The Iowa Insurance Division is dedicated to assisting consumers in resolving insurance-related issues. Filing an Iowa Insurance Commissioner Complaint allows individuals to address disputes with insurance companies, agents, or policies. To ensure the process runs smoothly, it’s important to provide all necessary information and documentation when submitting your complaint.

Complaint Information Checklist

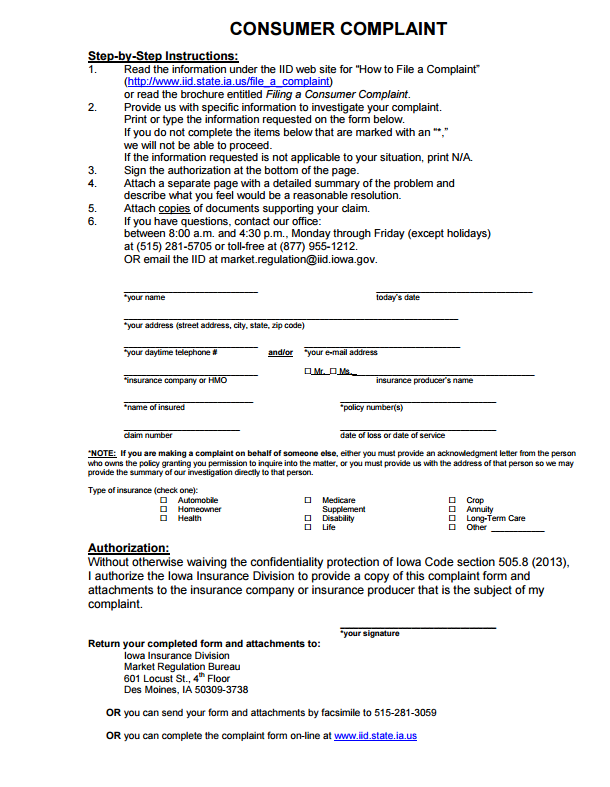

For our staff to begin evaluating and analyzing your request, specific information is necessary. Review the following checklist to ensure you are providing the necessary information. Be sure to include a detailed summary of the problem and attach copies of documents supporting your claim. Failure to provide this information may delay or limit our ability to help you.

- A detailed summary of the problem.

- Your name.

- Complete address.

- Daytime telephone number.

- Cell phone number (if available).

- Email address (if available).

- The name of the insurance company issuing the policy.

- The type of insurance coverage (e.g., automobile, life, homeowner, health, annuity, long-term care, or others).

Important Note:

If you are submitting a complaint on behalf of someone else, you must include a signed acknowledgment letter from the policyholder granting you permission to inquire on their behalf.

How to File an Iowa Insurance Commissioner Complaint

1. File Online

The most efficient way to file your complaint is through the Iowa Insurance Division Online Complaint Form. This method allows for faster submission and processing.

2. File by Mail

If you prefer to file by mail, download and complete the Iowa Department of Insurance Complaint Form (PDF). Attach all relevant documents and send your form to:

Mailing Address:

Iowa Insurance Division

Market Regulation Bureau

601 Locust St., 4th Floor

Des Moines, IA 50309-3738

What to Include with Your Iowa Insurance Commissioner Complaint

When submitting your complaint, ensure you attach supporting documents such as:

- Copies of correspondence with the insurance company or agent.

- Policy documents and claim numbers.

- Evidence supporting your claim (e.g., receipts, contracts, or photos).

Providing comprehensive information helps the Iowa Insurance Division evaluate your complaint more effectively.

Conclusion

Filing an Iowa Insurance Commissioner Complaint can help you resolve disputes and clarify insurance-related concerns. The Iowa Insurance Division offers accessible options for submitting complaints, whether online or by mail.

By providing a detailed summary and supporting documents, you can expedite the process and receive the assistance you need. Don’t hesitate to contact the division if you require further guidance.