Even a minor accident can significantly impact the value of your 2022 Tesla Model Y. Despite high-quality repairs, the mere fact that your vehicle has a documented accident history can reduce its resale value. That’s where diminished value comes into play.

The reality is that the insurance company is not your friend, so even though obligated to pay you for this loss in value, 90% of the time, they will make a low offer on your claim.

In this article, we’ll show you how diminished value is calculated, why it matters, and how you can file a claim to recover your losses.

Was Your 2022 Tesla Model Y in an Accident?

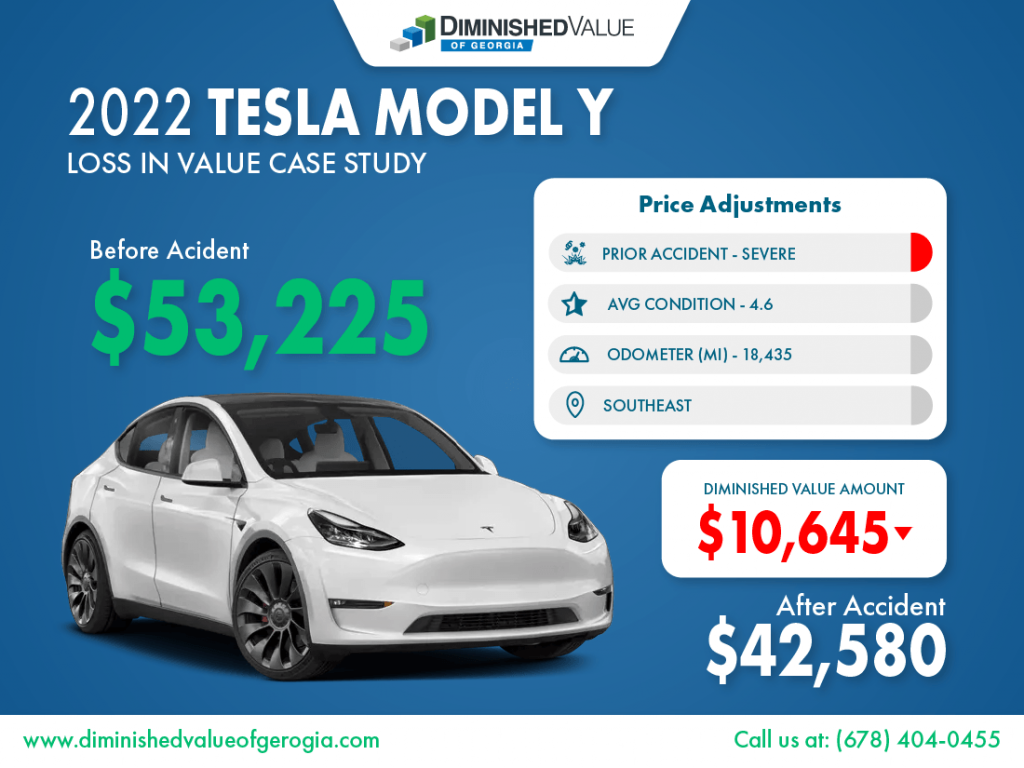

Using a detailed analysis and our patent pending methodology, we can determine the diminished value of your Tesla Model Y. Here’s a breakdown of the essential figures:

| Diminished Value Calculator | |

| Before Accident Cash Value | $53,225 |

| After Accident Cash Value | $42,580 |

| Diminished Value | $10,645 |

These numbers are not just pulled out of thin air. They’re derived from a combination of comparable market data, the quality of repairs, and the vehicle’s condition before the accident.

This calculated approach ensures a realistic representation of your car’s loss in value, unlike the unfair 17c Formula method used by most insurance companies.

How about letting our team get you the best value for your insurance claim?

- Discover your car’s true value

- No payment upfront

- Vehicle history report

What Is Diminished Value?

Diminished value is essentially the difference in your car’s market value before and after an accident. Even if your Tesla Model Y is repaired to the highest standards, the fact that it was in an accident will lower its resale value. Buyers and dealers typically view a vehicle with an accident history as less desirable, which translates into a lower offer.

→ Read: How to File a Diminished Value Claim After a Car Accident?

Factors That Impact your Tesla Model Y Diminished Value

Several factors contribute to determining your Tesla Model Y’s diminished Value:

- The severity of the damage: Significant structural or cosmetic damage will have a greater impact on your car’s value.

- The quality of repairs: While high-quality repairs help, any evidence of damage reduces value.

- Vehicle age and mileage: Newer, low-mileage vehicles like the Tesla Model Y are more likely to suffer higher diminished values.

Click here to check our frequently asked questions for more Diminished Value content: Diminished Value Information Center

How to File a Diminished Value Claim and Get Fair Compensation

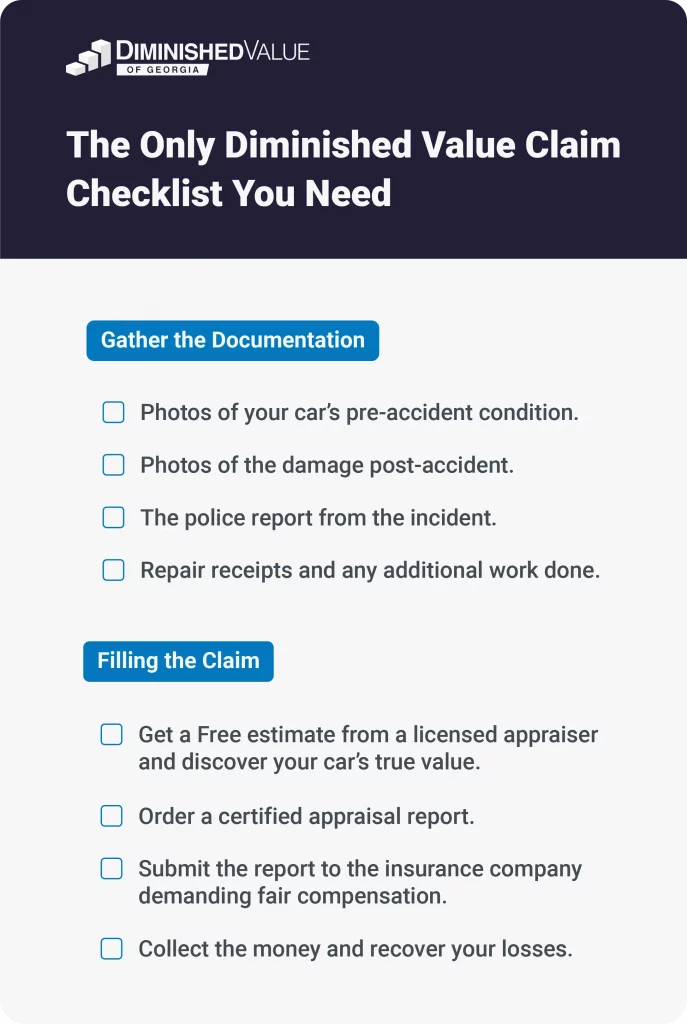

Filing a diminished value claim can be a straightforward process if you follow these steps:

1. Gather Comprehensive Documentation

The strength of your insurance claim relies on solid documentation. Before filing your claim, make sure to gather all the necessary evidence, including:

- Photos of your vehicle’s condition before the accident.

- Detailed photos of the damage immediately after the incident.

- A copy of the police report from the auto accident.

- All repair estimates, invoices, and receipts, including any additional work performed.

Having thorough documentation makes it much harder for the insurer to dispute the validity of your claim.

2. Get an Independent Diminished Value Appraisal

One of the most critical steps in the process is to get an independent appraisal of your vehicle’s diminished value.

Instead of relying solely on the insurer assessments, which may not always be impartial, hiring a professional appraiser ensures a more accurate evaluation of your car’s true loss in value.

Auto appraisers provide unbiased estimates that reflect the actual impact on your vehicle’s market value, strengthening your claim with reliable evidence.

The good part here is that most appraisers provide a free claim review, so you can first check the amount you are truly owed by the insurance company before making any purchases.

Get a Free Tesla Model Y Diminished Value Claim Review

"*" indicates required fields

4. Understand Your Policy and State Laws

Knowing the details of your insurance policy and state laws is crucial when filing a diminished value claim. Some states allow both first-party and third-party claims, while others limit you to filing against the at-fault driver’s insurance.

Outside of Georgia, for example, you can only file a diminished value claim against the at-fault driver’s insurance, as no law allows first-party (comprehensive) diminished value claims.

Understanding your rights and the specifics of your state’s regulations can make a significant difference in how much you can recover for your diminished value claim.

Why Do You Need an Independent Appraiser?

Bringing an appraiser on board can make a world of difference for your diminished value claim. Here’s why:

- Expertise: These pros have the expertise to accurately assess the diminished value of your car, maximizing your claim.

- Credibility: Their detailed reports bolster your claim, making it tough for insurance companies to lowball you.

- Leverage: Armed with a professional appraisal, you’ve got the upper hand when negotiating with insurers.

Fill out the form below to get a FREE Claim Review or call (678) 404-0455 and receive the compensation you deserve. Discover how much your car lost in value for free.

Wrapping it up

A diminished value claim isn’t just about getting compensation—it’s about standing up for what’s rightfully yours.

If your 2022 Tesla Model Y has lost thousands in value due to an accident, you shouldn’t settle for the insurance company’s lowball offer.

With the right documentation, a professional appraisal, and a clear understanding of your rights, you can fight back and recover the full amount you’re owed.

Don’t leave money on the table—get your FREE Claim Review today and take the first step toward fair compensation!