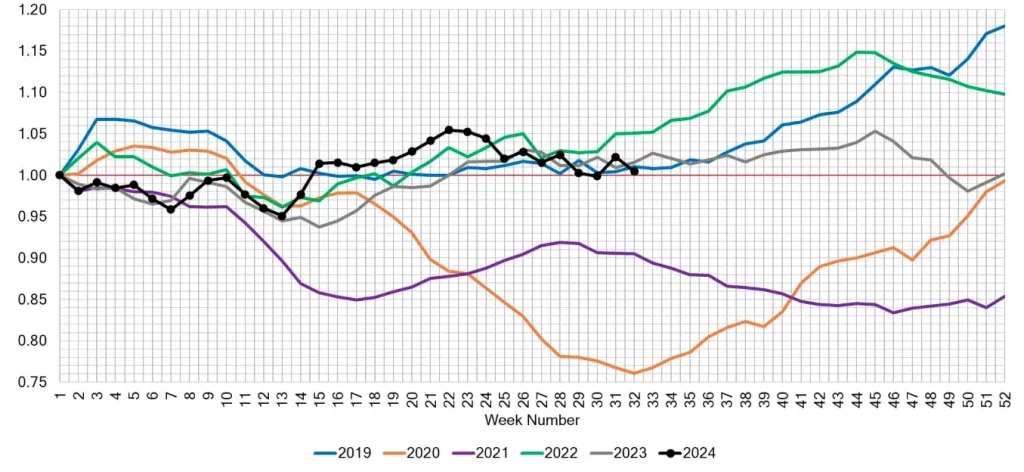

While wholesale trends are always fascinating, the retail side of things tells another part of the story. The Used Retail Active Listing Volume Index—a measure of inventory levels across most dealerships—indicates that inventory is staying on lots longer, with the Days-to-Turn now sitting around 48 days. This is crucial because it suggests that despite slower depreciation, buyers are still taking their time, possibly waiting for better deals or simply navigating through tighter budgets.

But here’s something that’s flying under the radar: dealer incentives on new 2024 models are shaking things up in the used market. The introduction of rebates and hefty incentives on these brand-new vehicles is driving down the auction values of their used counterparts. So, if you’re eyeing a used 2024 model, now might be the time to strike while the iron’s hot—prices could be softer than you’d expect.

Wholesale Insights: What the Numbers Are Hiding

Let’s not forget the wholesale market—where the nitty-gritty of vehicle pricing really takes shape. The first full week of August saw a slower depreciation rate compared to July, but the Prestige Luxury Cars and Small Pickup segments stood out for their significant declines of -0.88% and -0.71%, respectively. These aren’t just random numbers—they’re reflective of broader market forces at play.

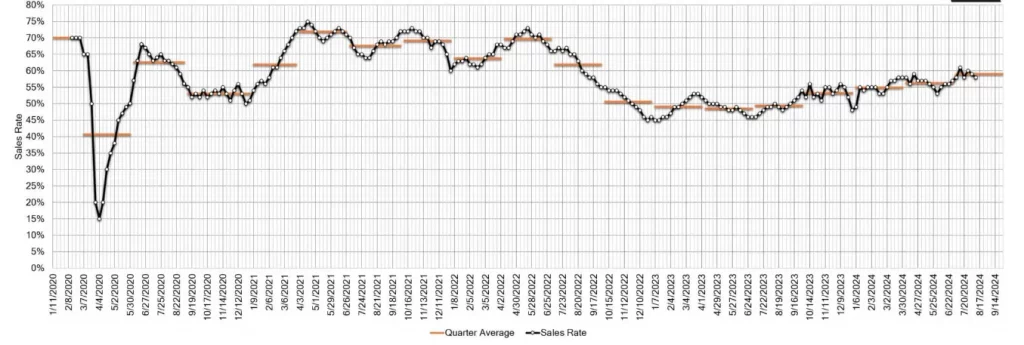

Another point worth noting is the auction conversion rate, which stood at 58% last week, a slight dip from the previous week’s 59%. While a 1% drop might not seem like much, in the context of a high-stakes market, it’s worth paying attention to. Dealers might be more cautious, waiting for a clearer signal before committing to large purchases, which in turn could impact what consumers see on dealership lots in the coming weeks.

Wrapping It All Up

So, what’s the takeaway from this week’s auto market update? Well, the market’s giving us mixed signals. Depreciation rates are slowing, but certain segments like Prestige Luxury Cars and Small Pickups are seeing steeper declines than you might expect.

Retail dynamics are being influenced by factors beyond just supply and demand, especially with those dealer incentives on new models shaking up the used market. And while the auction conversion rate remains relatively high, there’s a slight pullback that might hint at some dealer hesitancy.

The auto market is far from predictable these days, and that’s what makes it so intriguing. Will these trends continue, or are we in for another round of surprises next week?