Car Imports Are More Welcome In The U.S. Than In Europe or China (PDF)

The car trade industry changes constantly, and the outcome can depend on a number of factors. For example, car manufacturers may try to gain new traction by opening factories in developing countries or promoting new trade deals between economic blocs. At the same time, many governments will protect their local industry by imposing high tariffs on imported goods.

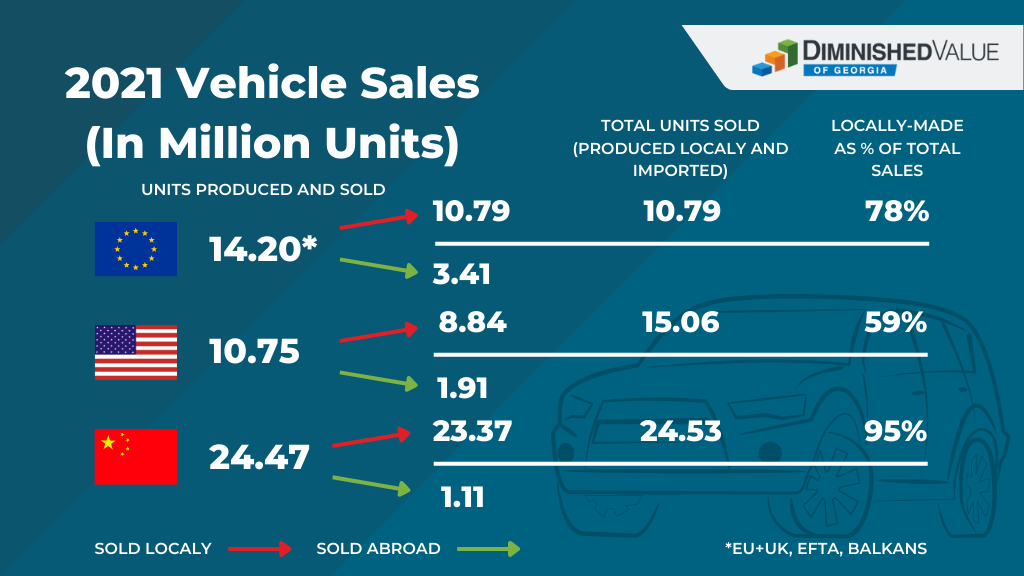

If you take the United States, the second-largest car market, and the second-most prolific producer of new vehicles, what do you find? That it is by far the most open in its appetite for imports when compared to Europe and China. Almost 60% of all automobiles sold domestically last year were produced by United States-based manufacturers, leaving an important piece in the market for foreign cars.

The absence of locally made cars in America is a stark contrast to the presence they have in Europe and China.

Last year, European car manufacturers sold 10.79 million cars in Europe, representing 78% of all new car sales in the region. More than likely, Europeans prefer purchasing local merchandise over American goods given this trend.

In China, the automotive industry is thriving, with sales totals higher than in any other country in the world. The industry is so expansive that it produced 24.47 million vehicles worldwide in 2021. Of these, 23.37 million were sold domestically and 1.16 million cars were exported; this means over 95% of Japan’s auto-industry market was reliant on Chinese production.

In order to understand how closed China’s market can be, let’s take a look at what happened in Mexico last year. More cars were imported into Mexico than into China, and China’s car market was 24 times larger than Mexico’s.

On the other hand, there are many different perspectives to consider when looking at the European automobile market. Germany is the main producer and the largest consumer of cars, but it’s Spain that sold more cars within Europe. According to my calculations, there were 1.76 million new customers in Europe who purchased Spanish-made cars while there were 1.64 million clients in Europe who bought German automobiles – both without counting countries where they’re produced.