Oregon Insurance Commissioner Complaint Information

Oregon Insurance Complaint Department

If you have problems with an insurance company or agent, complete a complaint form so we can look into the situation.

We are not attorneys and cannot act as your legal representative. However, we can determine whether the company or agent is following insurance laws and your policy. Results vary from explaining a situation to getting a claim paid.

What happens once I file a complaint?

Most complaints are resolved within 60 days but it depends on the type of complaint. You can learn more here: Once you file a complaint.

Electronic Complaint Form

Oregon Insurance Complaint Form

Paper Complaint Form

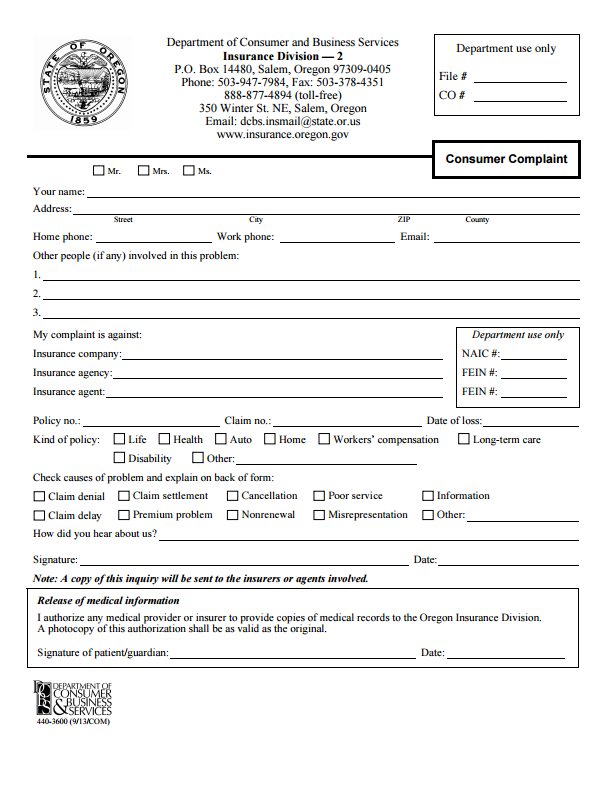

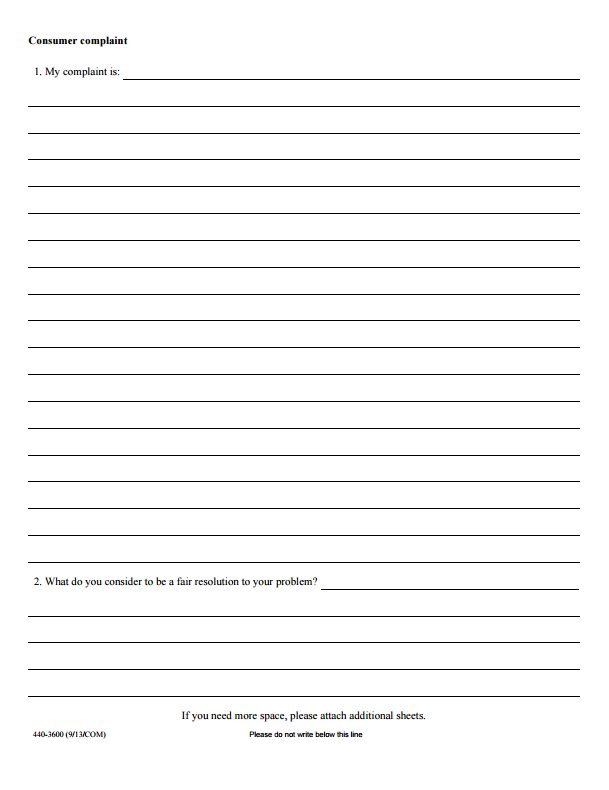

oregon-insurance-commissioner-complaint – pdf

Complaint data

The Insurance Division helps thousands of consumers with insurance questions and complaints each year. In 2014, Oregon Insurance Division helped 17,938 Oregonians with their insurance issues and resolved 3,549 complaints. Efforts resulted in the recovery of more than $2.2 million for consumers.

Although individual consumer complaints are confidential, we annually publish a report on the number of complaints by the insurer. Most complaints involve disputes about claims processing and benefits.

Our insurance experts can help you interpret this data.

Contact Information

Mail to:

Department of Consumer and Business Services

Insurance Division — 2

P.O. Box 14480, Salem, Oregon 97309-0405

Phone: 503-947-7984

or FAX supporting documents along with a copy of this form to: (503) 378-4351