Specialty market Highlights for August 2021:

- In Powersports, values this month are both of the water-based segments, Personal Watercraft and Jet Boats, and Scooters.

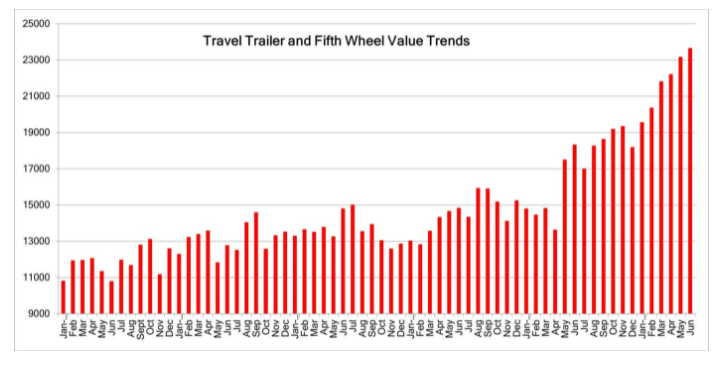

- The values of used RVs sold at wholesale auctions rose across the board once again last month.

- In Collectible Cars, the collector car community is looking forward to the associated auctions held in Monterey.

- According to the Federal Reserve Economic Data (FRED), new retail sales grew 10.4% from May to June. The month prior (April 2021 -May 2021) new retail sales dropped 1.08%.

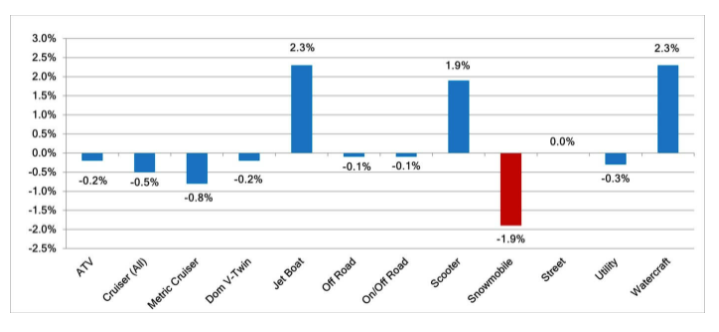

The segments showing growth in values this month are both of the water-based segments, Personal Watercraft and Jet Boats, and Scooters. All three of these segments have one thing in common. They are vehicles that are in high demand as rental units in vacation and destination areas.

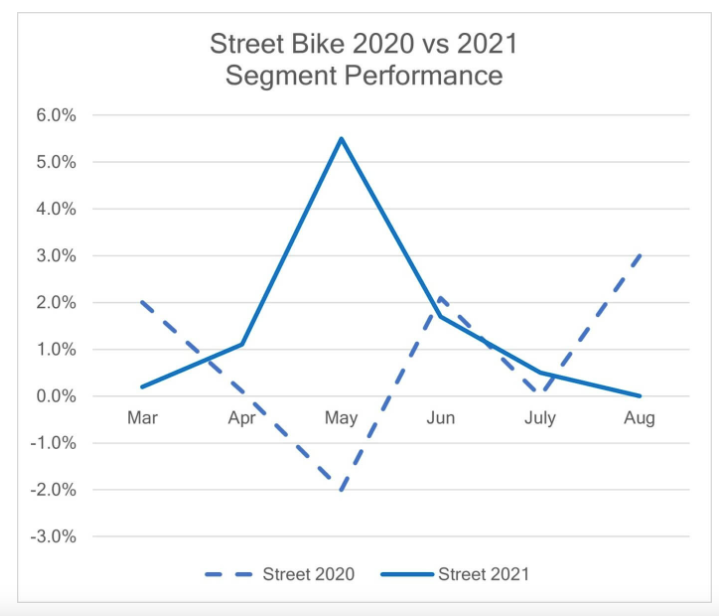

Street Bike Performance

Street Bikes show no change in value this month. Combined with the Dual Sports and Cruisers, both of which went down, all of the on-road motorcycle segments are showing a return to more traditional seasonal pricing trends.

TV & Utility Vehicle Performance

Both the ATVs and the Utility Vehicles are down slightly this month after exhibiting strong value growth over the past 18 months. As you can see below, last year at this time, both of these segments saw extraordinary growth in values as were heading into the fall.

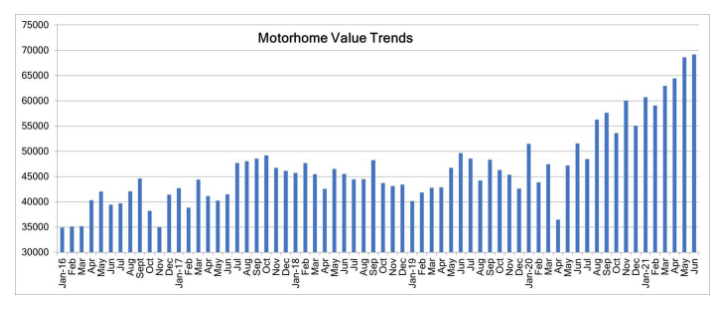

Motorhomes (including Class A, B, and C)

- The average selling price was $69,157, up $534 (0.7%) from the previous month.

- One year ago, the average selling price was $51,574.

- Auction volume was down 11.3% from the previous month.

- The average model year was 2010.

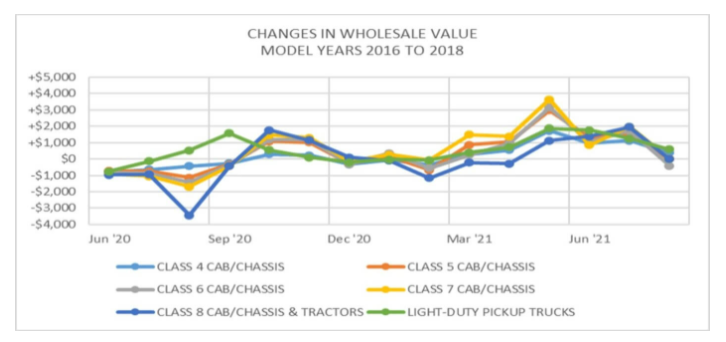

Heavy-Duty Trucks

- Dry vans and box trucks have grown in demand as production delays continue to limit the number of new trucks being delivered.

- Due to the chip shortage and other production delays, fleets are keeping their units in service longer, which equates to higher mileage, worse conditioned units being sold at auction.

- From July to August, Medium Duty Trucks have only depreciated an overall weighted average of 0.1%

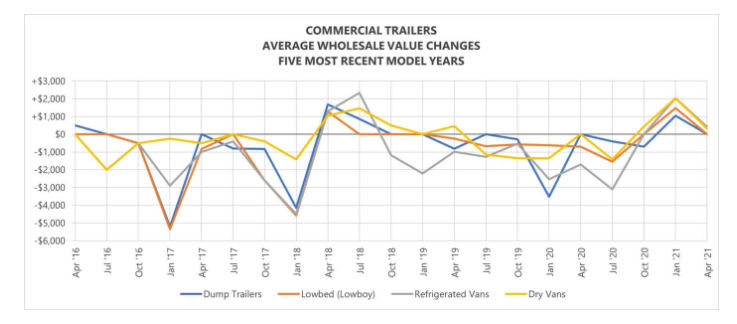

Commercial Trailer Market Update

- Commercial Trailer values have been relatively stable since August of 2020 due to production shortages and strong freight demand.

- In January of this year, prices began to increase as new and used volumes became more scarce.

- Our team is currently analyzing the most recent auction and retail transactions to make another round of value increases heading into October.

- Since the beginning of the year, Dry Vans have increased 16.1%, Refrigerated Vans have increased 8.4%, Lowboys have increased 3.2%, and Dump Trailers have increased 2.8%.

- These numbers are amazing when you consider by this time last year Dry Vans had depreciated 9.0%, Refrigerated Vans were down 13.1%, Lowboys down 2.7%, and Dump Trailers had depreciated 9.1%.

- Recent auction and retail sales figures indicate that this market will continue on an upward trend through the reminder of this calendar year as commercial trailer production remains idled and freight demand grows.