Auto Market Update Week Ending October 7, 2023 (PDF)

The United Auto Workers (UAW) strike continues to cast a shadow over the automotive industry. In the latest developments, last week’s auction activity exhibited a noticeable slowdown.

Buyers approached the market with caution as negotiations with major players like Ford, Stellantis, and General Motors showed signs of modest progress with counteroffers. Additionally, sellers responded to the prior week’s auction success by raising their floor prices, leveraging the increased strength in valuations and conversion rates.

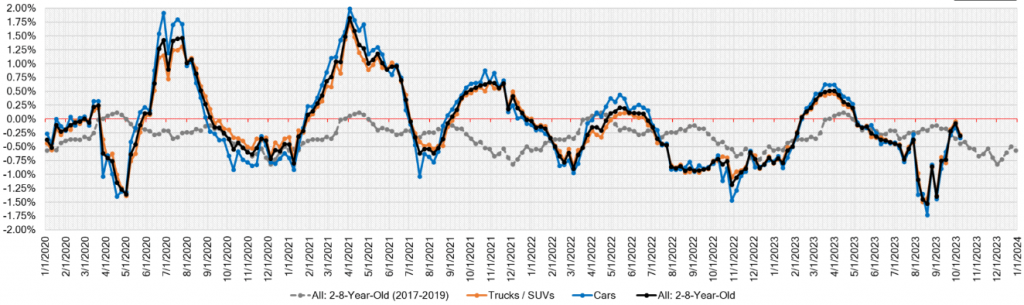

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.34% | -0.15% | -0.52% |

| Truck & SUV segments | -0.31% | -0.05% | -0.39% |

| Market | -0.32% | -0.08% | -0.44% |

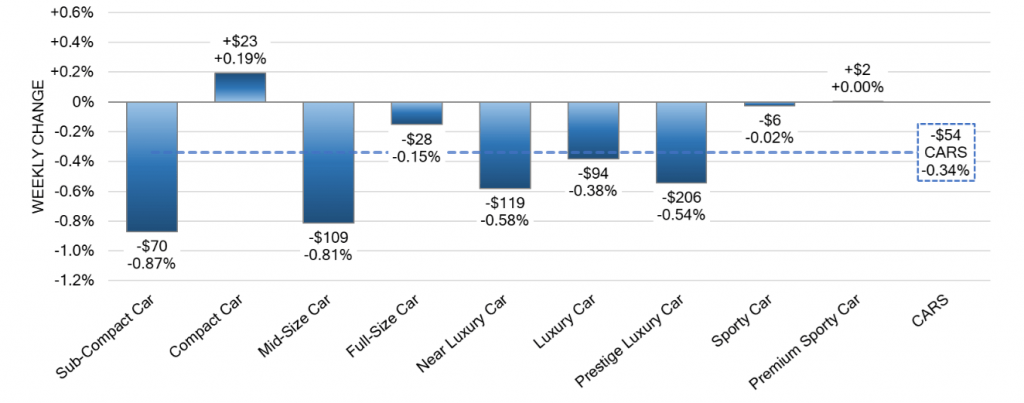

Car Segments

On a volume-weighted basis, the Car segment declined by -0.34% this week, compared to a decrease of -0.15% in the previous week. Notable changes include:

- The 0-to-2-year-old car segment decreased by -0.32%.

- Cars for 8-to-16-year-olds declined by -0.23%.

- There was a decline in seven out of nine car segments.

However, Compact Car and Premium Sporty Car saw increases of +0.19% and +0.003%, respectively, with Compact Car posting its second consecutive weekly gain.

Conversely, Sub-Compact (-0.87%) and Mid-Size Cars (-0.81%) faced the steepest declines. Mid-Size Car, in particular, has seen a consistent decline over nineteen weeks, with an average weekly depreciation of -0.79%.

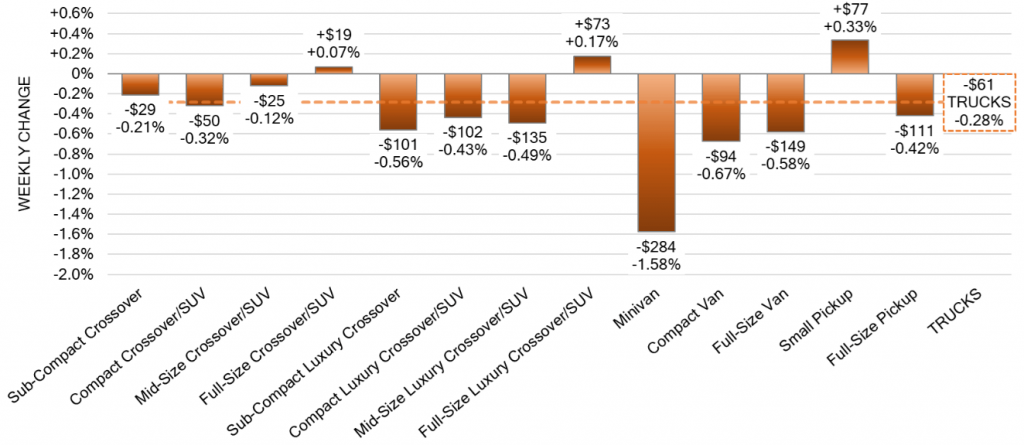

Truck / SUV Segments

The Truck segment experienced a decline of -0.28% on a volume-weighted basis, representing an increase compared to the previous week’s decline of -0.05%. Key points include:

- On average, 0-to-2-year-old models declined by -0.28%.

- The number of 8-to-16-year-olds decreased by -0.23%.

- Small Pickup took the lead with an increase of +0.33%, closely followed by Full-Size Luxury at +0.17%, and Full-Size Crossover/SUV showing a commendable uptick of +0.07%.

In contrast, Minivan faced the largest decline, dropping by -1.58%. This segment has been on a seventeen-week decline streak, with an average weekly change of -0.81%.

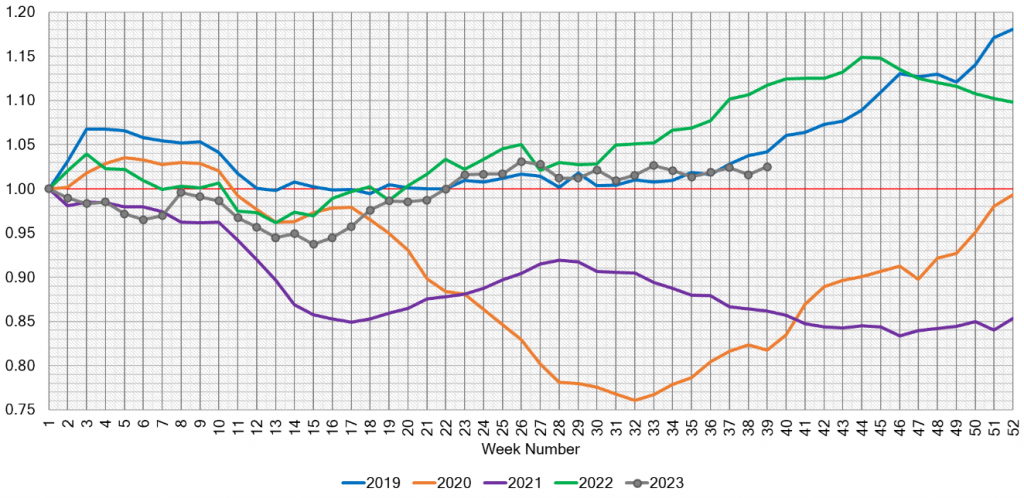

Used Retail

The Used Retail Days-to-Turn estimate currently hovers at an average of approximately 45 days, while the Used Retail Active Listing Volume Index is holding steady at 1.02 points.

Wholesale Market

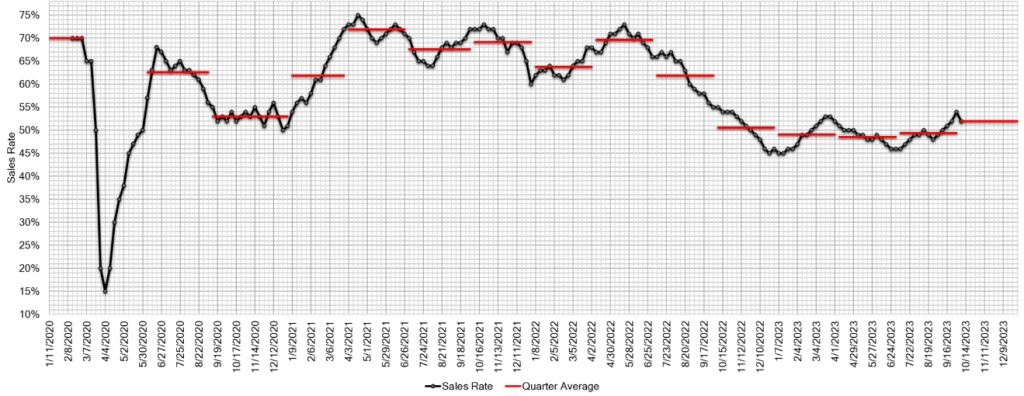

The ongoing United Auto Workers (UAW) strike maintains its influence on the wholesale market. Amid prevailing market uncertainty, exemplified by reduced conversion rates, we witnessed a decline in auction conversion rates, accompanied by a notable uptick in nationwide inventory. Furthermore, the estimated Average Weekly Sales Rate experienced a decline, dropping to 52% in the past week.

The automotive industry remains in a state of flux as negotiations with the UAW unfold, affecting both buyers and sellers. The cautious approach in auctions and fluctuating market conditions suggest that the industry is bracing for potential changes in the weeks to come.

Stay tuned for the next Auto Market Update as we track the evolving dynamics in the automotive market.