Used Car Prices and Inventory April 2022 (pdf)

Used Cars: Retail Prices

Used Retail Prices are more accessible than in years past, due to the proliferation of ‘no-haggle pricing’ for used-vehicle retailing. Transparent pricing upfront makes the car buying process more enjoyable for customers and allows Black Book to accurately measure retail market trends.

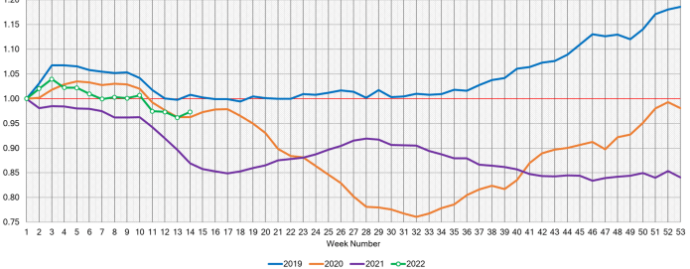

At the onset of the pandemic, in CY2020, used retail prices increased slightly, following typical seasonal patterns, and then began dropping in April, finally hitting a low point in the late spring months.

By the late summer of CY2020, Used Retail Prices increased as the supply of new vehicle inventory started to become scarce, but retail demand slowed down at the end of CY2020, resulting in declining retail asking prices for the last several weeks of the year. When CY2021 kicked off, demand rebounded while retail prices lagged slightly behind wholesale prices; March of 2021 started the dramatic increases in Used Retail Prices, fueled by stimulus payments, tax season, and shortages of new inventory. During the third quarter, retail prices continued to rise at a slower rate but soon picked up the pace once again to start the fourth quarter.

In Q4, prices on retail listings steadily increased week after week. As CY2021 came to an end, the retail listing price index closed 36% above where the year began.

So far in 2022, the Retail Listings Price Index has remained relatively unchanged (green curve on the graph below), The Index sits around 0.99, indicating a very slight decrease in retail pricing. Typically, there is a lag between changes in wholesale prices and retail prices.

This analysis is based on approximately two million vehicles listed for sale on U.S. dealer lots. The graph below looks at 2-6-year-old vehicles. The Index is computed by keeping the average age of the mix constant to identify market movements.

Used Cars: Retail Inventory

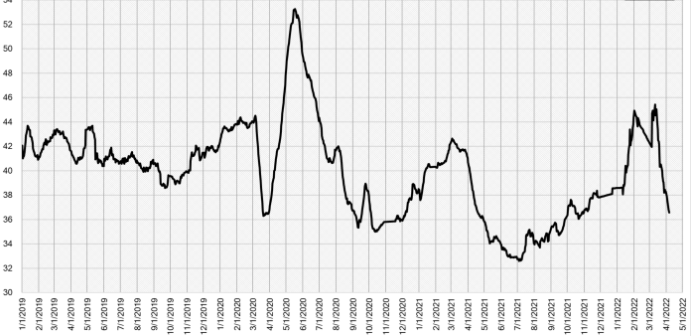

Used Retail Listing Volume continues to drop and now sits just above 0.95. The Index for CY22 resembles pre-pandemic trends and is an indicator that there may be some seasonal normality this year.

The Used Retail Days-to-Turn Estimate also dropped this week and is now just below 37 days.

Used Cars: Wholesale Market

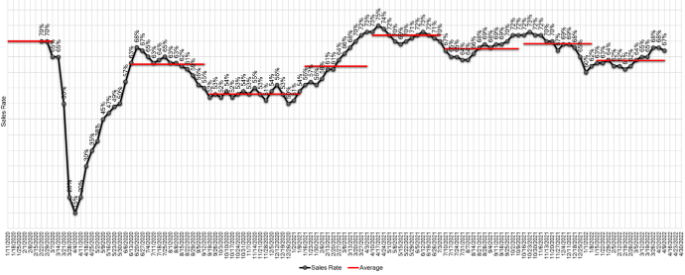

The strength of the 8-to-16-year-old vehicles continued last week, with the overall segment average increasing 0.18%, compared with the 2-to-8-year-old vehicles reporting a decline of -0.15%. The car segments increased +0.45% in the older vehicles, compared with the +0.12% increase for the 2-to-8-year-olds. Supply on the lanes is being dominated by trucks and crossovers/SUVs and sellers are holding firm to floors. Typically, this time of year, we would already be seeing 2022 model year vehicles being offered for sale, but this year they are a rare sight. Rental companies are still having some difficulties acquiring inventory from manufacturers directly and have been extremely competitive in the lane; with Americans gearing up for summer travels, increased competition from rental companies is anticipated to continue through the fall.

The Estimated Average Weekly Sales Rate decreased a little last week to 67%, with sellers holding firm to floor pricing.