The automotive market is a dynamic and ever-changing landscape. This update for the week ending June 29, 2024, delves into unique and often overlooked aspects of the auto market, including wholesale price trends and depreciation rates.

Auto Market Update Week Ending June 29, 2024 (PDF)

Wholesale Prices: Week Ending June 28, 2024

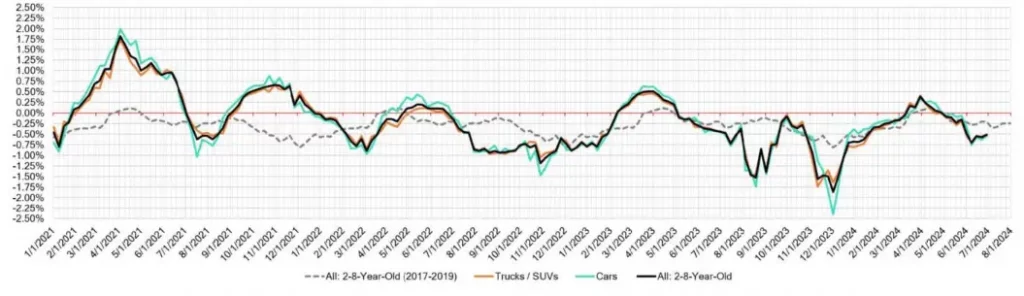

A Closer Look at Depreciation Trends

The market’s depreciation rate has been notable this June, surpassing pre-pandemic seasonal trends which averaged less than a quarter percent per week. This June, the rate has been around half a percent per week, indicating a significant shift.

| Week Ending | Car Segments | Truck & SUV Segments | Overall Market |

|---|---|---|---|

| June 28, 2024 | -0.53% | -0.50% | -0.51% |

| Previous Week | -0.62% | -0.55% | -0.57% |

| 2017-2019 Average | -0.30% | -0.15% | -0.21% |

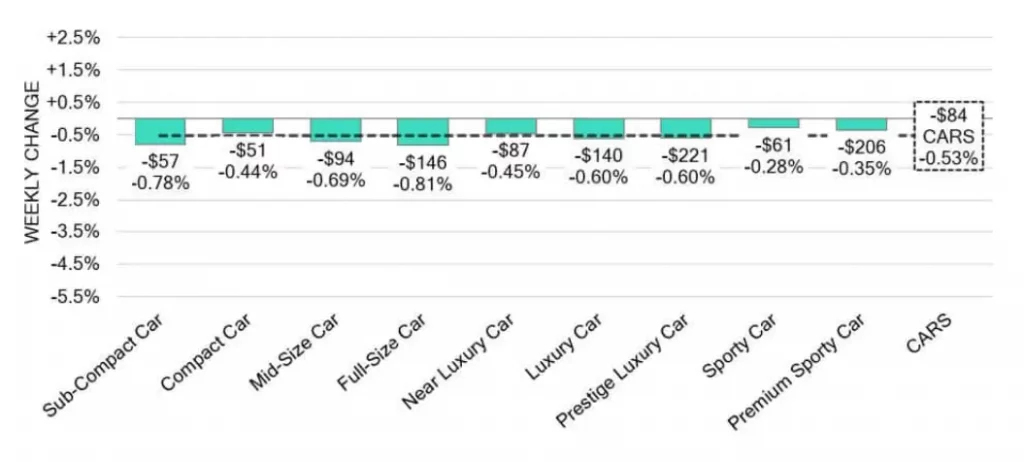

Car Segments: A Detailed Breakdown

Weekly Depreciation in Car Segments

On a volume-weighted basis, car segments decreased by -0.53% this week, a slight improvement from the previous week’s -0.62%.

| Age Group | Depreciation Rate |

|---|---|

| 0-to-2-year-old cars | -0.37% |

| 8-to-16-year-old cars | -0.36% |

Among the nine car segments, Full-Size and Sub-Compact Cars saw the largest declines, at -0.78% and -0.81% respectively. The Sporty Car segment experienced a smaller decline of -0.28%, maintaining a lower average depreciation rate compared to the overall car market.

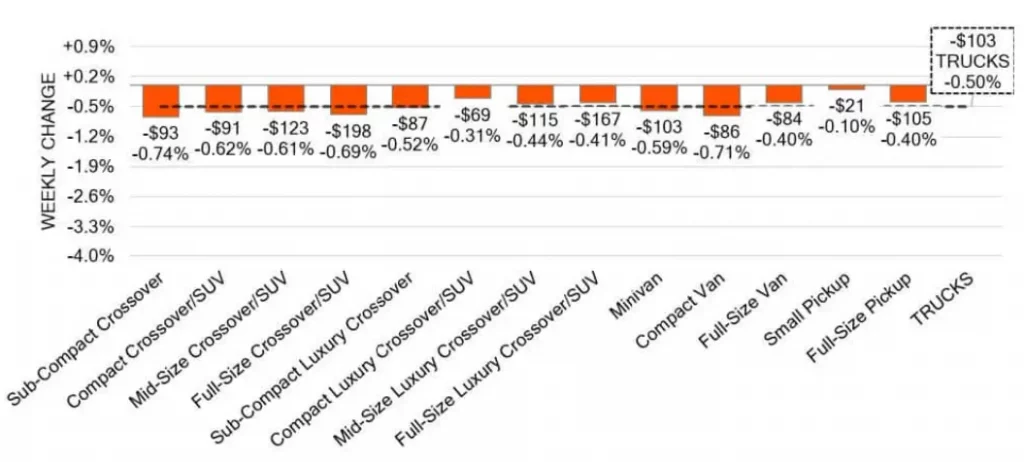

Truck and SUV Segments: Current Trends

Weekly Depreciation in Truck and SUV Segments

The truck segment, on a volume-weighted basis, decreased by -0.50%, which is a slight improvement from the prior week’s -0.55%.

| Segment | Depreciation Rate |

|---|---|

| Compact Van | > -0.70% |

| Sub-Compact Crossover | > -0.70% |

| Small Pickup | -0.10% |

Compact Vans and Sub-Compact Crossovers experienced the most significant declines, with the Compact Van segment facing twelve consecutive weeks of depreciation.

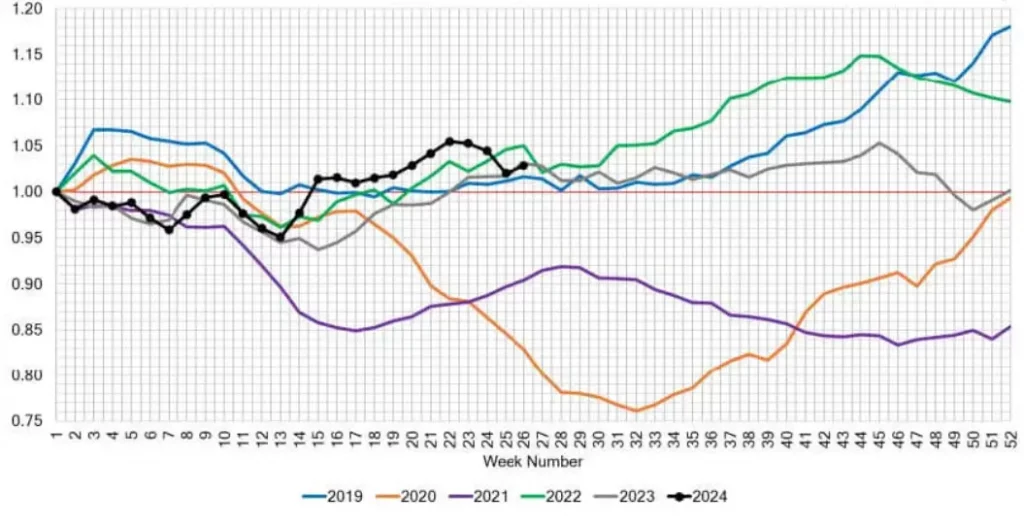

Used Retail Market Insights

Active Listing Volume Index

The Used Retail Active Listing Volume Index, based on inventory analysis of independent and franchised dealerships, provides a clear picture of annual market movements.

Wholesale Market Dynamics

Stability and Depreciation in June

June’s market has been stable, yet depreciation continues across car and truck segments. This depreciation, despite a higher auction conversion rate, highlights a complex relationship between supply and demand, market conditions, and economic factors.

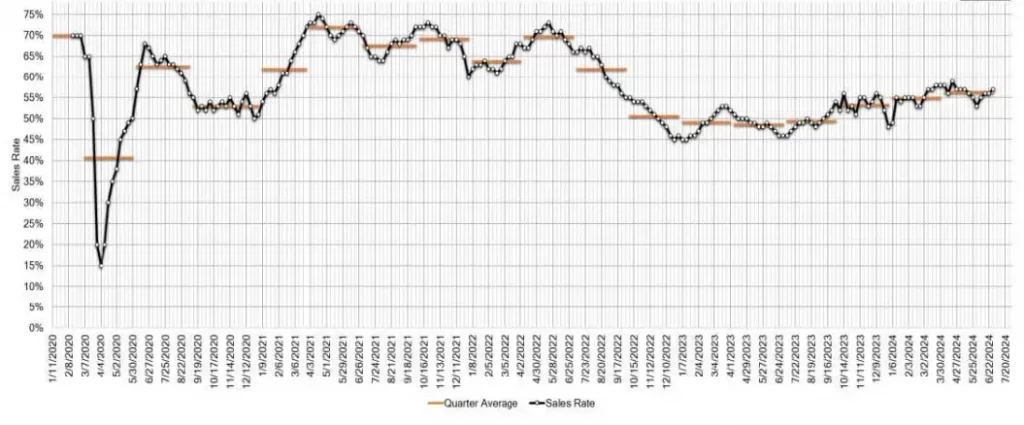

In the last week of June, the auction conversion rate peaked at 57%, indicating strong vehicle sales at auctions despite ongoing depreciation trends.

Conclusion

The auto market is in the midst of significant transformations, characterized by persistent depreciation and intricate market dynamics. Understanding these trends is vital for everyone involved, from dealers and buyers to industry analysts.

As vehicles continue to lose value at an accelerated rate, strategic planning and informed decision-making become crucial. The intersection of supply and demand, alongside external economic factors, shapes these trends, making market insights more valuable than ever. How will you navigate these shifts and make the best choices for your automotive needs?