The automotive industry has seen notable shifts in 2024. While some automakers experienced significant growth, others faced challenges.

This analysis delves into the sales performance of the top 10 automakers in the first half of 2024, highlighting key trends and market dynamics.

Top 10 Automakers in 2024: Sales Analysis and Trends (PDF)

Introduction

The first half of 2024 has been a dynamic period for the automotive industry. Despite an overall industry growth of 2.2%, several major players experienced varying degrees of success.

This article examines the top 10 automakers based on their sales performance, providing insights into the trends that shaped the market.

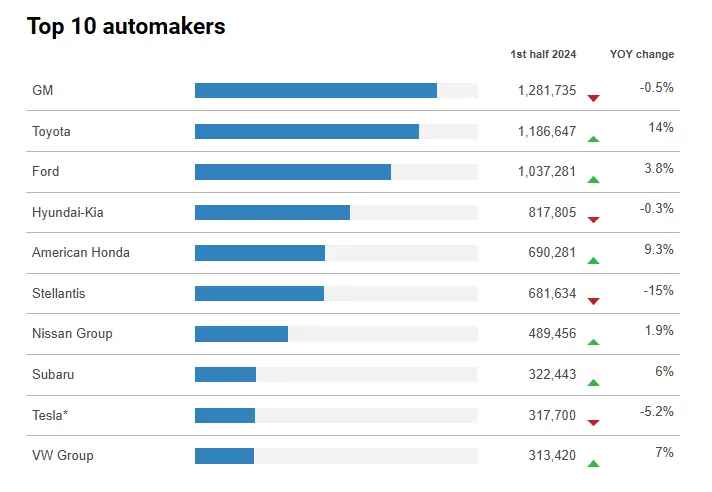

Top 10 Automakers in 2024

- General Motors (GM)

- Sales: 1,281,735 unitsYear-Over-Year Change: -0.5% GM maintained its position as the leading automaker, despite a slight decline in sales. The company faced challenges due to shifting market preferences and increased competition.

- Toyota

- Sales: 1,186,647 units

- Year-Over-Year Change: +14% Toyota showed remarkable growth, securing the second position. The company’s robust lineup and strong demand for its vehicles contributed to this success.

- Ford

- Sales: 1,037,281 units

- Year-Over-Year Change: +3.8% Ford saw a moderate increase in sales, driven by its popular models and a strategic focus on electric vehicles and SUVs.

- Hyundai-Kia

- Sales: 817,805 units

- Year-Over-Year Change: -0.3% Hyundai-Kia experienced a slight dip in sales but remained a strong contender in the market, thanks to its diverse vehicle offerings.

- American Honda

- Sales: 690,281 units

- Year-Over-Year Change: +9.3% Honda made significant gains, overtaking Stellantis. The company’s focus on fuel efficiency and reliable models resonated well with consumers.

- Stellantis

- Sales: 681,634 units

- Year-Over-Year Change: -15% Stellantis faced a considerable decline in sales, struggling with market dynamics and increased competition.

- Nissan Group

- Sales: 489,456 units

- Year-Over-Year Change: +1.9% Nissan managed a modest increase in sales, supported by its strong lineup of SUVs and electric vehicles.

- Subaru

- Sales: 322,443 units

- Year-Over-Year Change: +6% Subaru enjoyed steady growth, bolstered by its reputation for safety and reliability.

- Tesla

- Sales: 317,700 units

- Year-Over-Year Change: -5.2% Tesla saw a decline in sales, attributed to intensified competition and market saturation in some regions.

- Volkswagen Group (VW)

- Sales: 313,420 units

- Year-Over-Year Change: +7% VW Group achieved respectable growth, driven by its electric vehicle offerings and strategic market positioning.

Market Trends and Analysis

The automotive market in 2024 has been shaped by several key trends:

Rise of Electric Vehicles (EVs)

Electric vehicles continued to gain traction in 2024. Automakers like Tesla, Nissan, and VW Group invested heavily in EV technology, contributing to their market positions. However, increased competition and evolving consumer preferences impacted Tesla’s sales negatively.

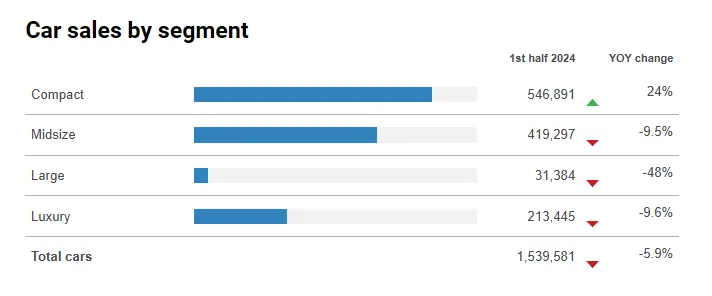

Shift Towards Compact and Subcompact Vehicles

There was a notable shift towards compact and subcompact vehicles. This segment saw substantial growth, with compact cars experiencing a 24% increase. Consumers favored these vehicles for their fuel efficiency and affordability.

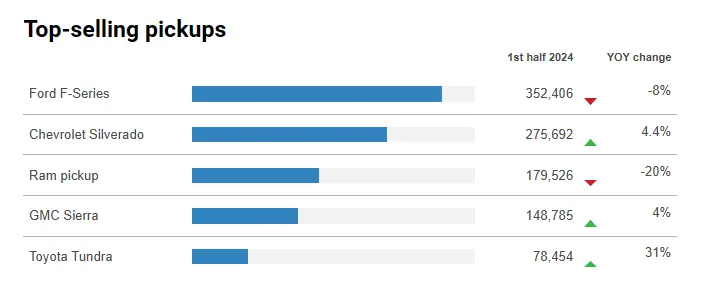

Decline in Pickup Truck Sales

The pickup truck segment faced a decline, with overall sales dropping by 3.9%. Ford’s F-Series, despite being the best-selling pickup, saw an 8% decrease in sales. The shift towards more fuel-efficient and versatile vehicles contributed to this trend.

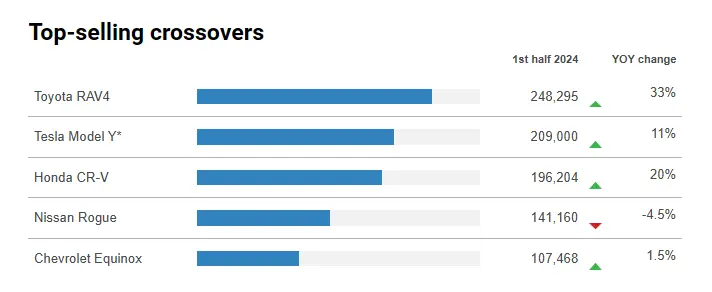

Growth of Crossovers

Crossovers continued to dominate the market, accounting for 45% of total sales. Subcompact and compact crossovers were particularly popular, with significant sales increases.

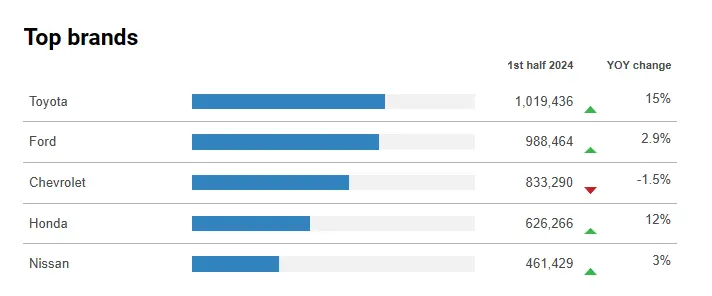

Performance of Top-Selling Brands

Toyota and Ford led the market, with Toyota achieving a 15% sales increase. Chevrolet, however, saw a slight decline in sales, reflecting the challenges faced by traditional automakers.

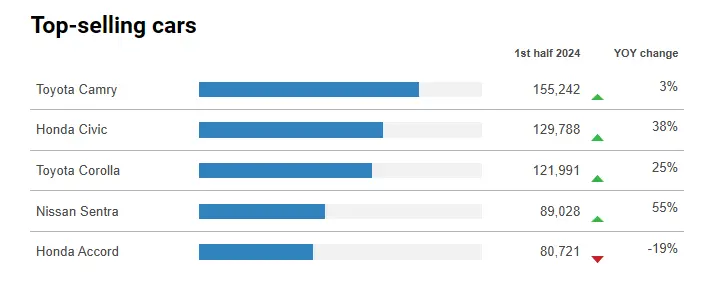

Success of Top-Selling Models

Models like the Toyota Camry, Honda Civic, and Nissan Sentra were among the top sellers. The Honda Civic, in particular, saw a 38% increase in sales, highlighting the continued demand for reliable and fuel-efficient sedans.

Conclusion

The initial half of 2024 presented a varied landscape for the automotive sector. Automakers such as Toyota and Honda saw notable growth, whereas companies like Stellantis and Tesla encountered difficulties. Current market trends indicate a rising preference for electric vehicles, compact cars, and crossovers. To remain competitive, automakers must adapt to these shifting dynamics as the industry continues to transform.

In summary, the automotive market in 2024 is characterized by growth in certain segments and declines in others. Automakers that can innovate and meet consumer demands will likely see continued success in the latter half of the year.

FAQs

Q1: Which automaker had the highest sales in the first half of 2024? A1: General Motors (GM) had the highest sales, with 1,281,735 units sold.

Q2: Which automaker experienced the most significant sales growth? A2: Toyota experienced the most significant growth, with a 14% increase in sales.

Q3: Why did pickup truck sales decline in 2024? A3: Pickup truck sales declined due to a shift in consumer preference towards more fuel-efficient and versatile vehicles like compact and subcompact crossovers.

Q4: What segment saw the most growth in 2024? A4: The compact car segment saw the most growth, with a 24% increase in sales.

Q5: Which car model saw the highest increase in sales? A5: The Nissan Sentra saw the highest increase in sales, with a 55% growth.

By staying informed about these trends and understanding the market dynamics, stakeholders can make strategic decisions to navigate the evolving automotive landscape.