Auto Market Update Week Ending Jul 8, 2023 (PDF)

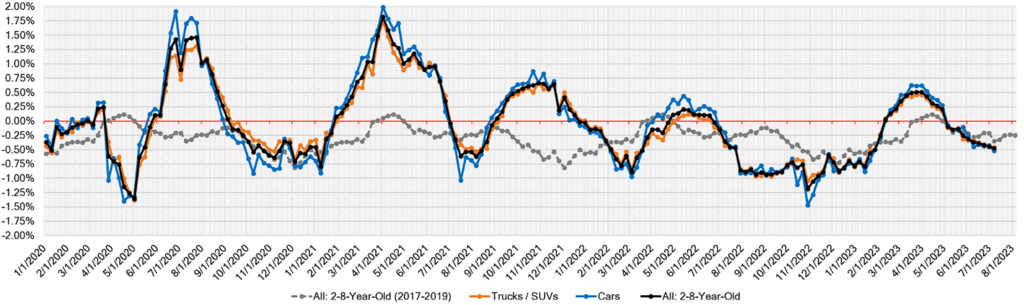

In the aftermath of the recent holiday, the auto auction scene witnessed a decrease in both the number of vehicles offered for sale and the number of bidders vying for inventory. While valuations continued their decline, the rate of decrease remained consistent over the past few weeks, with a weekly drop of less than half a percent.

Let’s delve into the specifics of the market’s performance:

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.52% | -0.42% | -0.47% |

| Truck & SUV segments | -0.45% | -0.45% | -0.28% |

| Market | -0.47% | -0.44% | -0.35% |

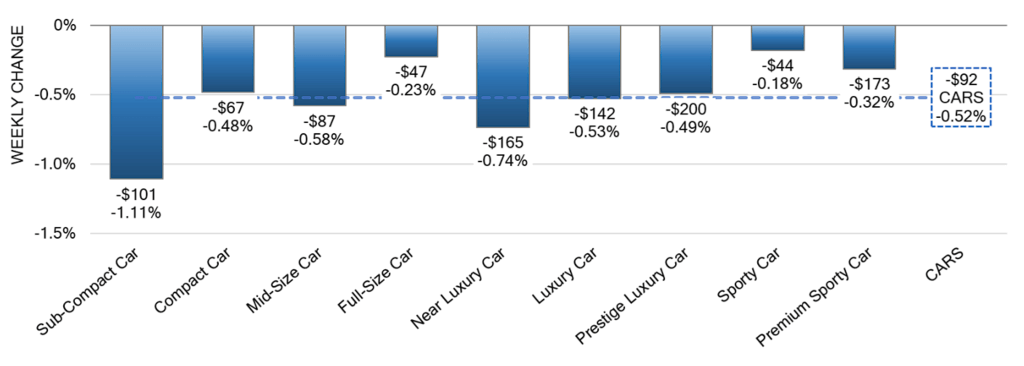

Car Segments

The overall Car segment experienced a volume-weighted decline of -0.52% this week. To provide context, the previous week saw a decrease of -0.42% in car valuations. Within the Car segment, the 0-to-2-year-old vehicles witnessed a modest decline of -0.35%, while the 8-to-16-year-old Cars experienced a drop of -0.48%. Notably, all nine Car segments showed a decrease in value.

Last week, the Sub-Compact Car segment experienced a notable downturn, with a sharp decline of -1.11%. This decline extends the segment’s downward trajectory for ten consecutive weeks, resulting in an average weekly depreciation rate of -0.58%. Similarly, the Sporty Car segment encountered its second consecutive week of decline, with a decrease of -0.18% following a -0.16% drop in the previous week. Notably, the Near Luxury Car segment witnessed a substantial decline of -0.74%, representing its most significant single-week drop since mid-January.

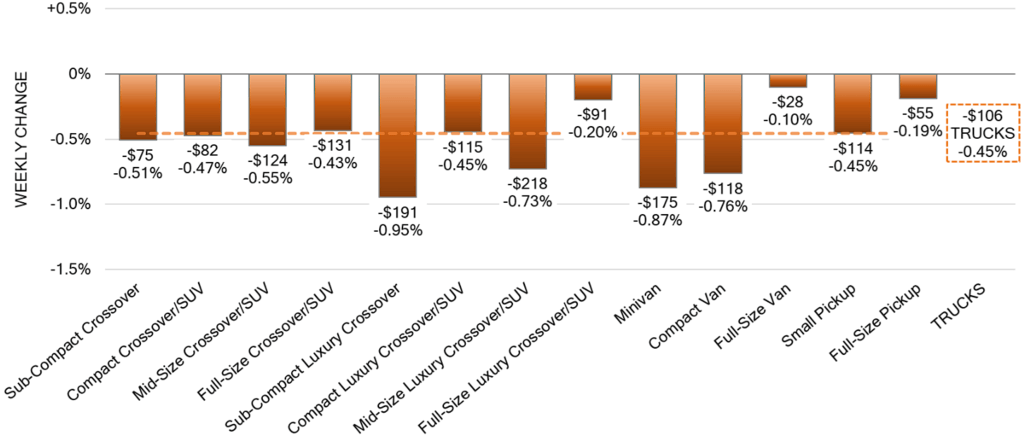

Truck / SUV Segments

The volume-weighted Truck segment witnessed a decline of -0.45%, maintaining consistency with the previous week’s decrease of -0.45%. Among the Truck segments, both the 0-to-2-year-old and 8-to-16-year-old categories reported smaller declines of -0.35%. Similar to the Car segments, all thirteen Truck segments experienced a decrease in value.

The Sub-Compact Luxury Crossovers suffered the most significant decline within the Truck segment, dropping by -0.95%. This represents the segment’s largest single-week decline since the final week of January. The Minivan segment faced a depreciation rate of -0.87%, the highest since late December 2022 when the segment declined by -1.12%. Although Full-Size Vans continue to experience a decline, the rate of decrease has lessened, with only a -0.10% drop observed last week.

Used Retail

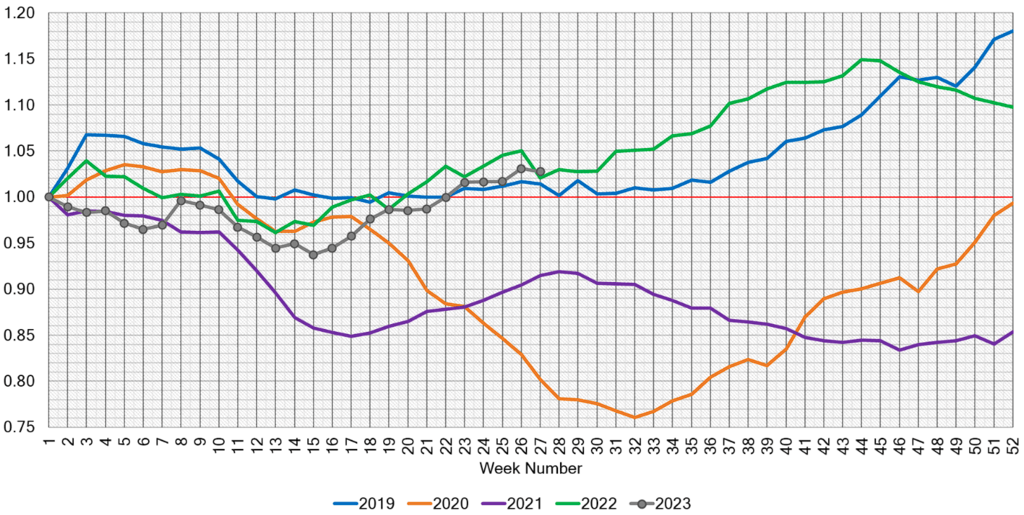

At the beginning of 2023, the Used Retail Active Listing Volume Index returned to a value of one. Currently, the index sits at 1.03 points, suggesting a marginal uptick in active listings.

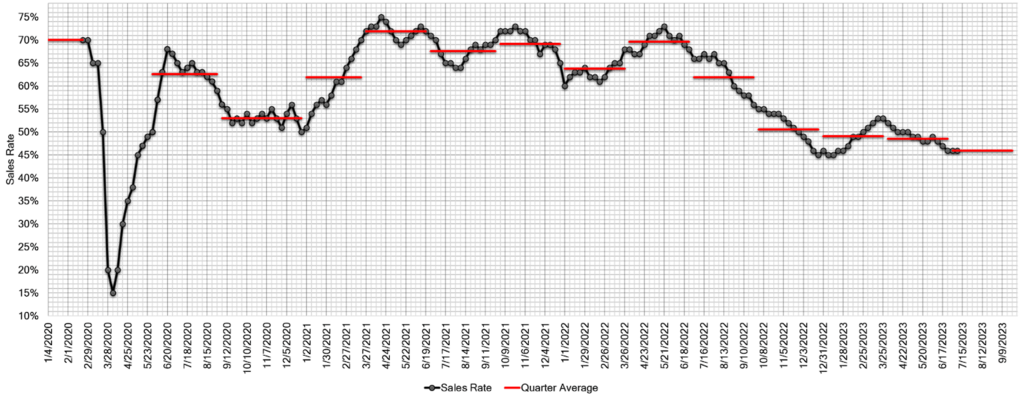

Wholesale

July commenced similarly to the end of June, with wholesale prices persisting in their downward trend and auction conversion rates remaining low. During the first week of July, there was a slight uptick in auction volume, accompanied by an increase in repossessions hitting the lanes. Notably, the 2023 trucks and full-size SUVs passing through the auction continued to command robust prices. As we transition into July, the “summertime slowdown” appears to be fully in effect. The Estimated Average Weekly Sales Rate remained unchanged at 46% compared to the previous week.

This concludes our Auto Market Update for the week ending Jul 8, 2023. Stay tuned for the latest developments in the automotive market as we continue to monitor the trends and fluctuations impacting the industry.