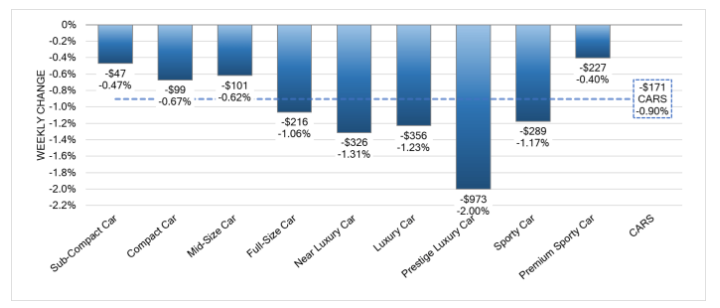

The Market Experiences Significant Declines

Large market declines continued last week, exceeding the levels that are expected for this time of year.

Luxury segments continued to experience severe depreciation last week.

The Prestige Luxury Car segment reported the largest decline at -2%, following the prior week’s already large decline of -1.34%.

Other volume segments, such as Compact, lessened to a decrease of -0.67%, compared with the prior week’s -1.06%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.90% | -0.92% | -0.15% |

| Truck & SUV segments | -0.82% | -0.88% | -0.19% |

| Market | -0.85% | -0.89% | -0.18% |

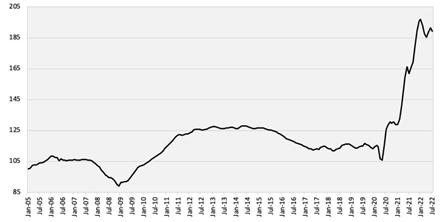

Retention Index Dropped to 189.4 Points in July

The Retention Index decreased to 189.4 points, a 2.2-point (or 1.1%) drop.

The Index currently stands 17% above where it was at the same time in 2021 and 65% above March 2020, pre-pandemic.

High gas prices, inflationary pressure, and global events kept consumer confidence low.

Even with the lack of adequate new inventory, used retail demand continued to soften which finally pushed wholesale prices down.

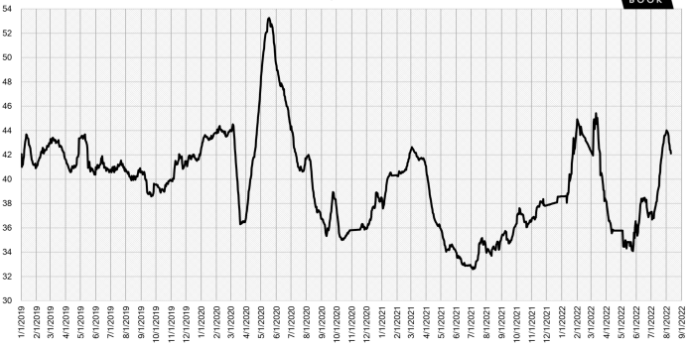

Used Wholesale Inventory

The wholesale channels have remained consistent the past two weeks, with more model year 2022 vehicles available throughout the lanes, as well as newer used vehicles (model year 2019 to model year 2021). The condition of these vehicles has been average but with higher mileage. Smaller franchise dealers took advantage of the absence of the larger independent dealers and were very active in the lanes last week. Sales rates were stable, but inventory is still on the lower side as sellers’ floors are continuing to soften. Fuel prices are still decreasing, but that does not seem to help with the demand, as the market is still on a downward trend, showing signs of weakness. In the Car Segments, Prestige Luxury took the biggest hit, followed by Near Luxury, Luxury, and Sporty Cars. In the Truck Segments, Sub-Compact Luxury fell the hardest, followed by Full-Size Luxury, Compact Crossover, and Mid-Size Crossovers.