Special IRS Depreciation Tax Benefit of Buying 6,000 lb Cars and Trucks.

The informational guide and list in this article are updated for 2023.

- List of Vehicles with GVWR exceeding 6,000 lbs.

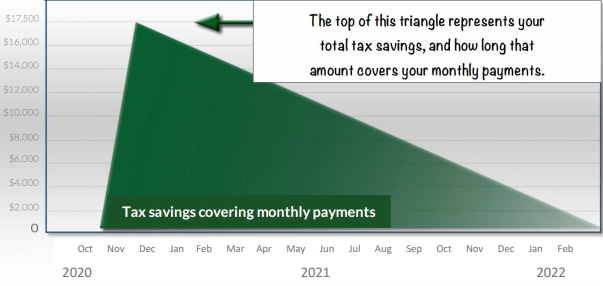

- Under the current tax law, vehicles with a GVWR of 6,000 lbs or more are exempt from annual depreciation caps.

- Section 179(a) allows a taxpayer to elect to treat the cost (or a portion of the cost) of any § 179 property as an expense for the taxable year in which the taxpayer places the property in service.

- IRS Tax Code 179 – Depreciation of Vehicles

- The tax deduction for business autos is equal whether they are bought outright, leased, or financed

Limits for Cars, Trucks, SUVs or Crossover Vehicles with GVW above 6,000lbs

Certain cars or trucks (with a gross vehicle weight rating higher than 6,000 lbs. but don’t exceed 14,000 lbs.) qualify for withholding up to $27,000 in 2022 ($28,900 in 2023) if the car/truck meets all IRS qualifications.

Below is a list of vehicles that qualify for this exemption. These vehicles are designated by the manufacturer as trucks.

Please consult with a CPA before purchasing any of these vehicles and check the owner’s manual.

IRS Section 179 depreciation deduction:

Up to $27,000 in 2022 ($28,900 in 2023) of the cost of vehicles rated between 6,000 lbs GVWR and 14,000 lbs GVWR can be deducted using a section 179 deduction. This limitation on sport utility vehicles does not impact larger commercial vehicles, commuter vans, or buses.

|

Cars |

|

Light Trucks and Vans |

||

|

Year 1 |

$3,160 |

$3,460 |

||

|

Year 2 |

$5,100 |

$5,500 |

||

|

Year 3 |

$3,050 |

$3,350 |

||

|

Year 4 and thereafter |

$1,875 |

$1,975 |

Vehicle Requirements for Tax Incentives

- Motor Vehicles (6,000 lbs <GVWR < 14,000 lbs.) qualify for deducting up to $27,000 in 2022 ($28,900 in 2023) if the vehicle is purchased and placed in service prior to December 31 of the tax year.

- Vehicles that can seat nine-plus passengers

- Vehicles with a fully-enclosed cargo area

- Heavy construction equipment

List of vehicles 6,000 pounds or more that qualify for tax incentives

Audi

- AUDI Q7

- AUDI SQ7

- AUDI Q8

- AUDI SQ8

BMW

- BMW X5 XDRIVE45E

- BMW X6 M50i

- BMW X7 xDrive40i

- BMW X7 M50i

- X7 M50d

Bentley

- BENTLEY BENTAYGA

- BENTLEY BENTAYGA HYBRID

- BENTLEY BENTAYGA SPEED

- BENTLEY FLYING SPUR

- BENTLEY FLYING SPUR V8

- BENTLEY FLYING SPUR W12

- BENTLEY MULSANNE

- BENTLEY MULSANNE SPEED

- BENTLEY MULSANNE EXTENDED

Buick

- BUICK ENCLAVE AVENIR AWD

- BUICK ENCLAVE AVENIR FWD

- BUICK ENCLAVE ESSENCE AWD

- BUICK ENCLAVE ESSENCE FWD

Cadillac

- CADILLAC ESCALADE

- CADILLAC ESCALADE ESV

- CADILLAC ESCALADE PLATINUM

- CADILLAC ESCALADE ESV PLATINUM

Chevrolet

- CHEVROLET SILVERADO 2500HD

- CHEVROLET SILVERADO 3500HD

- CHEVROLET SILVERADO 4500HD

- CHEVROLET SILVERADO 5500HD

- CHEVROLET SILVERADO 6500HD

- CHEVROLET EXPRESS CARGO VAN 2500

- CHEVROLET EXPRESS CARGO VAN 3500

- CHEVROLET EXPRESS PASSENGER VAN

- CHEVROLET SUBURBAN

- CHEVROLET TAHOE

- CHEVROLET TRAVERSE

Chrysler

- CHRYSLER PACIFICA

Dodge

- DODGE DURANGO

- DODGE DURANGO SRT

- DODGE DURANGO CITADEL

- DODGE DURANGO R/T

- DODGE DURANGO GT

- DODGE DURANGO SXT

- DODGE GRAND CARAVAN

- FORD EXPEDITION

- FORD EXPEDITION MAX

- FORD F-250 SUPER DUTY

- FORD F-350 SUPER DUTY

- FORD F-450 SUPER DUTY

- FORD F-550 SUPER DUTY

- FORD TRANSIT CARGO VAN T-250 HD

- FORD TRANSIT CARGO VAN T-350 HD

- FORD TRANSIT PASSENGER WAGON

GMC

- GMC SIERRA 2500HD

- GMC SIERRA 3500HD

- GMC SIERRA 3500HD DENALI

- GMC SIERRA 4500HD

- GMC SIERRA 5500HD

- GMC SIERRA 6500HD

- GMC YUKON

- GMC YUKON XL

Honda

- HONDA ODYSSEY

Infiniti

- INFINITY QX80

Jeep

- JEEP GRAND CHEROKEE

- JEEP GRAND CHEROKEE SRT

- JEEP GRAND CHEROKEE L

- JEEP WRANGLER UNLIMITED

- JEEP GLADIATOR RUBICON

Land Rover

- LAND ROVER DEFENDER 110

- LAND ROVER DEFENDER 90

- LAND ROVER DISCOVERY

- LAND ROVER DISCOVERY SPORT

- LAND ROVER RANGE ROVER

- LAND ROVER RANGE ROVER SPORT

- LAND ROVER RANGE ROVER VELAR

- LAND ROVER RANGE ROVER EVOQUE

- LAND ROVER RANGE ROVER EVOQUE R-DYNAMIC

- LEXUS LX570

Lincoln

- LINCOLN AVIATOR

- LINCOLN NAVIGATOR

Mercedes Benz

- MERCEDES-BENZ GLS 580 4MATIC

- MERCEDES-BENZ GLS 600 4MATIC

- MERCEDES-BENZ G 550 4X4 SQUARED

- MERCEDES-BENZ GLS 580 4MATIC

- MERCEDES-BENZ GLS 600 4MATIC

- MERCEDES-BENZ AMG G 63 4MATIC SUV

Nissan

- NISSAN ARMADA 2WD/4WD

- NISSAN NV 1500 S V6

- NISSAN NVP 3500 S V6

- NISSAN TITAN 2WD S

Porsche

- PORSCHE CAYENNE TURBO COUPE

- PORSCHE CAYENNE TURBO S E-HYBRID COUPE

- PORSCHE CAYENNE TURBO S E-HYBRID

- PORSCHE PANAMERA TURBO S E-HYBRID

Tesla

- TESLA MODEL X

Toyota

- TOYOTA TUNDRA 2WD/4WD

- TOYOTA 4RUNNER 2WD/4WD LTD

- TOYOTA TUNDRA 2WD/4WD