The auto market’s recent performance has been quite the rollercoaster, hasn’t it? Let’s dive into some intriguing data and insights that you won’t find on most other sites. We’re talking about the nitty-gritty details that really make a difference.

Auto Market Update Week Ending June 22, 2024 (PDF)

Wholesale Prices, Week Ending June 22, 2024

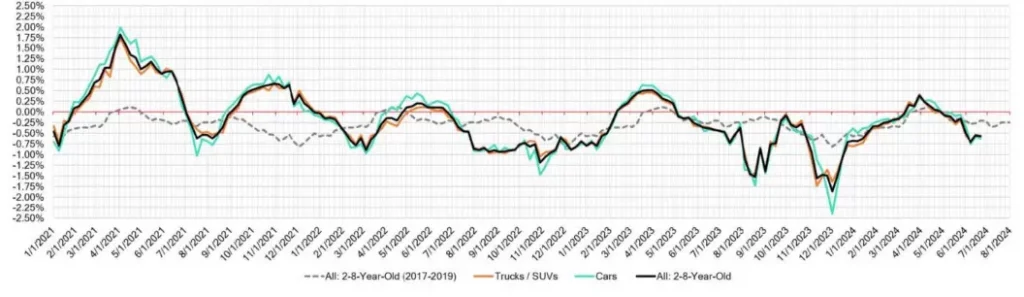

Wholesale prices continue their downward trend, dropping about half a percent per week. That’s steeper than the pre-pandemic average of nearly a quarter percent for this time of year. Auction activity remains steady, with conversion rates consistently at 56%.

Market Overview

| This Week | Last Week | 2017-2019 Average (Same Week) |

|---|---|---|

| Car segments | –0.62% | –0.58% |

| Truck & SUV segments | –0.55% | –0.54% |

| Market | –0.57% | –0.55% |

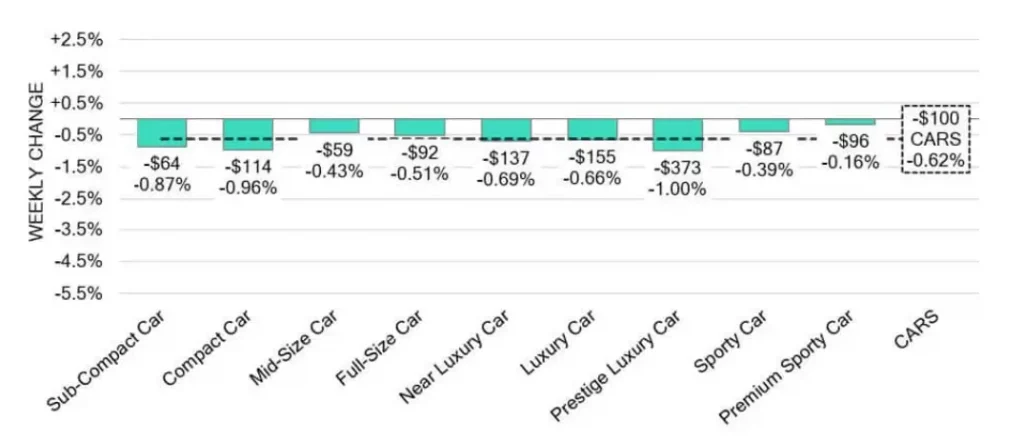

Car Segments

On a volume-weighted basis, the overall car segment saw a decrease of -0.62%. The previous week saw a slight lesser dip at -0.58%. Interestingly, all nine car segments reported declines, with six of them dropping more than 0.50%. Prestige luxury cars were hit hardest, plunging -1.00% — the largest single-week decline for this segment in twenty-four weeks. Compact cars weren’t far behind, declining -0.96% for the second consecutive week.

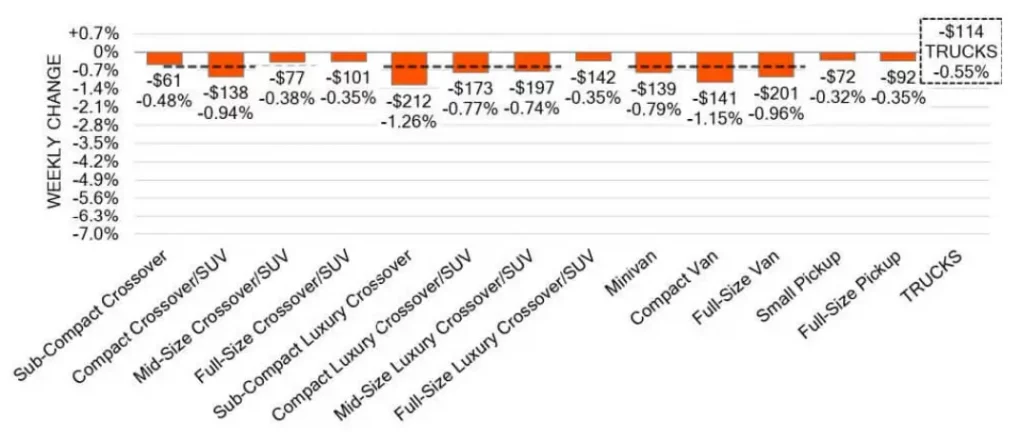

Truck and SUV Segments

Trucks and SUVs aren’t faring much better. The overall truck segment fell -0.55%, a tad more than the previous week’s -0.54%. Notably, sub-compact luxury crossovers experienced the largest decline at -1.26%, followed closely by compact vans, which decreased by -1.15%. It seems the compact crossover segment can’t catch a break, facing its third consecutive week of declines exceeding 0.90%.

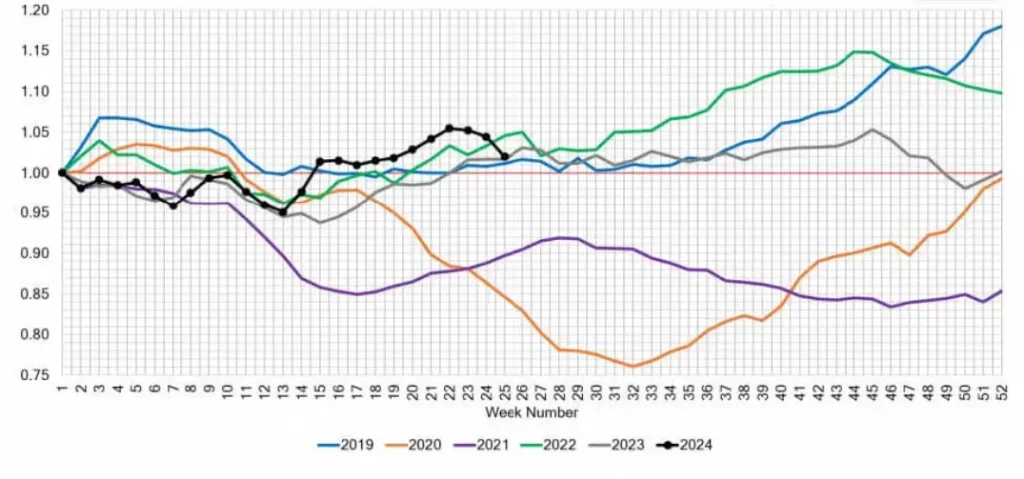

Used Retail Market

The Used Retail Active Listing Volume Index offers a snapshot based on inventory analysis from a majority of independent and franchised dealerships across the U.S. As of now, the estimated Used Retail Days-to-Turn has risen to 44 days. This uptick signals a slower turnover rate, indicating that used cars are taking longer to sell.

Wholesale Market Insights

The wholesale market has seen a continuous decline over the past two weeks, with little variation. For car segments, Prestige Luxury cars experienced the steepest drop at -1.00%, followed by compact cars at -0.96%. On the truck side, sub-compact luxury crossovers/SUVs plummeted -1.26%, while compact vans decreased by -1.15%. Despite stable auction inventories, conversion rates remain high, consistently above 50%.

Auction Activity

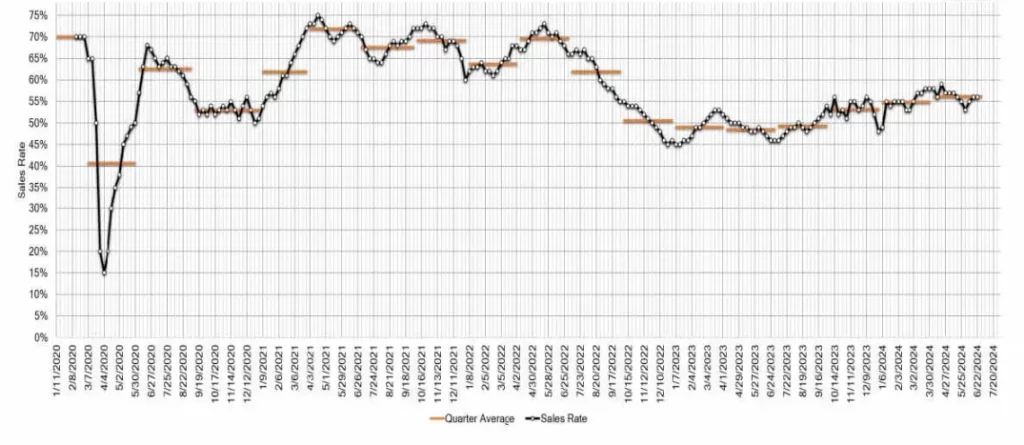

Despite the declines in wholesale prices, auction activity remains robust. The average auction sales rate this week was 56%, unchanged from the previous week. This stability in auction activity suggests that while prices are falling, the demand at auctions remains steady.

Keeping an Eye on the Market

Our team of analysts is always on the lookout for emerging trends and insightful data. This meticulous attention to detail helps us stay ahead of market changes and provides you with the most accurate and relevant information.

To wrap things up, the auto market for the week ending June 22, 2024, presents a mixed bag of steady auction activity amidst falling wholesale prices. Both car and truck segments are seeing notable declines, particularly in the luxury and compact categories. The used retail market is experiencing slower turnover rates, hinting at broader market dynamics at play.

Are these trends signaling a long-term shift or just a temporary dip in the market?