Auto Industry Related Headlines for July 2022

- With the exception of the Compact and Full-Size Van segments, all segments reported softening last week, leading up to the July 4th holiday weekend.

- In recent weeks, the sales rates at the auctions have been trending downward and dealer sentiment is that leads have softened, so it is no surprise that the overall market has now reported declines for two consecutive weeks.

- Used Retail Listing Volume has increased again and is now reporting at the 1.05 mark.

- The Used Retail Days-to-Turn Estimate now sits at 37 days.

- The Estimated Average Weekly Sales Rate continues to drop and is now at 66%, after several weeks of increases this spring.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.11% | 0.16% | -0.30% |

| Truck & SUV segments | -0.16% | -0.11% | -0.15% |

| Market | -0.15% | -0.02% | -0.21% |

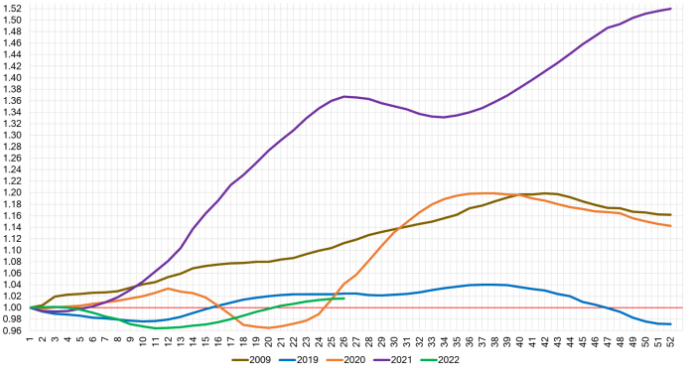

July 2022 Wholesale Index

Calendar year 2020 and 2021 ended with used wholesale prices at elevated levels. With economic patterns (including the automotive market) driven by the pandemic, normal seasonal patterns (e.g., 2019 calendar year) in the wholesale market were not observed for most of the last 2 years. We saw a similar picture in 2009, at the end of the Great Recession. Calendar year 2021 did not have typical seasonality patterns as the market had rapid increases in wholesale values for the majority of the year. The Wholesale Weekly Price Index reached the highest point of the year at the end of December, reporting over 1.51 points. Now, in calendar year 2022, the index has been reverted back to the 1.00 mark. Overall wholesale prices have increased over the last several weeks and they now sit just above where the year started.

The graph below looks at trends in wholesale prices of 2-6-year-old vehicles, indexed to the first week of the year. The index is computed keeping the average age of the mix constant to identify market movements.