Mid-Size Cars and Sub-Compact Crossovers showed slight increases in prices, indicating consumer demand for these segments in this tax season over other segments.

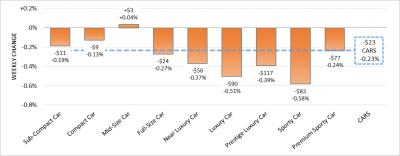

Model Years: 2007-2013, Volume Weighted Wholesale Average Values, Weekly Change from 2/26/16 to 3/4/16

Depreciation slowed a Little from Last Week

- Volume-weighted, overall car values decreased by -0.23% last week. In YOY comparison, the car values increased by +0.02% in a week this time last year.

- Mid-Size Car, Compact Car and Sub-Compact Car segments performed the best, changing by +0.04%, -0.13% and -0.19%, respectively.

- Volume-weighted, overall truck values decreased by -0.31% last week. In YOY comparison, the truck values decreased by only -0.02% in a week this time last year.

- Sub-Compact Crossover and Compact Van segments performed the best, changing by +0.33% and +0.09%, respectively.

Sentiment from the Auction Lanes

Our editors and personnel attend about 60 auctions every week across the country to provide key insights:

“Dealers still looking for that sharp, low mileage unit with good history.” Gerry from FL

“Good sale today with a normal selection of vehicles. Prices on most segments were level to up a little compared to last week.” Jim from WA

“Very active bidding today with sales in the 75% range.” Gene from PA

“Another strong sale today with very active bidding on the lanes and on the internet.” Mark from CA

“Market is getting stronger with 4wd trucks and SUV’s in demand.” Bob from WA

“The market trend in this area is still a little slow with everyone waiting on that spring market bump in action.” Richard from NJ

Auction Prices Very Strong But Not Record Setting

“It’s been a very busy few months on the vintage auction front: in addition to Mecum’s huge Kissimmee sale, we had six auctions in Scottsdale and three in Paris at Retromobile. Although some of the sales totals were not as high as last year, they were still very impressive and there was widespread interest among serious collectors.”

- The “Arizona Auctions” accounted for total sales of $256,000,000. As usual, Barrett-Jackson led the way with $102,000,000 on 1,469 vehicles, RM came in a strong second with $62,800,000 and an 85% sales conversion rate, Gooding took third with $43,000,000, Russo and Steele and Bonhams came in very close at $20,700,000 and $18,000,000, and Silver wrapped things up at roughly $4,000,000.

- Paris’ Retromobile was very successful as well, with $100,000,000 trading hands at a trio of high-end auctions. Artcurial claimed the top spot this year with $62,000,000, RM Sotheby’s accounted for $21,000,000, and Bonhams came in third with a very respectable $16,000,000.

Notable Sales Included:

- 1937 MB 540 K Special Roadster $9,900,000 (RM)

- Aston Martin DB4 (S5) Conv $1,644,000 (Art)

- 1966 Ferrari 275 GTB Coupe $2,319,000 (Bonhams)

- 1957 BMW 507 Roadster $2,230,000 (RM)

- 2015 McLaren P1 Coupe $2,000,000 (Bonhams)

- 2003 Ferrari Enzo $2,860,000 (Gooding)

- 2015 Porsche 918 Weissach Spyder $1,760,000 (BJ)

- Shelby Cobra 427 SC $2,255,000 (RM)

- 2003 Saleen S7 Coupe $387,750 (Russo and Steele)

- 1958 Mercedes Benz 190SL Conv $140,000 (Silver)

RV Values and Volume Hampered by Winter Weather

“The near record winter storms that paralyzed much of the country last month really threw a wrench into the normal seasonal patterns we’ve come to expect within the RV industry. Normally by this time of the year we’re seeing more RVs being sold at the auctions and higher transaction prices, but the recent bad weather had the dual effects of snarling the usual wholesale channels and delaying many consumers from entering the marketplace, which naturally trickled down to less aggressive buying from dealers.”

For Motor Homes (including Class A, B, and C)

- Average selling price was $34,902, down $4,168 (10.6%) from previous month

- One year ago, the average selling price was $36,207

- Auction volume was down 9% from previous month

- For Towables (including Travel Trailers, Fifth Wheels, and Camping Trailers)

- Average selling price was $10,822, down $367 (3.2%) from previous month

- One year ago, the average selling price was $10,251

- Auction volume was down 15% from previous month

SPECIALTY MARKETS:

POWERSPORTS

Powersports Market Ready for Spring

“Values in the Powersports Market have increased this month in advance of the upcoming Spring selling season. This is a welcome change from the weak performance we have seen over the winter.”

- Leading the increases this month are a trio of the on road segments: Scooters, Street Bikes, and Dual Sports, all of which are all up roughly 2%.

- Similarly, Cruisers, the other on road segment, are not far behind with a 1.7% increase versus last month.

- In the off road segments, the bikes are up 1.2%, while the ATVs are up a little less at 0.8%, and the Utility Vehicles are up the most at 1.6%.

- Not surprisingly, considering the change of seasons, Snowmobiles have declined by 1.5% and will likely drop even more over the coming months.

- The Jet Boats and Personal Watercraft are both up a little less than 1% and will likely continue to increase as warmer weather draws near in most areas of the country.

SPECIALTYSPECIALTY MARKETS MARKETS: :

HEAVY DUTYHEAVY DUTY

Dump Trucks Didn’t Show up at February Auctions

“Depreciation in February dropped for all Medium Duty and Heavy

Duty Segments we report”. Charles Cathey, Editor – Heavy Duty Truck Data

That’s right, it dropped in all segments, and it is good to see depreciation slow up a

little since witnessing some rather large drops in the previous months. Dump trucks haven’t showed up at auction because they are staying very busy and their owners don’t want to stop them to sell them and/or replace them. They are running them, new and old, and getting as much life out of them as they can. They get bent a little and pretty much stay dirty, but they don’t accumulate a zillion miles like the current over the road tractors, so why get rid of them as long as they run well and still dump.

Things could change in March with one of the largest, mainly dump truck auctions of the year, right in the middle of the month.

We’ll be there, and let you know what happens, along with the other MD Trucks, HD Trucks and Commercial Trailers we report.

| DATE | Constructional/Vocational | Over the Road Trucks & Tractors | Regional Tractors | MODEL YEARS | ||||||

| Value $ Change % Change | Value $ Change % Change | % Value $ Change Change | ||||||||

| 03/01/16 | 79,517 | -581 | -0.7% | 67,518 | -1039 | -1.5% | 58,531 | -979 | -1.6% | 2013-2014 |

| 02/01/16 | 80,098 | -795 | -1.0% | 68,557 | -2273 | -3.2% | 59,510 | -1923 | -3.1% | 2013-2014 |

- 2013-2014 HD Construction/Vocational segment dropped an average of $581 (0.7%) in Feburary compared to the average decline of $795 (1.0%) in January.

- 2013-2014 HD Over the Road Tractor segment dropped an average of $1,039 (1.5%) in Feburary compared to the average drop of $2,273 (3.2%) in January.

- 2013-2014 HD Regional Tractor segment dropped an average of $979 (1.6%) in Feburary compared to the average depreciation of $1,923 (3.1%) in January.

| DATE | Constructional/Vocational | Over the Road Trucks & Tractors | Regional Tractors | MODEL YEARS | ||||||

| Value $ Change | % Change | Value $ Change % Change | % Value $ Change Change | |||||||

| 03/01/16 | 38,593 | -266 | -0.7% | 32,633 | -383 | -1.2% | 24,598 | -384 | -1.5% | 2005-2012 |

| 02/01/16 | 38,859 | -425 | -1.1% | 33,016 | -864 | -2.6% | 24,982 | -803 | -3.1% | 2005-2012 |

- 2005-2012 HD Construction/Vocational segment dropped an average of $266 (0.7%) in Feburary compared to the $425 (1.1%) in January.

- 2005-2012 HD Over the Road Tractor segment dropped an average of $383 (1.2%) in Feburary compared to the $864 (2.6%) average deprciation in January.

- 2005-2012 HD Regional Tractor segment dropped an average of $384 (1.5%) in Feburary compared to the average drop of $803 (3.1%) in January.

SPECIALTY MARKETS: MEDIUM DUTY

Better Month for Medium Duty Segment

“This Medium Duty Segment had much smaller declines this past month.”

Bret Swanson, Editor – Medium Duty Truck Data

In the Medium Duty market, the amount of decline was about half of what it was in January. The 20052012 model years came down on average, $178. In January, that average decline for this group was, $371. The 2013 & 2014 model years had very similar declines. The average amount of decline was $360 for February, and in January, that average decline was $813.

| DATE | Medium Duty | MODEL YEARS | DATE | Medium Duty | MODEL YEARS | |||||

| Value $ Change % Change | Value $ Change % Change | |||||||||

| 03/01/16 | 18,574 | -178 | -1.0% | 2005-2012 | 03/01/16 | 41,098 | -360 | -0.9% | 2013-2014 | |

| 02/01/16 | 18,753 | -371 | -1.9% | 2005-2012 | 02/01/16 | 41,458 | -813 | -1.9% | 2013-2014 | |

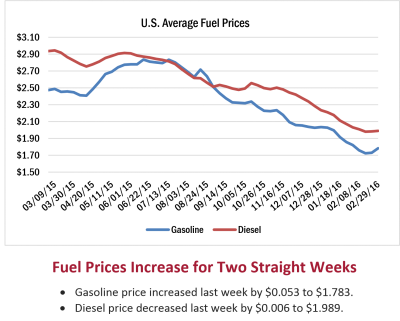

The continued decline of diesel fuel prices has placed the price per gallon in a territory it has not seen in a long time. The national average is now below the $2.00 mark at $1.99 per gallon. That is $.95 lower than this time last year.

Report courtesy of Black Book.

Source: Market-Insights-Q1-2016