Auto Market Update Week Ending Jun 17, 2023 (PDF)

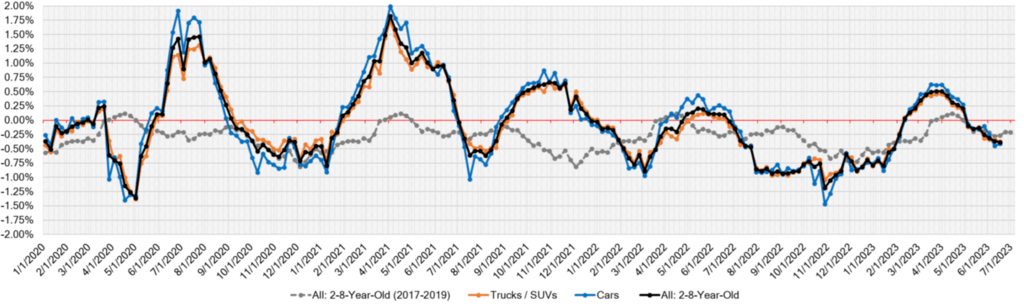

In the latest auto market update for the week ending in 2023, wholesale values continued their decline, exhibiting only slight deviations from what is typically observed during this time of year. With the exception of the Small Pickups segment, all other segments experienced a decline in wholesale values. However, when compared to the pre-pandemic period, these declines remain relatively consistent with historical averages.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.41% | -0.45% | -0.35% |

| Truck & SUV segments | -0.37% | -0.34% | -0.22% |

| Market | -0.38% | -0.37% | -0.27% |

Let’s take a closer look at the specific changes in each segment:

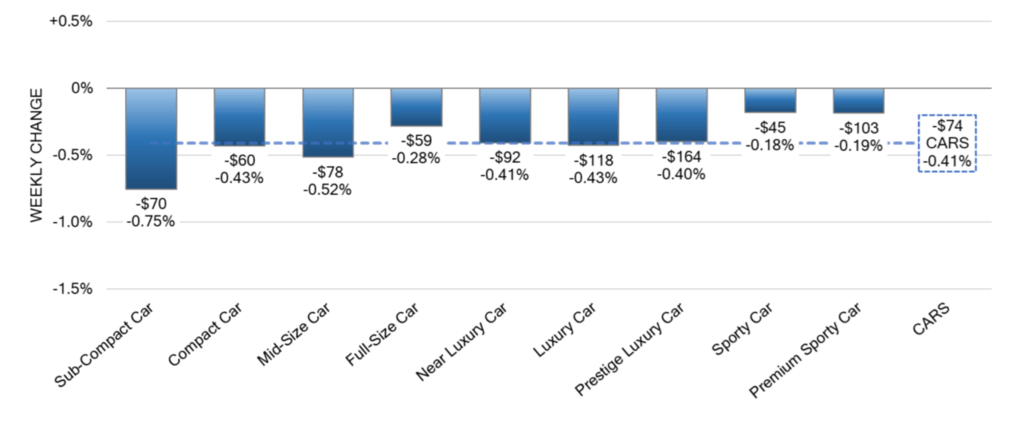

Car Segments

- Interestingly, all nine Car segments reported an increase in values last week.

- The overall Car segment witnessed a decrease of -0.41% on a volume-weighted basis this week. To provide context, the previous week saw a slightly higher decline of -0.45% for cars.

- The Sub-Compact Car segment recorded the largest drop at -0.75%. In the prior week, this segment also experienced the most significant decline among cars with a decrease of -0.89%.

- Sporty Car values turned negative last week, experiencing a decline of -0.18%, compared to a minimal gain of +0.04% in the previous week.

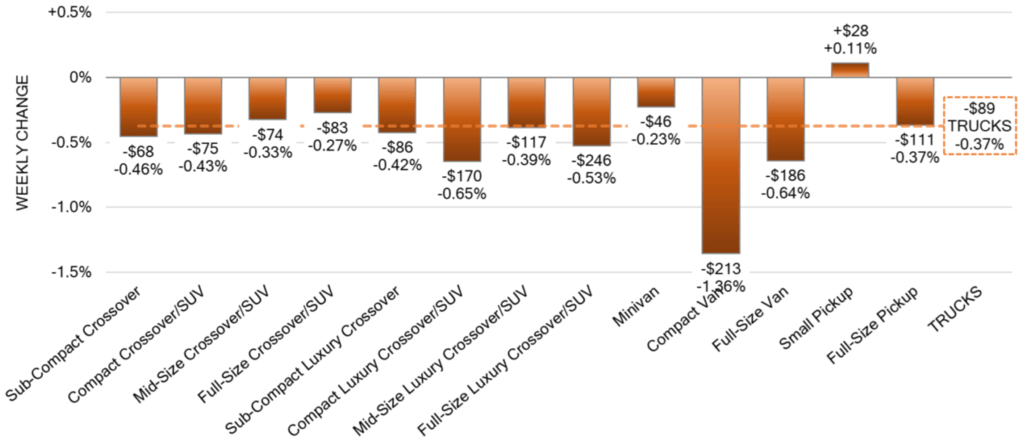

Truck & SUV Segments

- Among the thirteen Truck segments, twelve reported a decrease in values during the past week.

- The volume-weighted, overall Truck segment experienced a decline of -0.37%, maintaining consistency with the previous week’s decrease of -0.34%.

- Notably, the Small Pickup segment stood out as the only segment to report an increase, with values rising by +0.11%. This increase follows four consecutive weeks of declines, averaging a weekly decrease of -0.27%.

- The Compact Van segment reported the largest decline at -1.36%. It is worth mentioning that this segment’s smaller size makes it more prone to significant percentage changes even with relatively minor fluctuations.

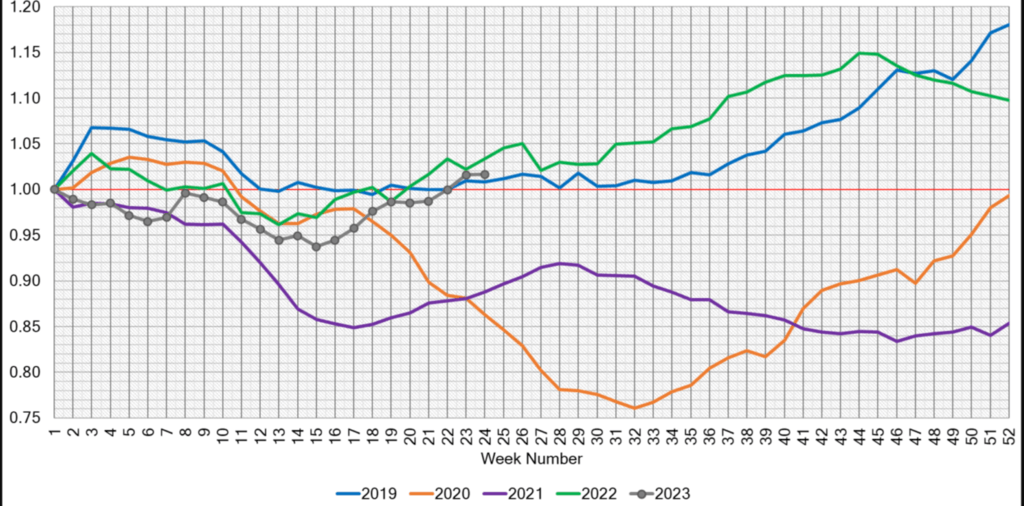

Used Retail

The Used Retail Active Listing Volume Index began the year 2023 by reverting back to one. Currently, the index sits at 1.01 points, indicating a slight increase from the initial dips observed earlier in the year. This marks the first time in 2023 that the index has surpassed the 1.00 mark.

Wholesale

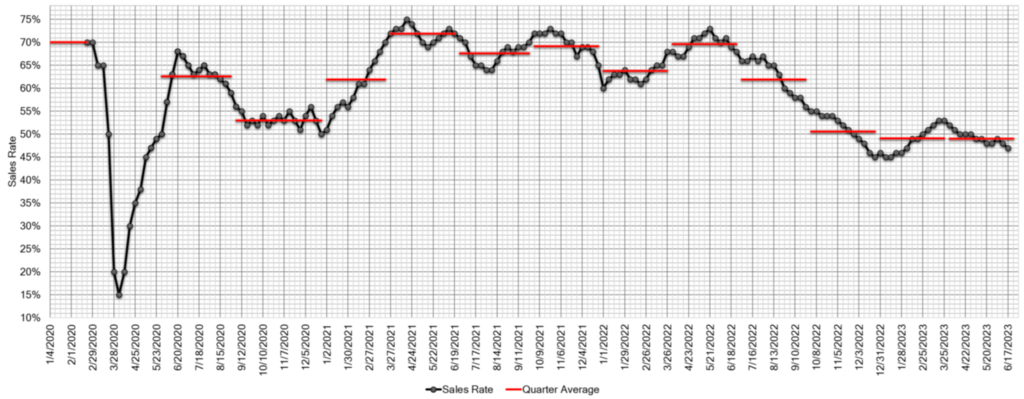

Most auctions across the country are still experiencing a significant number of IF’s (vehicles that don’t sell) and NO sales, leading to lower conversion rates in the past two weeks. While prices in nearly all segments are declining, these adjustments align closely with what is typically observed for this time of year, even when comparing to the pre-pandemic period. Some auctions have reported an increase in inventory, potentially due to a rise in repossessions entering the market. The Estimated Average Weekly Sales Rate declined to 47% last week.

In conclusion, the auto market update for the week ending in 2023 reveals a continued decline in wholesale values across various segments, with deviations that remain within the bounds of typical seasonal trends. Additionally, the analysis highlights the fluctuations in used retail prices over the past few years, emphasizing factors such as stimulus payments, tax season, and inventory shortages that have impacted price dynamics. As the industry moves forward, close attention to auction inventory and sales rates will be crucial in understanding the market’s trajectory.