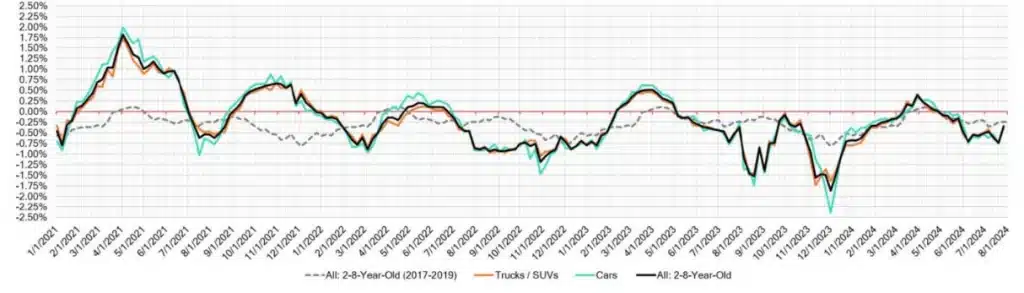

As July comes to a close, the auto market is showing signs of stabilization. The depreciation rates, which had seen significant declines in previous weeks, are now aligning more closely with typical rates for this time of year. Let’s dive into the specifics of the week ending July 27, 2024, and uncover some lesser-known insights.

Auto Market Update: Week Ending July 27, 2024 (PDF)

Wholesale Prices

Wholesale Price Changes (Week Ending July 27, 2024):

| Segment | This Week | Last Week | 2017-2019 Average (Same Week) |

|---|---|---|---|

| Car segments | -0.34% | -0.75% | -0.31% |

| Truck & SUV segments | -0.36% | -0.73% | -0.19% |

| Market | -0.36% | -0.74% | -0.24% |

While the overall market saw a depreciation of -0.36%, this is a significant improvement from the previous week’s -0.74%. This week’s rates are starting to look more like the 2017-2019 average, indicating a potential return to normalcy.

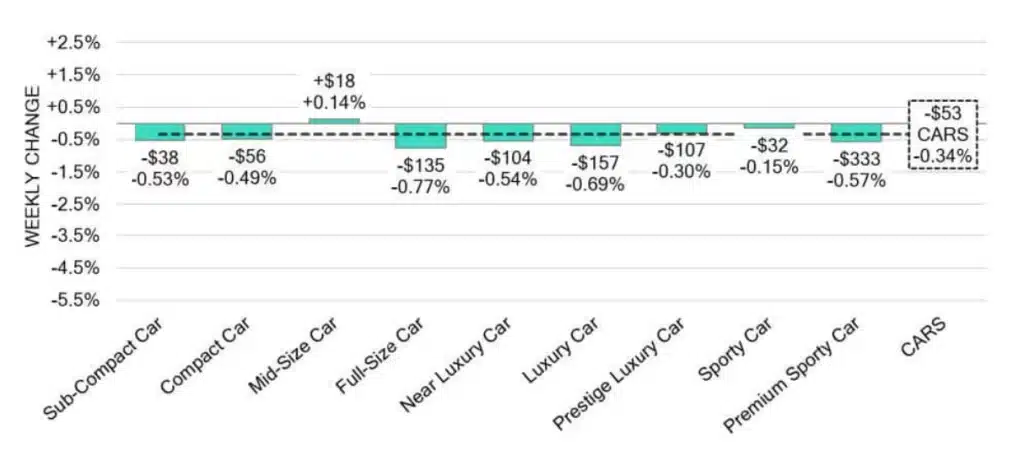

Car Segments

Taking a volume-weighted approach, the overall car segment dipped by -0.34%, a notable rebound from the previous week’s steeper drop of -0.75%. Let’s break it down:

- 0-to-2-year-old cars saw a decrease of -0.26%.

- 8-to-16-year-old cars declined by -0.28%.

Interestingly, eight out of nine car segments reported declines, but the mid-size car segment bucked the trend with a rise of 0.14%. This is its first increase since late spring. However, 0-to-2-year-old mid-size cars saw a smaller gain of 0.05%. On the flip side, full-size cars experienced the largest decline last week, dropping by 0.77%. Over the past four weeks, this segment has averaged a weekly drop of 0.60%.

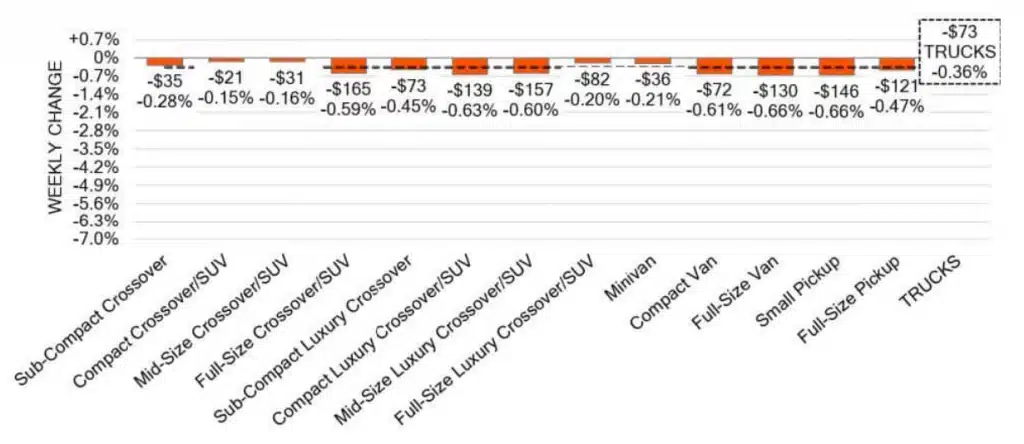

Truck and SUV Segments

The volume-weighted overall truck segment saw a decrease of -0.36%, a marked improvement from the prior week’s -0.73%. Highlights include:

- 0-to-2-year-old models declined by -0.36% on average.

- 8-to-16-year-olds decreased by -0.24% on average.

All thirteen truck segments reported declines, yet there were some bright spots:

- Full-size van depreciation slowed to -0.66% after significant drops of -2.59% and -1.37% in the previous two weeks.

- Compact crossover depreciation slowed to -0.15%, compared to the previous week’s -0.70%.

- Mid-size crossover declined by -0.16%, a notable improvement from the prior week’s -0.39%.

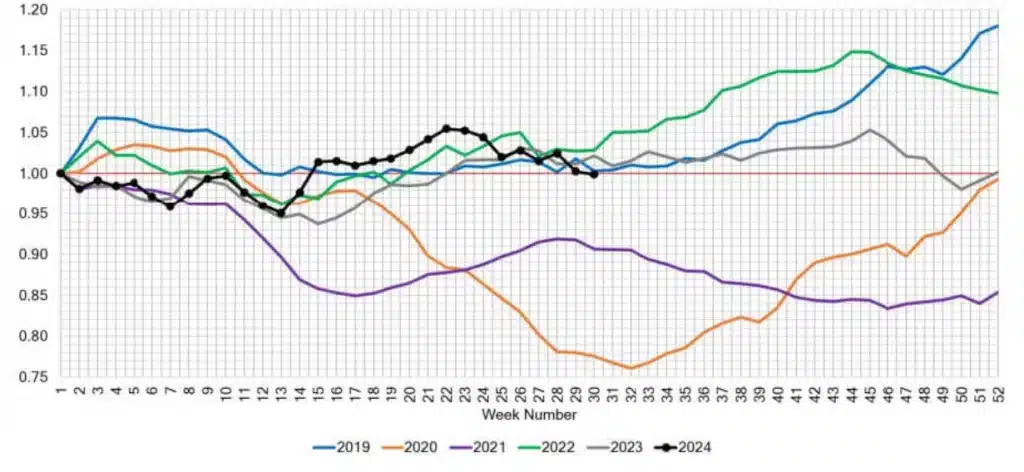

Used Retail Trends

The Used Retail Active Listing Volume Index, which is based on the inventory analysis of most independent and franchised dealerships in the US, is showing some interesting trends. The estimated Used Retail Days-to-Turn is now roughly 53 days. This means cars are taking longer to sell, possibly due to stabilizing depreciation rates making buyers more cautious.

Wholesale Market Insights

The first three weeks of July saw significant declines in both car and truck segments:

- The Prestige Luxury Car segment saw a decline of -1.28%.

- Full-Size Vans experienced the largest drop at -2.59%, followed by another drop of -1.37% the next week.

These declines were some of the largest seen all year. However, the wholesale market showed signs of stability in the last full week of July.

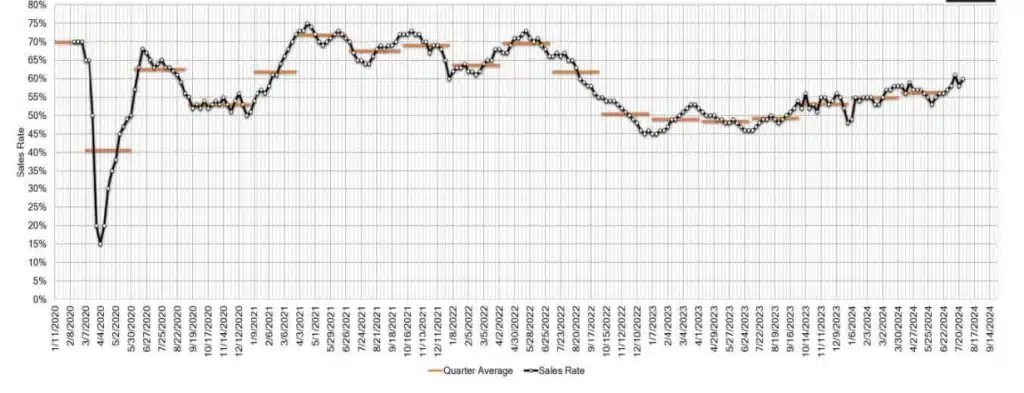

The auction conversion rate remains high, with last week’s rate at 60%, up 2% from the previous week and just 1% below the highest conversion rate recorded this year. This indicates a strong performance in the auction market, suggesting that demand remains robust despite overall market fluctuations.

What’s Next?

As August approaches, our team of analysts remains vigilant, monitoring emerging trends with keen interest. This recent stabilization might signal that the market is beginning to stabilize, yet numerous variables could still influence future performance. Will this steadying trend persist, or are more fluctuations on the horizon in the coming weeks?