Auto Market Update Week Ending Mar 11, 2023 (PDF)

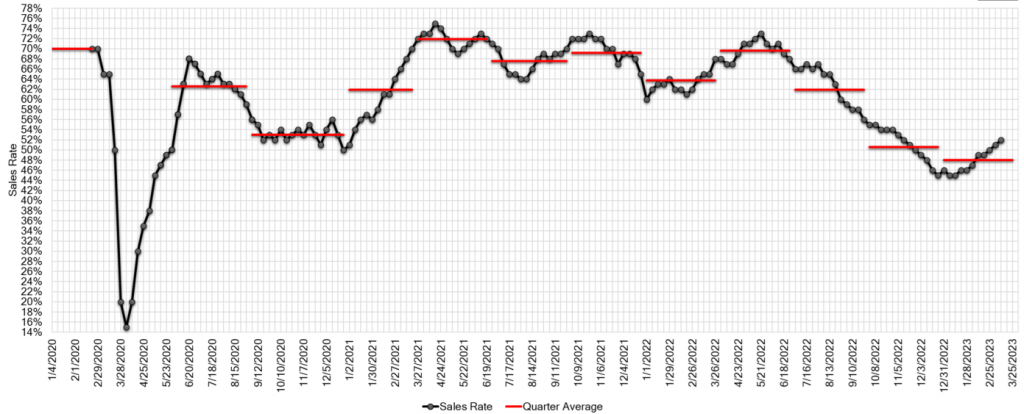

During the last week, the market saw its largest single weekly gain in quite some time. The last time we saw a similar gain was in November 2021. Despite abundant activity at the auctions, there were no sales on vehicles, not because of a lack of bids, but rather because sellers held firm to their prices.

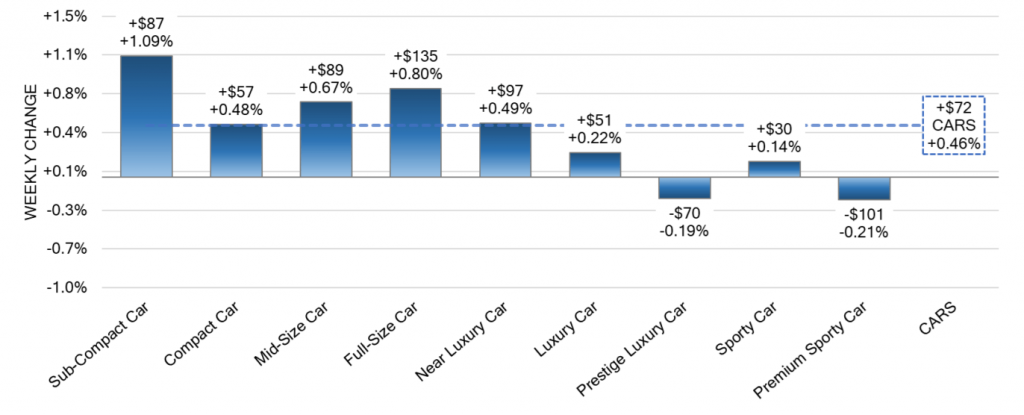

- The overall Car segment increased by +0.46% volume-weighted. For comparison, cars increased +0.46% the previous week.

- Last week, seven of the nine Car segments increased.

- It had been a hot streak for Sporty Cars with seven consecutive weeks of gains that averaged +0.47% a week. However, last week’s gains were only +0.14%.

- It was the first time since May 2021 that the sub-compact car segment had more than a 1% gain in a single week.

- Luxury car depreciation has slowed to its lowest level since July 2022.

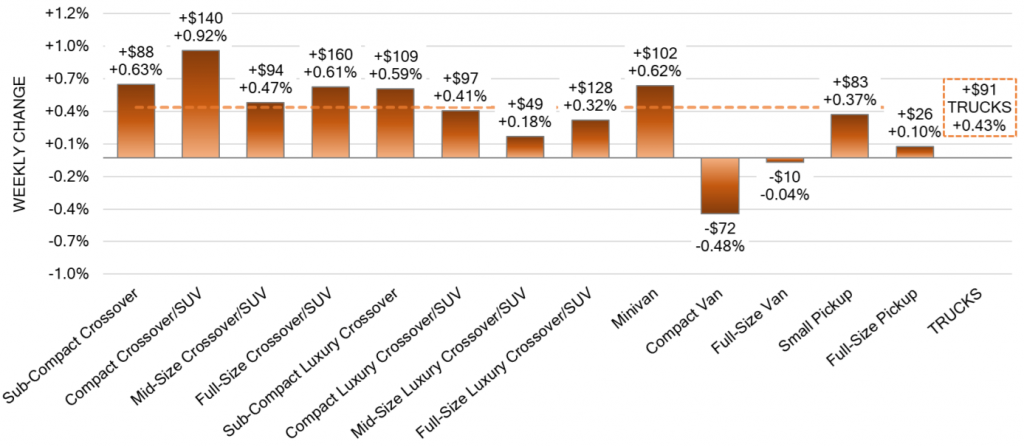

- Overall, the volume-weighted Truck segment increased by +0.43%, compared to +0.30% the previous week.

- Last week, eleven of the thirteen Truck segments reported increases.

- While full-size trucks are still in positive territory, their rate of gain slowed to +0.10% last week, compared to +0.15% the week before.

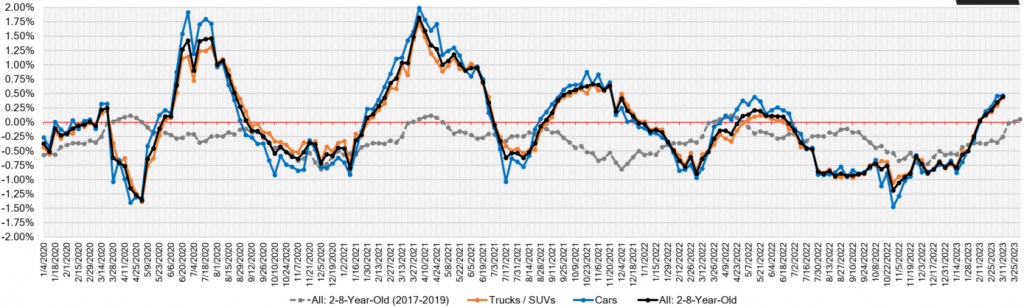

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | +0.46% | +0.46% | -0.12% |

| Truck & SUV segments | +0.43% | +0.30% | -0.34% |

| Market | +0.44% | +0.35% | -0.25% |

Retail (Used and New) Insights

- Volkswagen has confirmed that the U.S. will get the long-wheelbase version of the much-anticipated ID. Buzz, their all-electric Microbus. The van is expected to arrive in June, but sales won’t begin until at least the second half of this year.

- Mercedes-Benz made headlines last week when they released the pricing for the EQE SUV. The all-electric crossover will be priced exactly the same for RWD and AWD entry levels.

- Due to kinks in the assembly process, Nissan has stopped taking reservations for the Ariya, its all-electric crossover.

- Ferrari’s first 4-door model, the Purosangue, will be available later this year.

Wholesale

The market is on the rise with values rising every week higher than we usually expect for the Spring/tax season. We’re seeing single-week increases that are evocative of 2021, yet conversion rates haven’t returned to their former rate just yet. Despite increased bidding throughout the country, sellers’ resolute stance on their floors has kept sales from taking off. Even as auction lanes show optimistic news, dealers remain wary of how much negative equity customers have racked up trading in vehicles.