Auto Market Update Week Ending September 23rd, 2023 (PDF)

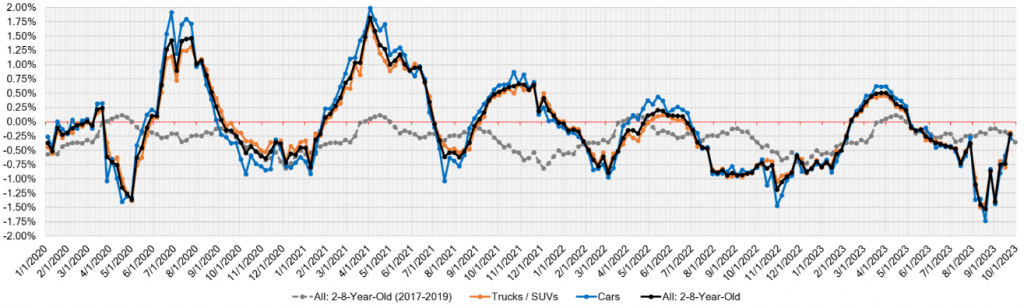

The automotive market has had an eventful week, dominated by the United Auto Workers (UAW) strike, which has left the industry with mixed signals. While overall depreciation rates are slowing down, the real story lies in the details.

Check here for last week’s Auto Market Update.

Impact of UAW Strike

The UAW strike has significantly impacted the market, particularly in the wake of the production halt for the Chevrolet Colorado. Here’s a snapshot of the market changes:

- Small Pickups: The demand for Small Pickups surged due to the strike, resulting in a +0.02% increase in the depreciation rate of newer used units (0-to-2-year-olds) last week.

Market Depreciation Overview

Here’s a breakdown of the depreciation rates for various segments:

| Segments | This Week (%) | Last Week (%) | 2017-2019 Average (%) |

|---|---|---|---|

| Car segments | -0.29% | -0.59% | -0.34% |

| Truck & SUV segments | -0.19% | -0.79% | -0.22% |

| Market | -0.22% | -0.73% | -0.27% |

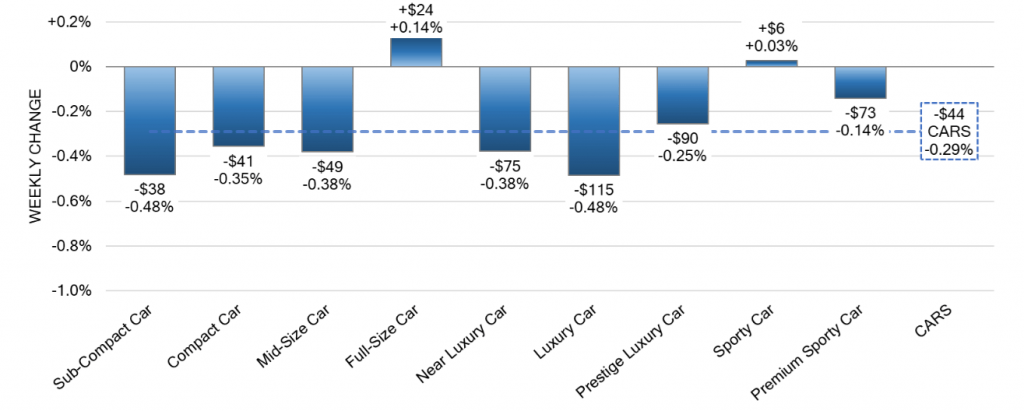

On a volume-weighted basis, the overall Car segment decreased by -0.29% this week, a notable improvement from the previous week’s -0.59% decline.

Car Segments

- 0-to-2-year-old Cars: These segments saw a -0.13% decrease, while 8-to-16-year-old Cars declined by -0.28%.

- Full-Size and Sporty Cars: Bucking the trend, Full-Size Cars increased by +0.14%, and Sporty Cars by +0.03%.

- Sub-Compact and Luxury Cars: Sub-Compact and Luxury Car segments experienced the largest declines at -0.48%. However, the rate of decline has slowed down significantly, with Sub-Compact Car showing the lowest single-week depreciation in two months.

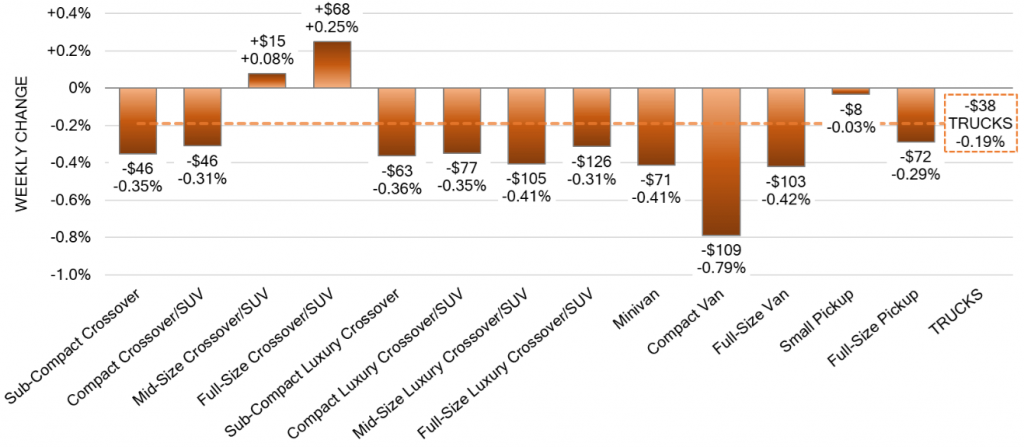

Truck / SUV Segments

- 0-to-2-Year-Old Truck Models: In the past week, these segments experienced a slight dip with a decline of -0.12%, while their older counterparts, the 8-to-16-year-olds, followed suit with a -0.14% depreciation.

- Emerging Positivity: Notably, there were some positive shifts in this segment. Mid-Size Crossovers defied the downward trend, recording a notable +0.08% change. Similarly, Full-Size Crossovers displayed resilience by increasing in value with a noteworthy +0.25% uptick. However, the Luxury equivalents in this category continued to face challenges with ongoing depreciation.

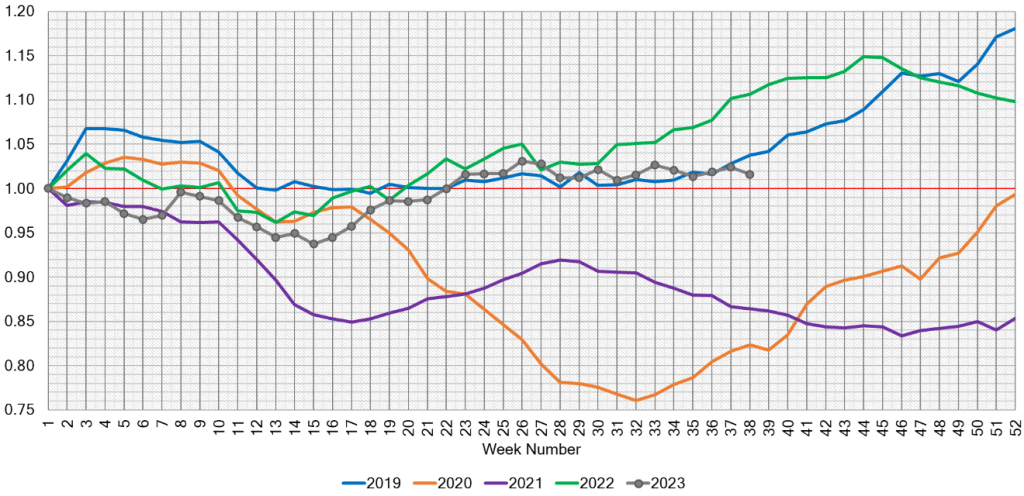

Used Retail Active Listing Volume Index

Currently stands at 1.02 points, with an estimated Days-to-Turn of around 45 days.

Wholesale Market

One week into the UAW strike, most segments experienced declines, albeit at a slower pace than in previous weeks. Notably, Full-Size and Sporty Cars on the car side, and Full-Size and Mid-Size Crossover/SUV segments on the truck side, saw increases.

However, the UAW has expanded strikes to 38 parts and distribution locations around the country for GM and Stellantis. Ford, on the other hand, saw positive developments in negotiations.

Check here for the best car deals and incentives in September 2023.

Conclusion

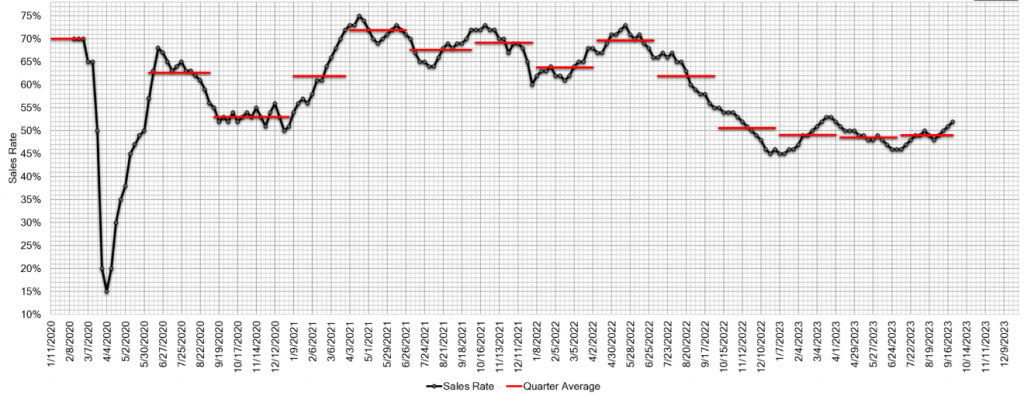

The estimated Average Weekly Sales Rate increased to 52%, indicating a resilient market despite the challenges posed by the UAW strike.

Stay tuned for more updates as we continue to keep a close eye on the evolving automotive landscape.